FXOpen

→ Revenue decreased by 10% to USD 13.2 billion compared to USD 14.65 billion a year ago. This was the third quarter in a row that HP fell short of analysts' estimates.

→ “While we expect another quarter of sequential growth in Q4, the external environment has not improved as quickly as anticipated and we are moderating our expectations as a result,” said HP CEO Enrique Lores.

→ Earnings per share was 86 cents (in line with forecasts), and the company estimates earnings for the next quarter could be between 85 cents and 97 cents.

As a result, at yesterday's low, the fall in the share price of HP Inc. exceeded 10%. Can the fall continue?

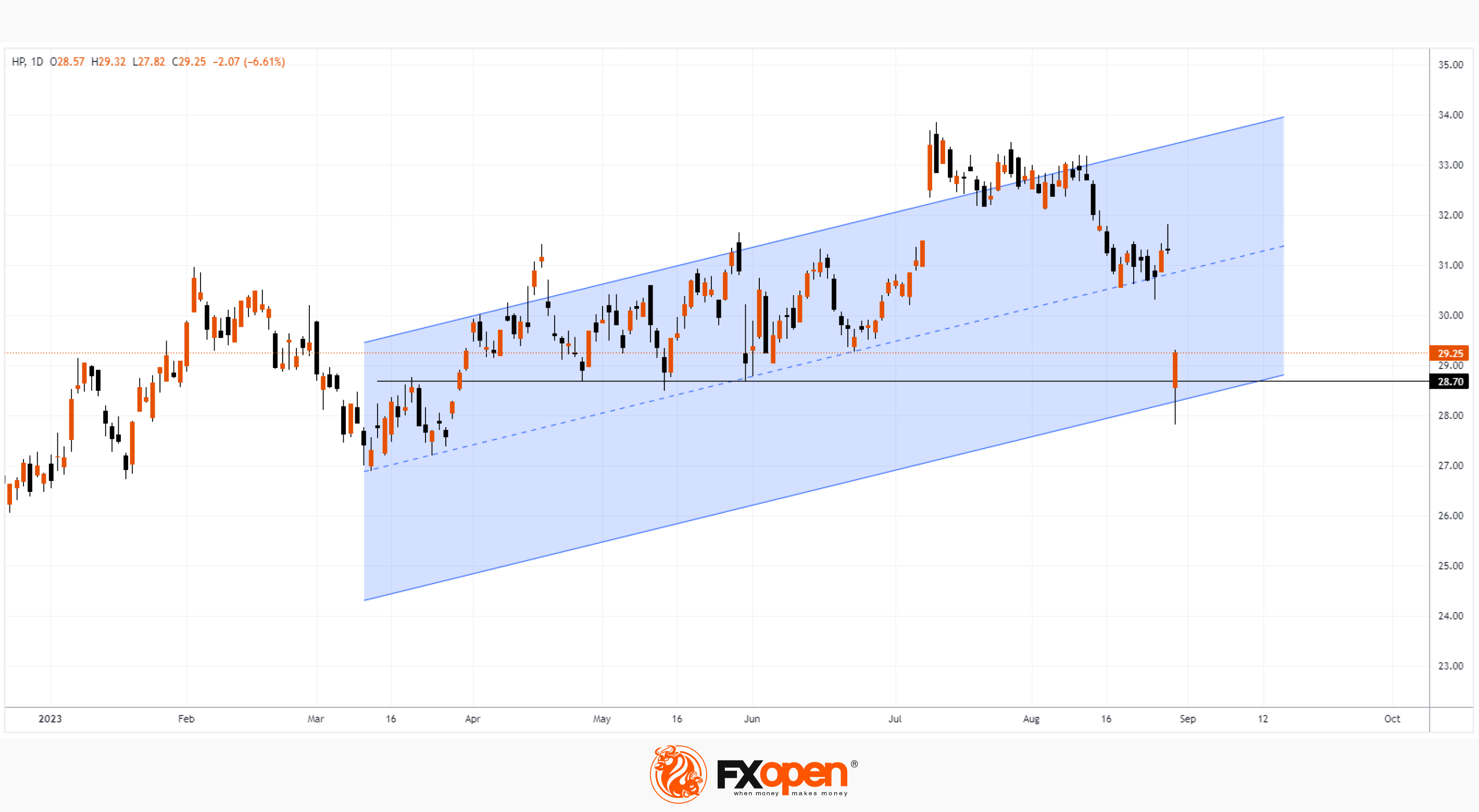

An analysis of the HPQ stock chart makes a strong bullish case:

→ HPQ price closed at the high of the day;

→ the price has found support from the lower boundary of the parallel channel;

→ the price fell below the support at 28.90, but closed above. This may mean that the increased volatility and activation of stop-losses located below the obvious support could be used by large players to accumulate long-term long positions at low prices, which were formed for a short period after the fundamental event.

By the way, according to Lores, the availability of artificial intelligence products at the end of 2024 should refresh consumer and commercial sales.

Buy and sell stocks of the world's biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.