FXOpen

The value of the largest cryptocurrency could reach USD 50,000 this year and USD 120,000 by the end of 2024, according to analysts at Standard Chartered, Reuters reports.

Note that earlier, bank analysts predicted that the cost of BTC at the end of 2024 would be USD 100,000, but now they have increased their forecast for the price of bitcoin by 20%, based on the assumption of a change in the behavior of miners that can limit the supply of bitcoins as its price rises.

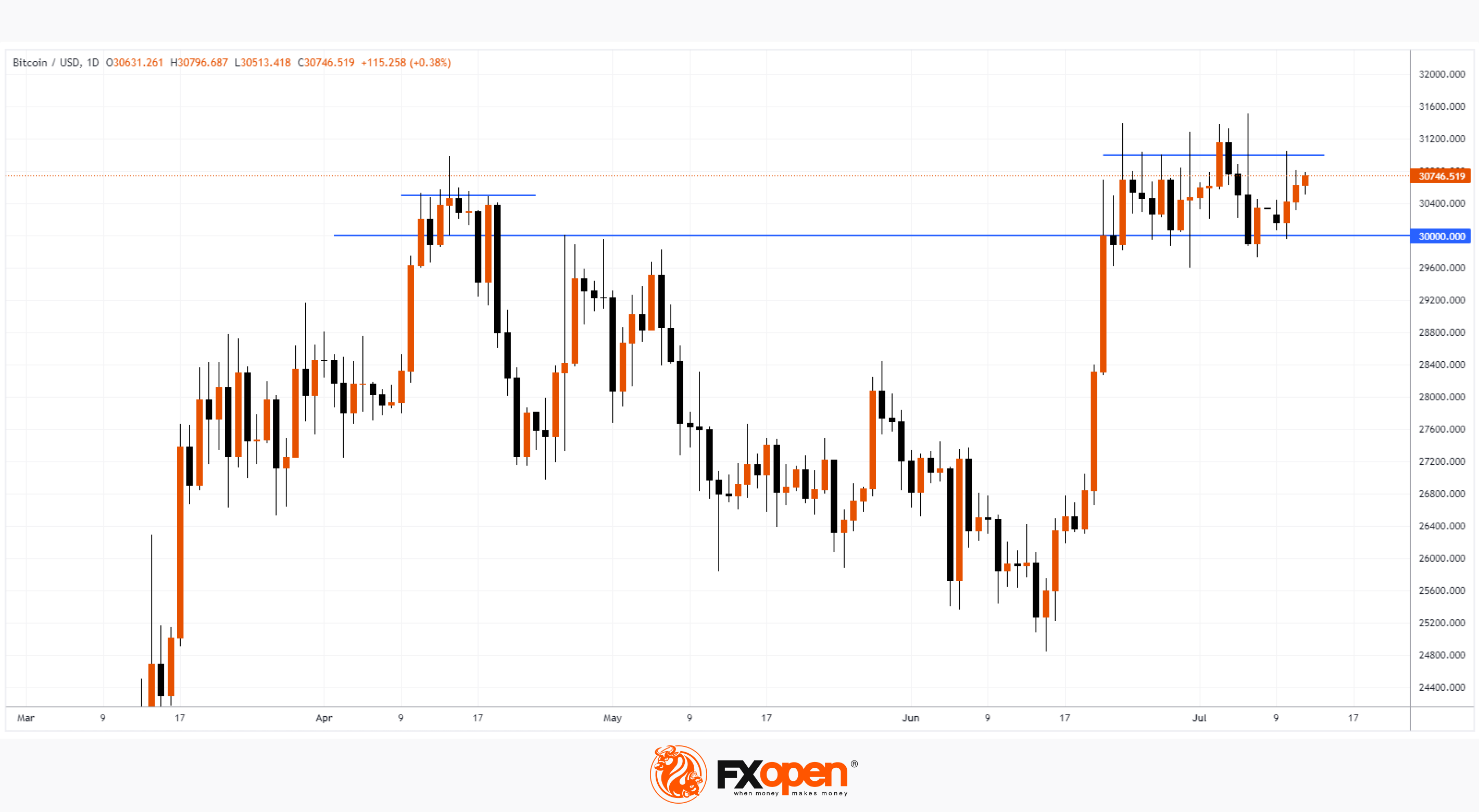

Time will tell how true the bitcoin price forecast for 2024 from Standard Chartered will be, but on the BTC/USD chart today there is an argument in favor of the fact that the forecast can be realized. This is the nature of price action around the USD 30k psychological level.

Compare 2 periods when the price of bitcoin exceeded USD 30k.

In April, the price met strong resistance only USD 500 higher, and a week after the breakdown of USD 30k, it rushed down.

And now is the second period, which began on June 21 and continues to last. The level of immediate resistance above the psychological level is already higher — at around 31k, and the price of bitcoin has not fallen (except for short-term punctures) below USD 30k for almost 3 weeks.

The comparison shows that the bulls are getting more of an edge at the USD 30k level, in other words, the market is shifting in favor of demand forces. And this is optimistic for Standard Chartered's USD 120k bitcoin price prediction.

FXOpen offers the world's most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.