FXOpen

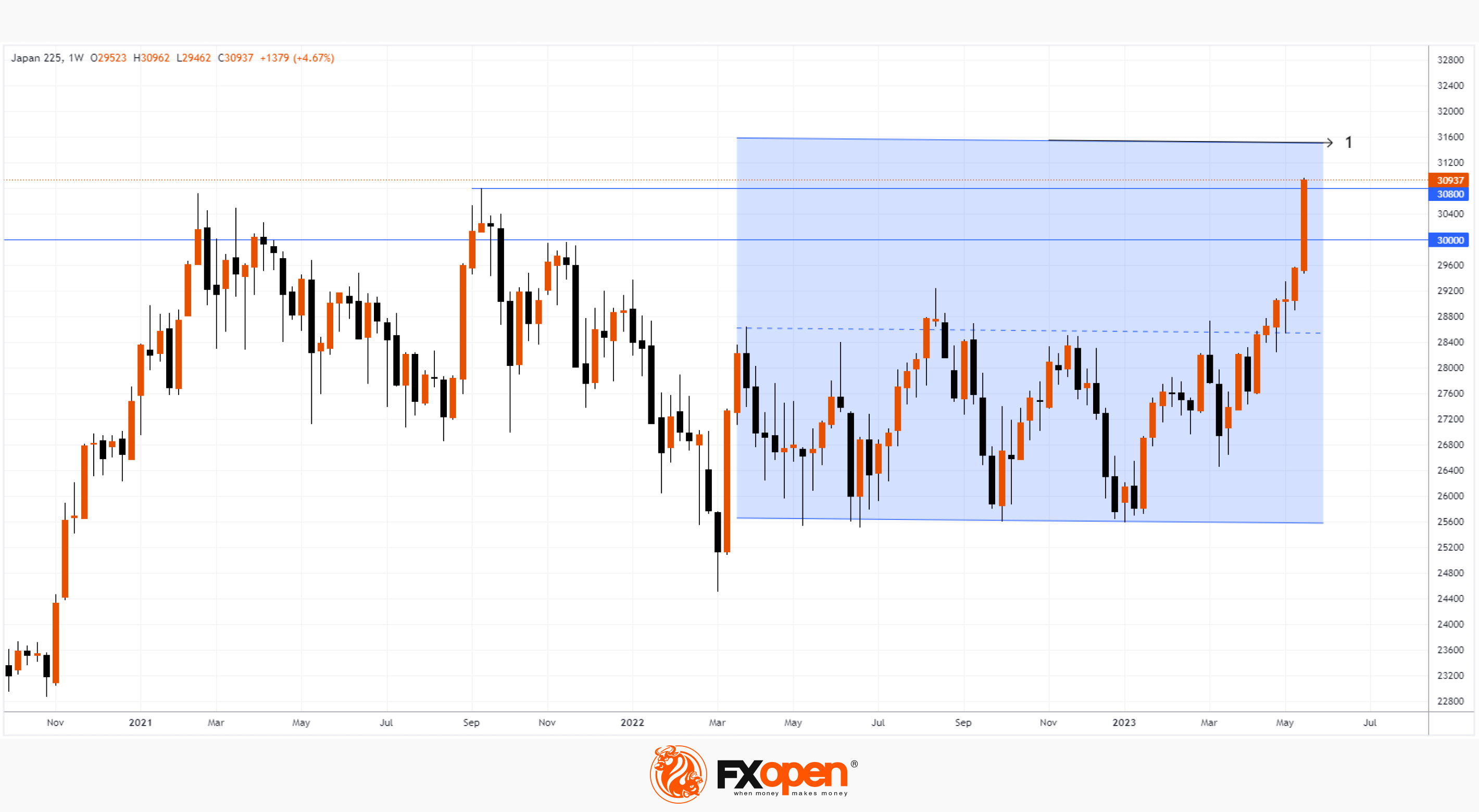

On Friday, the Japanese stock market index Nikkei 225 once again updated the maximum of the year. During this week, the bulls have overcome:

→ the psychological level of USD 30k;

→ the 2022 high around 30,800.

The strong momentum in the Nikkei 225 market is driven by:

→ the weak yen;

→ a strong reporting season for Japanese companies;

→ the news about foreign investment, including Warren Buffett's.

Today's bullish momentum is supported by the latest news that US lawmakers may reach an agreement on a debt ceiling. A bipartisan deal is scheduled to be voted on in the coming days to prevent a default in the US.

The Nikkei 225 chart shows that in case of further growth, the index value may encounter resistance in the 31,500 area — here lies the line (1) of the parallel channel, which is built on a series of important extremes in 2022-2023. At the same time, reasonable investors can take advantage of optimism to take profits on longs.

Trade global index CFDs with zero commission and tight spreads (additional fees may apply). Open your FXOpen account now or learn more about trading index CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.