FXOpen

The Senate, as expected, approved a bill on the ceiling of the US national debt, now it will go to President Biden's signature. The decision will set the course for federal spending for the next two years and suspend the debt ceiling until January 1, 2025, by which time a new episode of the US default drama series can be expected. Bloomberg estimates that US federal debt is on track to grow from 97% of GDP in 2022 to over 130% of GDP by 2033.

According to Reuters, BlackRock CEO Larry Fink believes that the protracted debate over the national debt ceiling has threatened the status of the dollar as the world's reserve currency. In the long term, this needs to be corrected and trust restored.

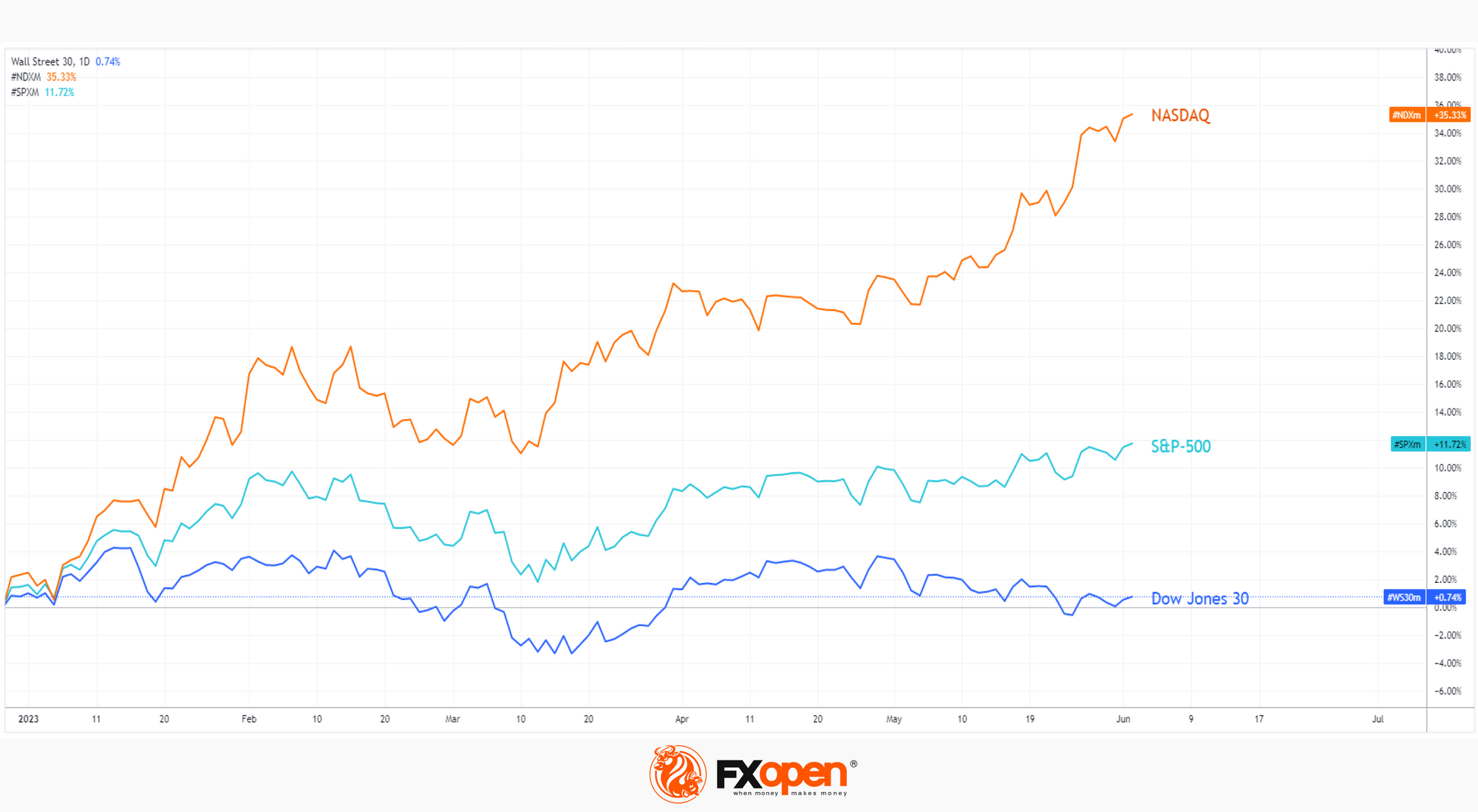

Meanwhile, stock index charts show that the market is dominated by positivity. Both the E-mini S&P 500 and the E-mini NASDAQ 100 are at yearly highs, buoyed by the AI hype. Dow Jones demonstrates lagging dynamics behind them.

Other drivers are becoming relevant for financial market participants — today at 15:00 GMT+3 official data on the US labor market for May will be released. It will be important in terms of assessing the likelihood of a recession. If the labor market does not disappoint, US economic growth should remain robust, or at least manageable – this is called a “soft landing.” But the fall in employment will be a harbinger of a recession.

Get ready for bursts of volatility today.

Trade global index CFDs with zero commission and tight spreads (additional fees may apply). Open your FXOpen account now or learn more about trading index CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.