FXOpen

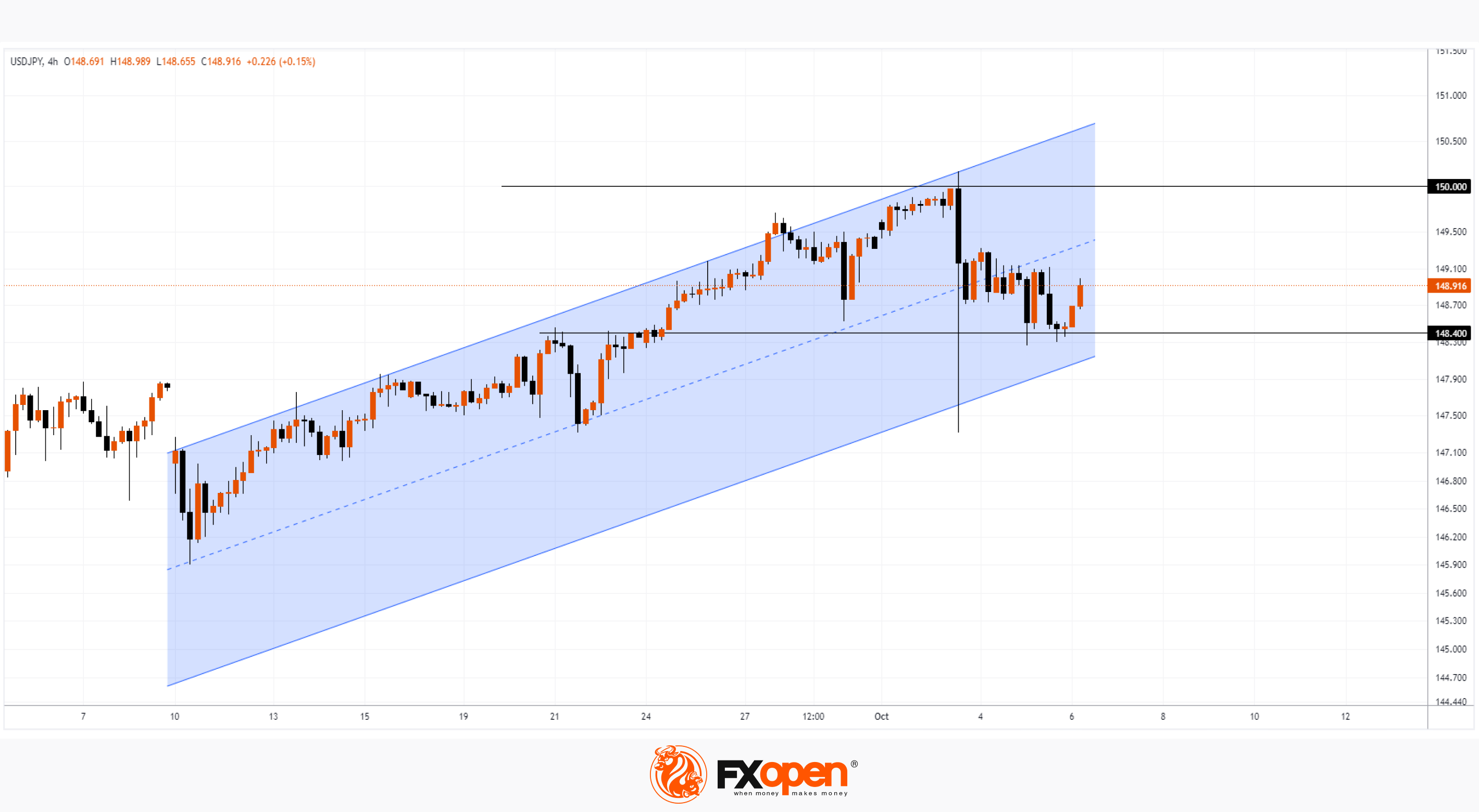

On Tuesday, the US dollar rose above the psychological level of 150 for the first time since October 2022 before falling sharply to a low of 147.30 as the yen rose.

The media are discussing whether this movement confirms the fact of intervention on the part of the Japanese authorities.

On the one hand, there are opinions that the yen's movement on Tuesday was much smaller (about 1.7%) than when the authorities intervened last year (the change was about 4%) to support the yen.

On the other hand, there are no clear explanations about the reasons for the sharp movement — except as a manifestation of the authorities’ interest in preventing excessive weakening of the national currency. Perhaps only about the influence of psychology when reaching and short-term exceeding the round figure — an effect that, by the way, is characteristic of the cryptocurrency market.

What are the possible scenarios for further development in the USD/JPY market?

Bullish arguments:

→ The price is within the uptrend (shown by the blue channel). Tuesday's move expanded it on a parallel channel basis. A sharp rebound from the lower boundary indicates the strength of demand.

→ After a sharp impulse, the price found support at the former resistance level of 148.4.

Bearish arguments:

→ When approaching the level of 150 yen per US dollar, psychological factors may again come into play. The memory of Tuesday's sharp momentum, reinforced by the broader momentum of last year, will keep market participants from expecting prices to rise above the round level.

→ It is acceptable to assume that the median line of the channel will now pose an obstacle if the price rises to it.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.