FXOpen

The rally of oil prices continues and is getting threateningly close to reaching a new high for the year. With just a day left before OPEC releases its World Oil Outlook, the WTI crude oil price trades with a bid tone, up over 1% at the start of the trading week.

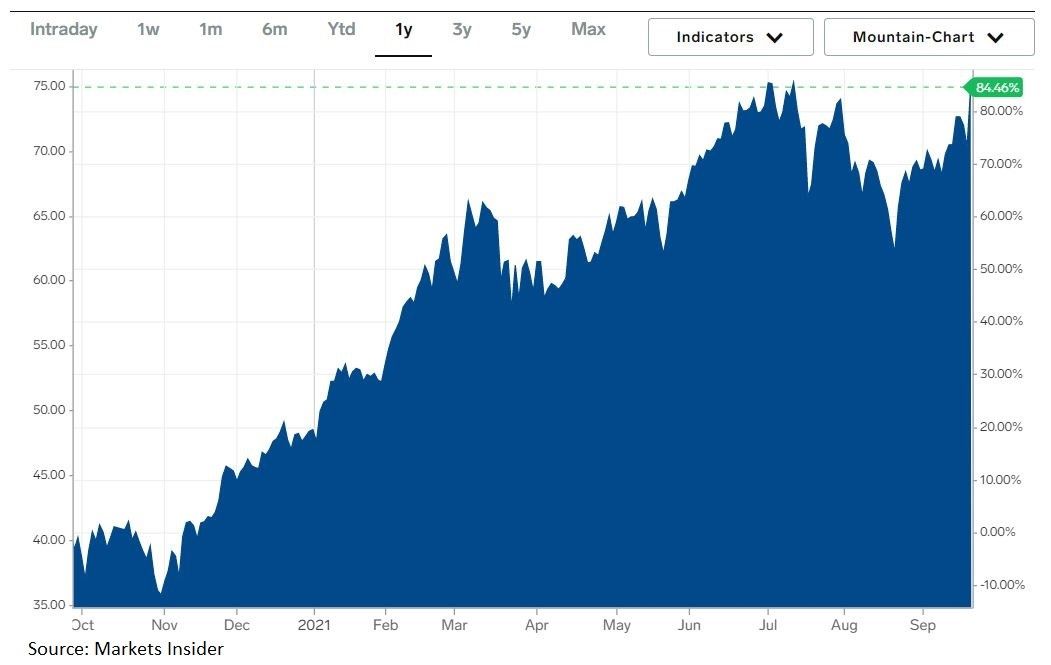

The WTI crude oil price has grown over 85% in the last year, moving in a steady, bullish trend. It corrected over the summer months, but found strong support at the $60 level.

Goldman Sachs Remains Bullish

The price of oil was driven higher by strong demand following the coronavirus lockdowns and OPEC’s swift reaction to the pandemic. As we get closer to the end of the year, Goldman Sachs remains bullish on the price of oil. More precisely, Goldman sees Brent oil at $90/barrel at the end of the year, and it also lifted its price targets for 2022 and 2023.

Oil is a commodity, and, as such, its price is affected by the imbalances between supply and demand. For now, demand is strong as economic recovery from the pandemic slump continues. Because OPEC has cut production below the demand level, the oil prices recovered from the negative territory in April 2020 all the way to $77, the 2021 high for the WTI crude oil.

The Vienna talks are seen as the biggest risk for the price of oil. Iran is ready to come back to the negotiations table after the local elections ended, and the markets expect them to be successful. If the Iranian oil hits the market, the price of oil will have to reflect the extra 2 million barrels or so per day. But the negotiations are yet to start… and they usually take a lot of time.

Therefore, the bias remains bullish for the price of oil for the end of the trading year. If the market manages to make a new higher high above $77, more upside is likely to come.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.