FXOpen

Commodity-linked currencies gained ground as optimism grew over a potential extension of the trade truce between the United States and China. Markets are looking ahead to upcoming talks between Donald Trump and Xi Jinping, expected to take place in South Korea in the coming days. Investors hope the meeting will help ease trade tensions and support global economic growth.

The US dollar is edging lower ahead of the Federal Reserve and Bank of Canada meetings. According to interest rate futures data (Reuters), markets currently price in a 95–98% probability of another rate cut in October. However, Bank of America notes that due to the government shutdown and delays in key employment data, the Fed is “flying blind”, with policymakers divided over the future path of rate reductions.

The Australian dollar received an additional boost from rising industrial metal prices and a rebound in risk appetite. Optimism was further fuelled by Donald Trump’s visit to Japan and comments from Prime Minister Sanae Takaichi on plans to expand economic cooperation with the US. Meanwhile, the Canadian dollar firmed against the greenback amid expectations of positive retail sales data and continued labour market stability.

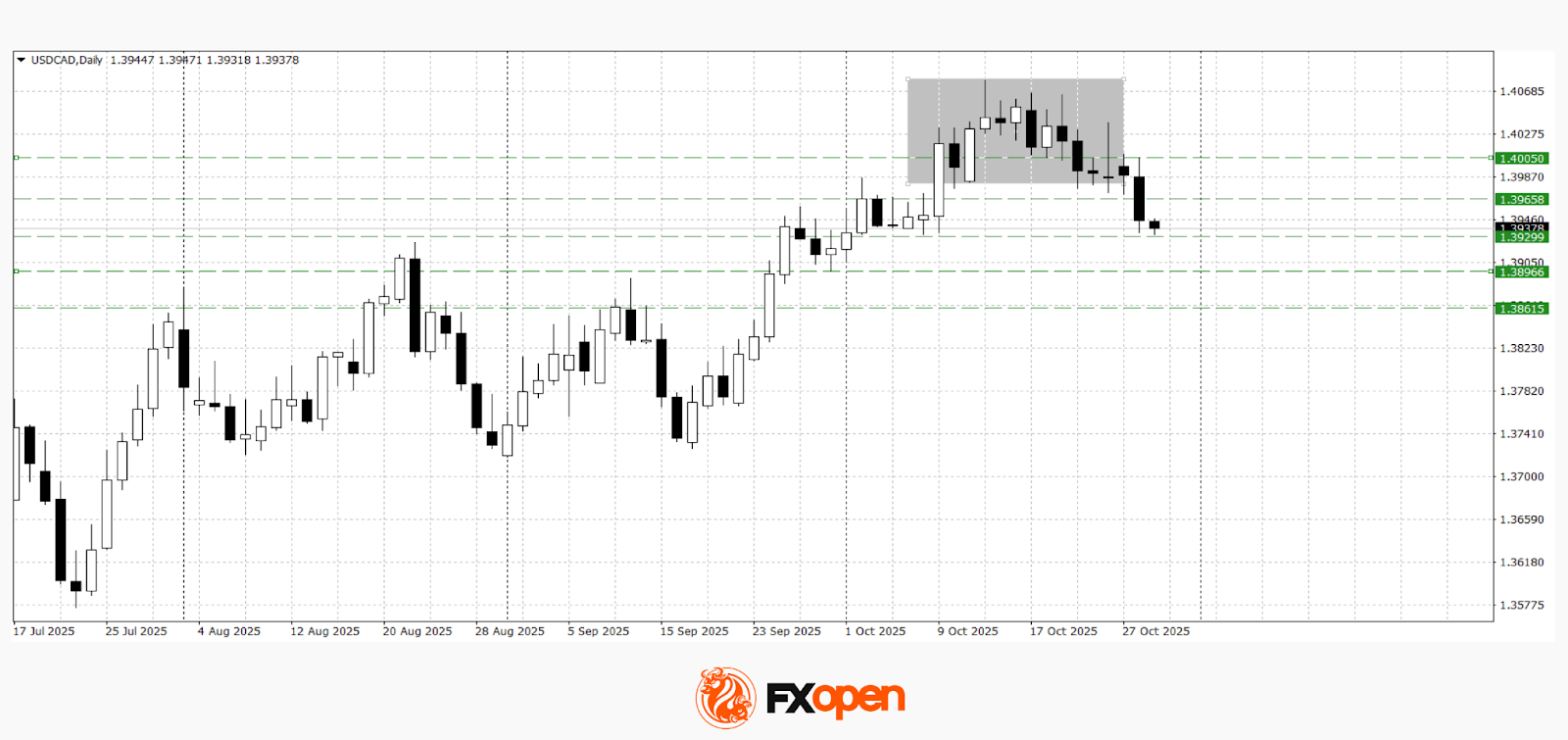

USD/CAD

The USD/CAD pair is showing signs of strengthening downside momentum as the “Tower Top” pattern continues to play out. The price tested the key range of 1.3930–1.3960. Should these levels turn into resistance, the pair could extend its decline towards 1.3860–1.3900. A bullish reversal scenario would only be considered if the price manages to consolidate above 1.4000.

Upcoming events likely to influence USD/CAD:

→ 15:30 (GMT+3) – US goods trade balance;

→ 16:45 (GMT+3) – Bank of Canada Monetary Policy Report;

→ 17:30 (GMT+3) – Bank of Canada press conference.

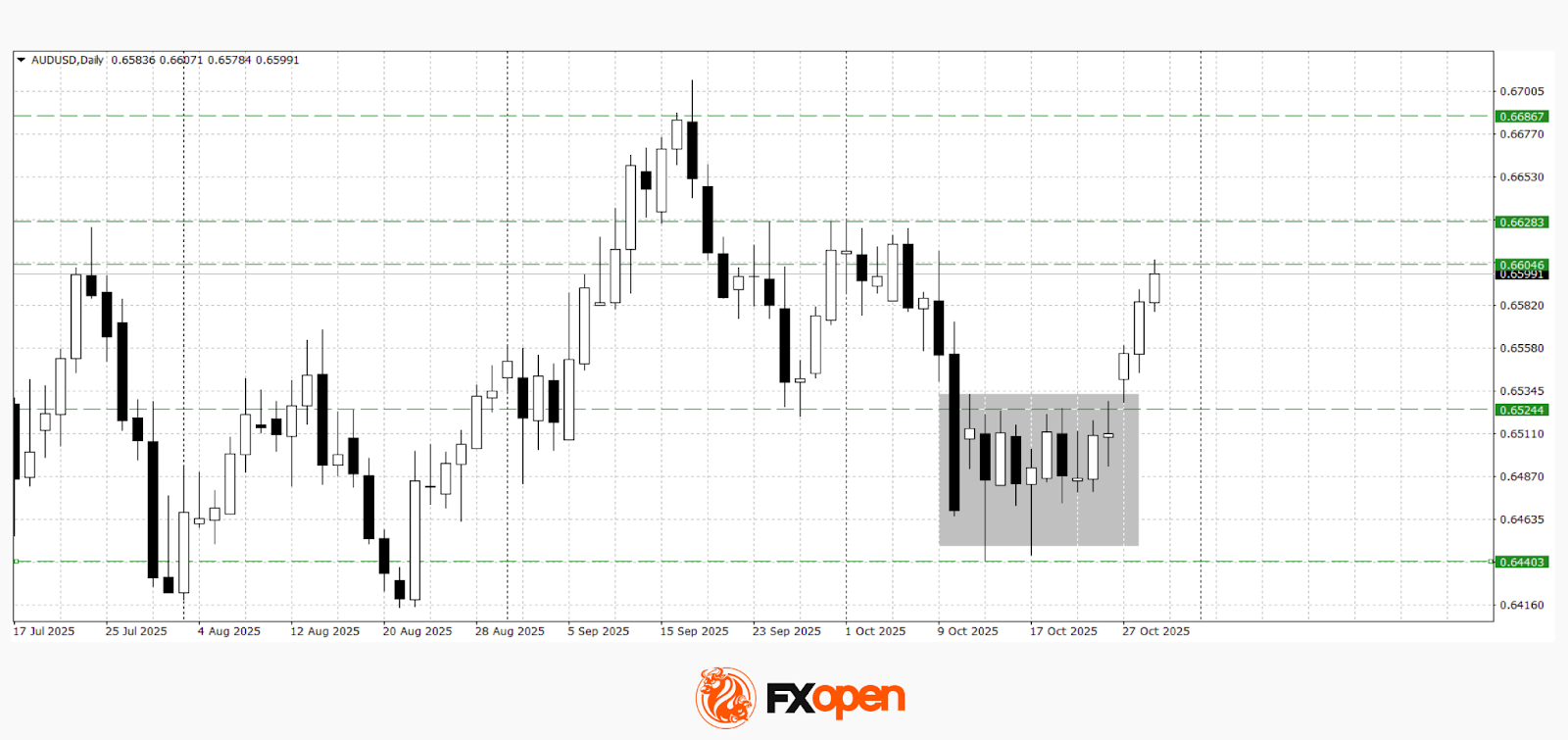

AUD/USD

A renewed rebound from the 0.6440 support level has allowed AUD/USD buyers to form a bullish “Tower Bottom” pattern. Technical analysis suggests that if the pair manages to secure a foothold above 0.6600, it could retest or even surpass this year’s current high. A break below 0.6520, however, would invalidate the bullish outlook.

Key events likely to affect AUD/USD:

→ 17:00 (GMT+3) – US new home sales;

→ 21:00 (GMT+3) – Federal Open Market Committee (FOMC) statement;

→ 03:30 (GMT+3) tomorrow – Australia import price index.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.