FXOpen

Commodity currencies have moved up to key levels after extending their recent gains, maintaining upward momentum. However, the next phase of price action will largely depend on fundamental drivers. For now, there are no clear signs of a slowdown, but proximity to important levels is increasing the market’s sensitivity to news.

Decisions from the Federal Reserve and the Bank of Canada, along with accompanying guidance from policymakers, could either confirm the strength of the current move or trigger a correction after the recent strong advance. Overall, the market remains directional, but it is approaching a point where fundamental signals become decisive.

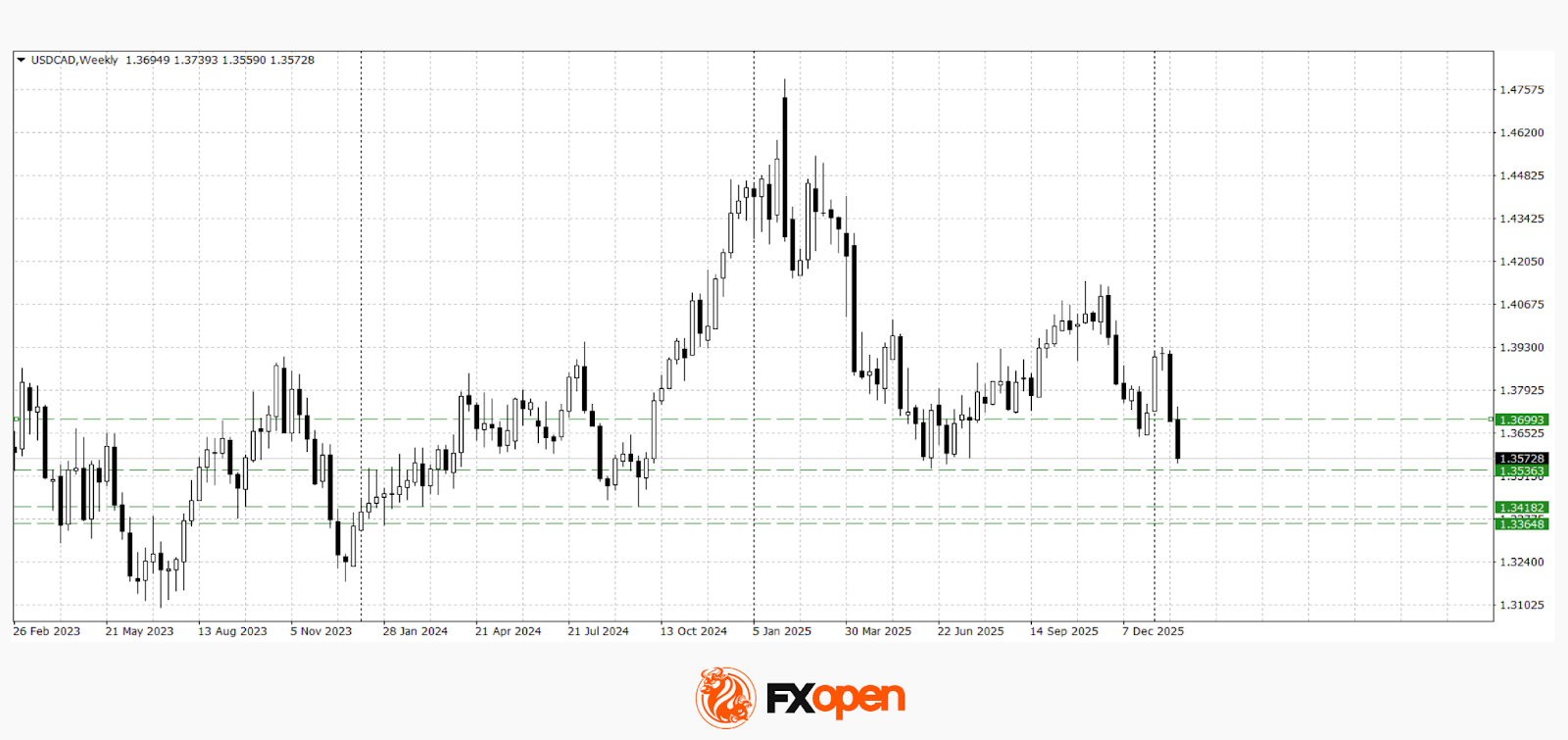

USD/CAD

The USD/CAD pair continues to decline, reflecting strength in the Canadian dollar and moving towards last year’s lows near 1.3500. The Canadian currency remains sensitive to expectations around Bank of Canada policy and developments in the oil market. The focus is on the BoC’s rate decision and press conference, as well as oil inventory data and key domestic indicators.

Depending on the tone of the Bank of Canada’s statements, the market may either continue to favour the CAD and extend the current momentum, or shift towards profit-taking and a moderate correction from current levels.

A break below the 1.3500–1.3540 support zone could reinforce the downside move towards 1.3400–1.3420. The bearish scenario would be invalidated by a sustained move above 1.3700.

Key events for USD/CAD:

- today at 15:30 (GMT+2): speech by US President Trump;

- today at 16:45 (GMT+2): Bank of Canada interest rate decision;

- today at 17:30 (GMT+2): Bank of Canada press conference.

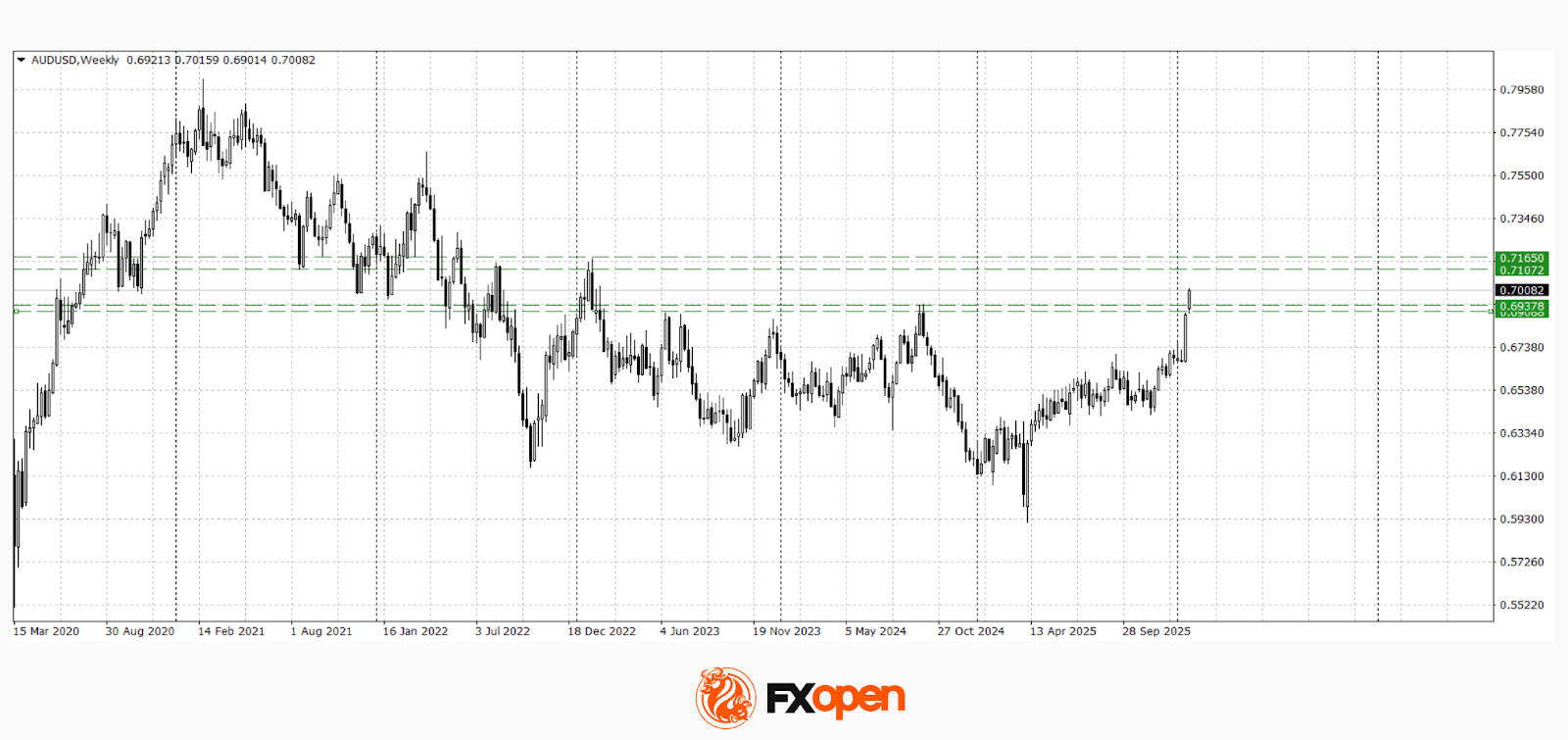

AUD/USD

AUD/USD buyers managed to test the key resistance level at 0.7000 this week. The pair has not traded above current levels for almost three years. If 0.7000 turns into support, AUD/USD may continue to rise towards 0.7100–0.7160. A corrective pullback could see the pair retreat to the 0.6900–0.6940 area.

Key events for AUD/USD:

- today at 21:00 (GMT+2): US Federal Reserve interest rate decision;

- today at 21:30 (GMT+2): Federal Open Market Committee press conference;

- tomorrow at 02:30 (GMT+2): Australia NAB business confidence index.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.