FXOpen

Yesterday's multidirectional statistics from the US contributed to the test of significant levels by major currency pairs. Thus, the GBP/USD pair fell to 1.2500, the EUR/USD pair re-tested 1.0700, and commodity currencies managed to find temporary support.

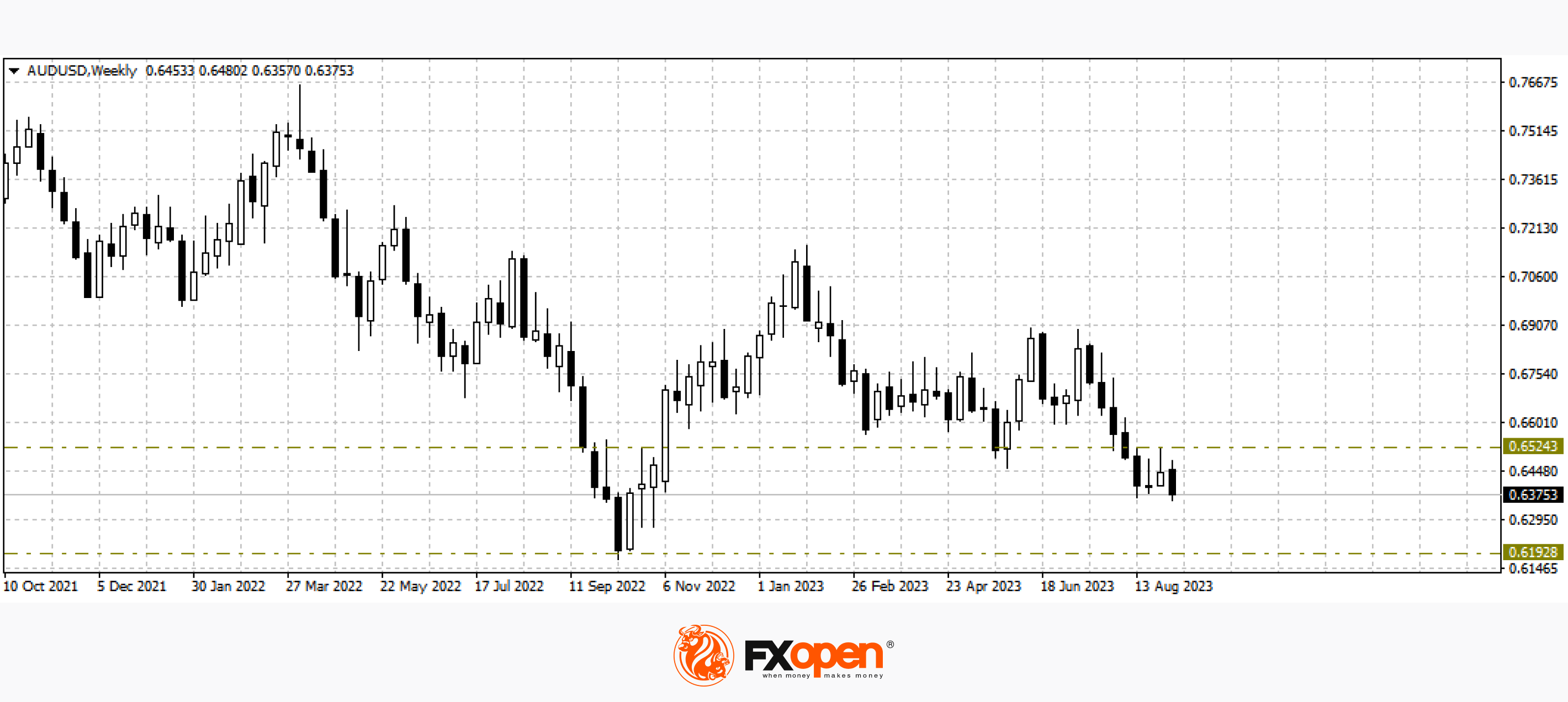

AUD/USD

In early September, the Australian currency came under additional pressure due to negative economic data from China. The slowdown in the world's second largest economy, provoked by the deepening decline in the real estate market, could not but affect the currencies of China's trading partners. After the RBA left the base interest rate unchanged at the beginning of the week, the AUD/USD pair updated the August low of this year at 0.6360. Yesterday, buyers managed to keep the price above the recent lows, but if the situation in the commodity market does not stabilise, the downtrend may continue towards 0.6100-0.6000. Cancellation of the downward scenario may be considered after a firm consolidation above 0.6520.

From the point of view of fundamental analysis, today at 15:30 GMT+3, we are waiting for weekly data on the number of applications for unemployment benefits in the US.

GBP/USD

GBP/USD continues its slow slide to the May extremes of the current year at 1.2500-1.2300. Yesterday, the buyers managed to find support just below 1.2500, but since there are no upward dynamics for the beginning of a corrective rollback, the fall may continue to 1.2380-1.2320.

No important fundamental analysis events from the UK are expected until the end of the week; the pair's pricing will depend entirely on the news from across the ocean and the general mood in the currency markets.

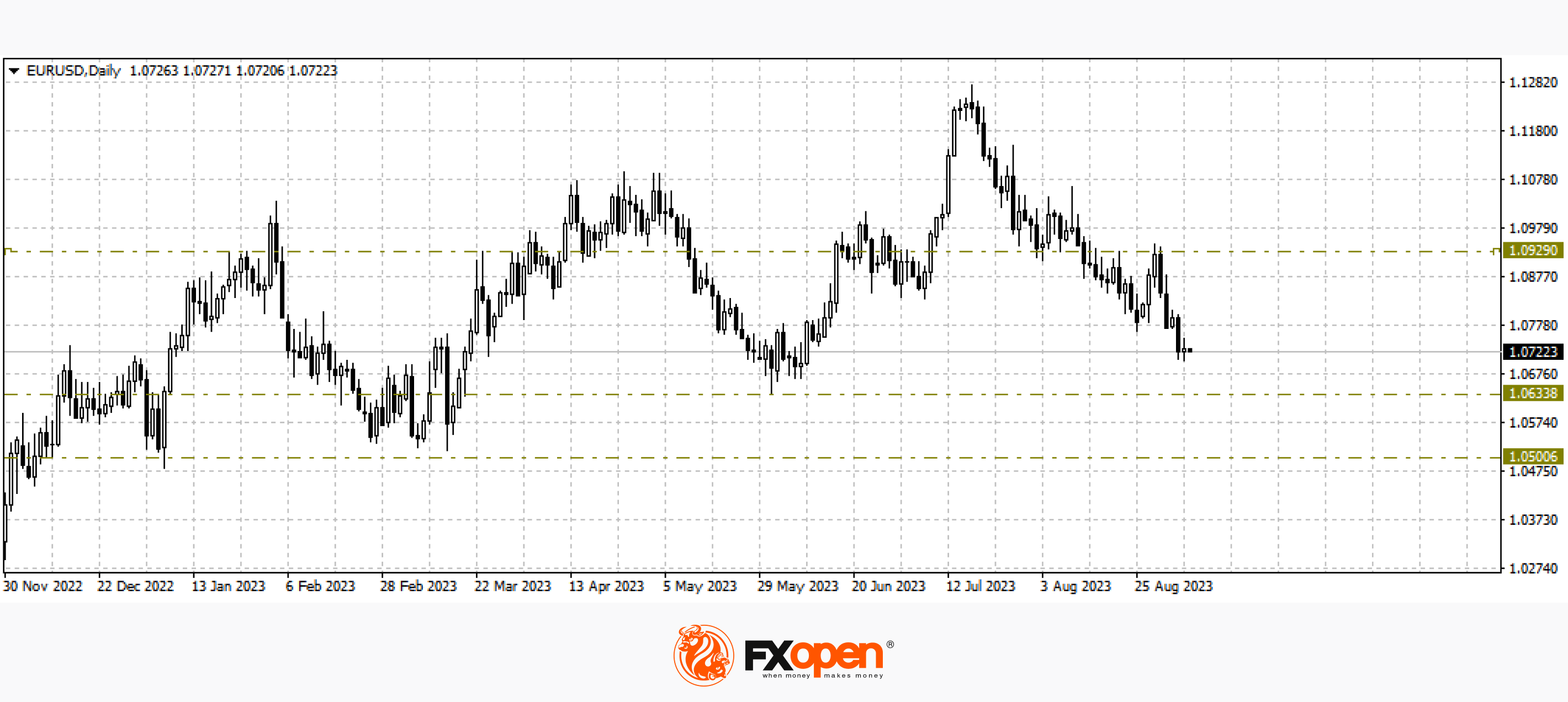

EUR/USD

The single European currency has been moderately declining in recent trading sessions. The price tried several times to go below 1.0700 but to no avail. The breakdown of the 1.0700-1.0680 range may open the way to significant support at 1.0500; the resumption of the upward movement may be possible only after a confident strengthening above 1.0900.

Today at 12:00 GMT+3, we are waiting for data on GDP in the euro area for the second quarter. Tomorrow at 09:00 GMT+3, the consumer price index in Germany for August will be released.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.