FXOpen

The fundamental data of recent trading sessions contributed to a slight strengthening of commodity and European currencies. Thus, the AUD/USD pair, after forming a bullish engulfing combination, managed to confidently gain a foothold above 0.6500. The pound/US dollar currency pair retested the support at 1.2540 and went above 1.2600, and greenback sellers in the US dollar/loonie pair are trying to break the support at 1.3500.

GBP/USD

The price of the pound on the GBP/USD chart has been trading for the third week in a rather narrow range of 1.2680-1.2540. Apparently, to enter new positions, investors need a more important foundation than the publication of the FOMC protocols. The head of the Bank of England, Andrew Bailey, whose speech took place on Tuesday at 13:15 GMT+3, also failed to inspire market participants to make new entries.

Today at 12:30 GMT+3, we are waiting for the publication of data on the business activity index in the UK services sector for February. At 17:45 GMT+3, the business activity index (PMI) in the US services sector for the same period will be released. Also at 18:00 GMT+3, data on sales on the secondary housing market for January will be published, and at the very beginning of the American session, weekly figures on the number of applications for unemployment benefits will be released.

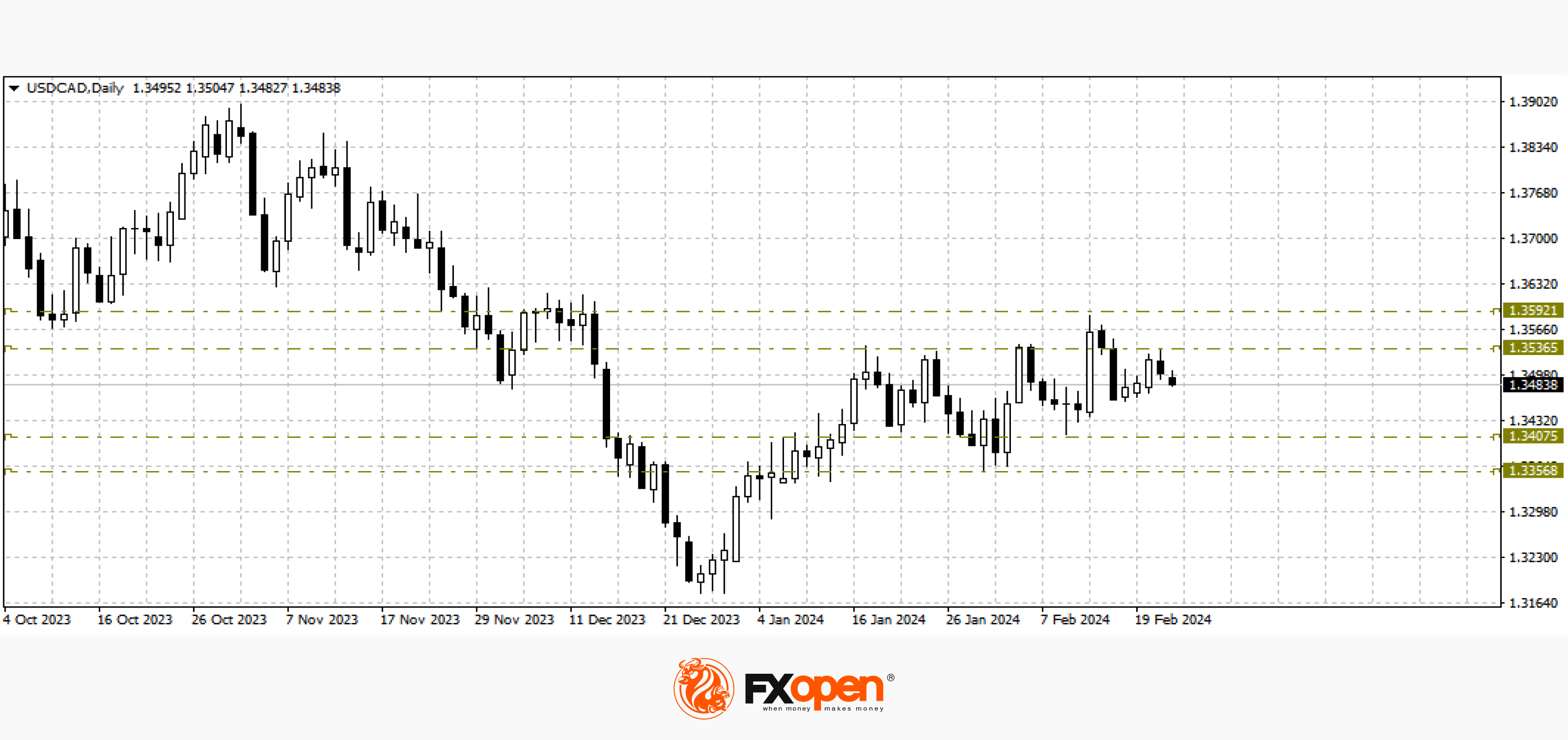

USD/CAD

Sellers of the USD/CAD pair managed to close yesterday with a reversal combination to sell dark clouds. If we receive confirmation of this formation on the USD/CAD chart, we can expect a repeat approach to 1.3400-1.3370.

Today at 16:30 GMT+3, we are waiting for the publication of the basic retail sales index in Canada for December. Also at 19:00 GMT+3, data on crude oil inventories in the United States for the last week will be released.

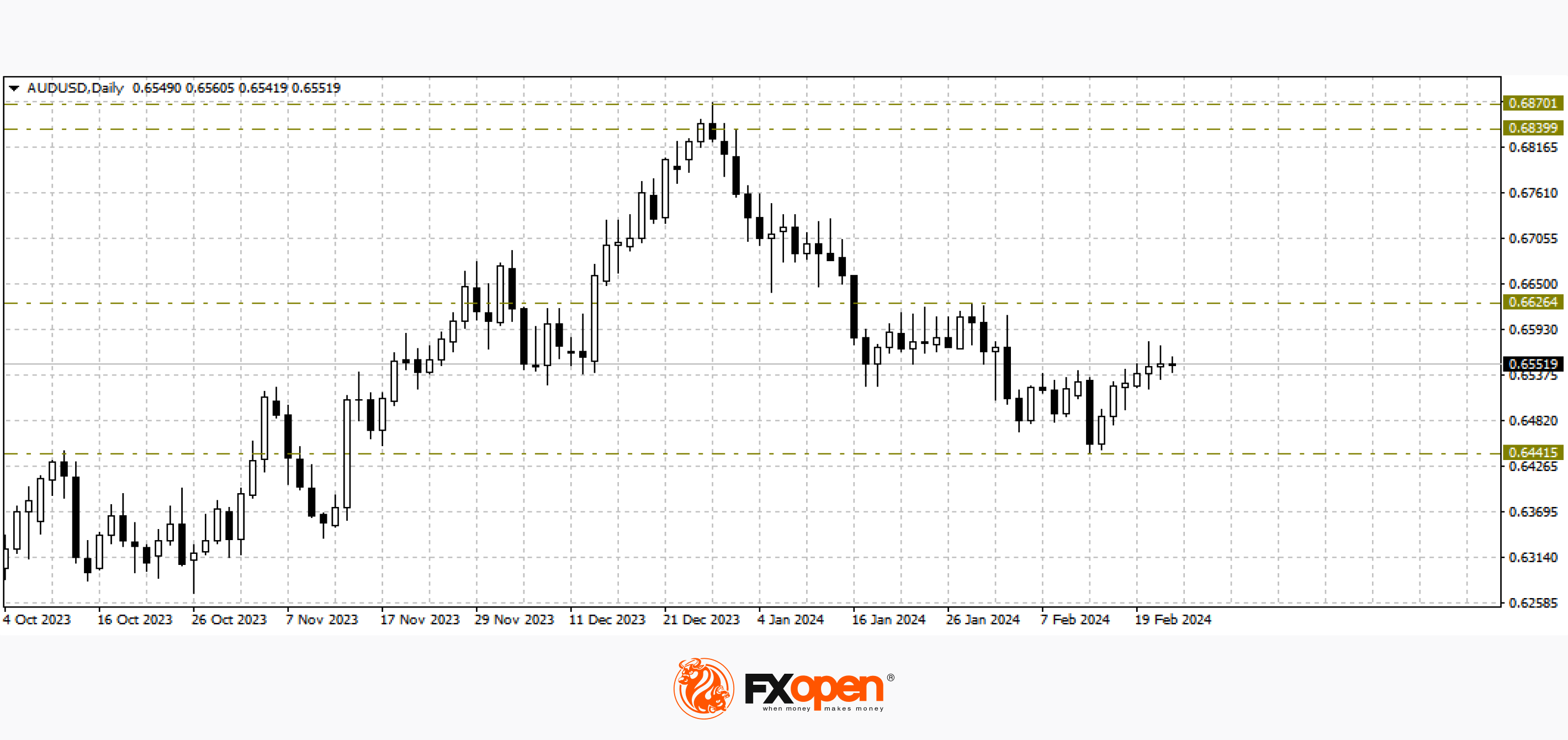

AUD/USD

After the formation of a bullish engulfing pattern on the daily chart of AUD/USD, the currency pair managed to strengthen by more than 100 points. If buyers of the pair manage to gain a foothold above 0.6620-0.6600, the price may continue to rise in the direction of 0.6870-0.6860. The upward scenario will be cancelled by a move below 0.6400.

This morning, data on the business activity index in the services and manufacturing sectors was released. But, as we see, this news did not have much impact on the pair’s pricing.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.