FXOpen

The US currency maintains its upward momentum against a backdrop of macroeconomic uncertainty, political pressure on the Federal Reserve and rising geopolitical risks. Investors continue to favour the dollar as a "safe-haven asset", despite mixed signals from the regulator and a muted market reaction to recent political developments in the United States. An additional source of support remains the stability of US Treasury yields, which, after recent volatility, have consolidated near local levels, reflecting a wait-and-see stance among market participants.

The overall backdrop for the FX market remains tense. The investigation involving the Fed Chair and the growing political pressure have intensified discussions about the regulator’s independence, adding uncertainty to interest-rate expectations. At the same time, geopolitical risks and instability in certain regions continue to underpin demand for the dollar and limit interest in higher-risk currencies. In the near term, USD/JPY and USD/CAD dynamics will be shaped by the balance between US yields, signals from the Fed and political developments in both the US and Japan, with markets remaining highly sensitive to any new news catalysts.

USD/JPY

USD/JPY continues to rise as the yen remains under pressure. The Japanese currency has fallen to its weakest levels since July 2024, approaching the 159 per dollar area amid rumours of a possible announcement of snap elections in Japan. The market is pricing in a scenario of strengthened political positions for the Prime Minister and a potential easing of fiscal and monetary policy, which has increased pressure on the yen and boosted speculative activity in the FX market.

Technical analysis of USD/JPY points to a potential test of the 2024 high at 160.70 if the bullish momentum persists. A corrective pullback could take the pair back towards recent extremes in the 157.80–158.20 area.

In the coming trading sessions, the following events may influence USD/JPY pricing:

- today at 15:30 (GMT+2): US Producer Price Index (PPI);

- today at 15:30 (GMT+2): US core retail sales;

- today at 19:00 (GMT+2): Atlanta Fed GDPNow indicator.

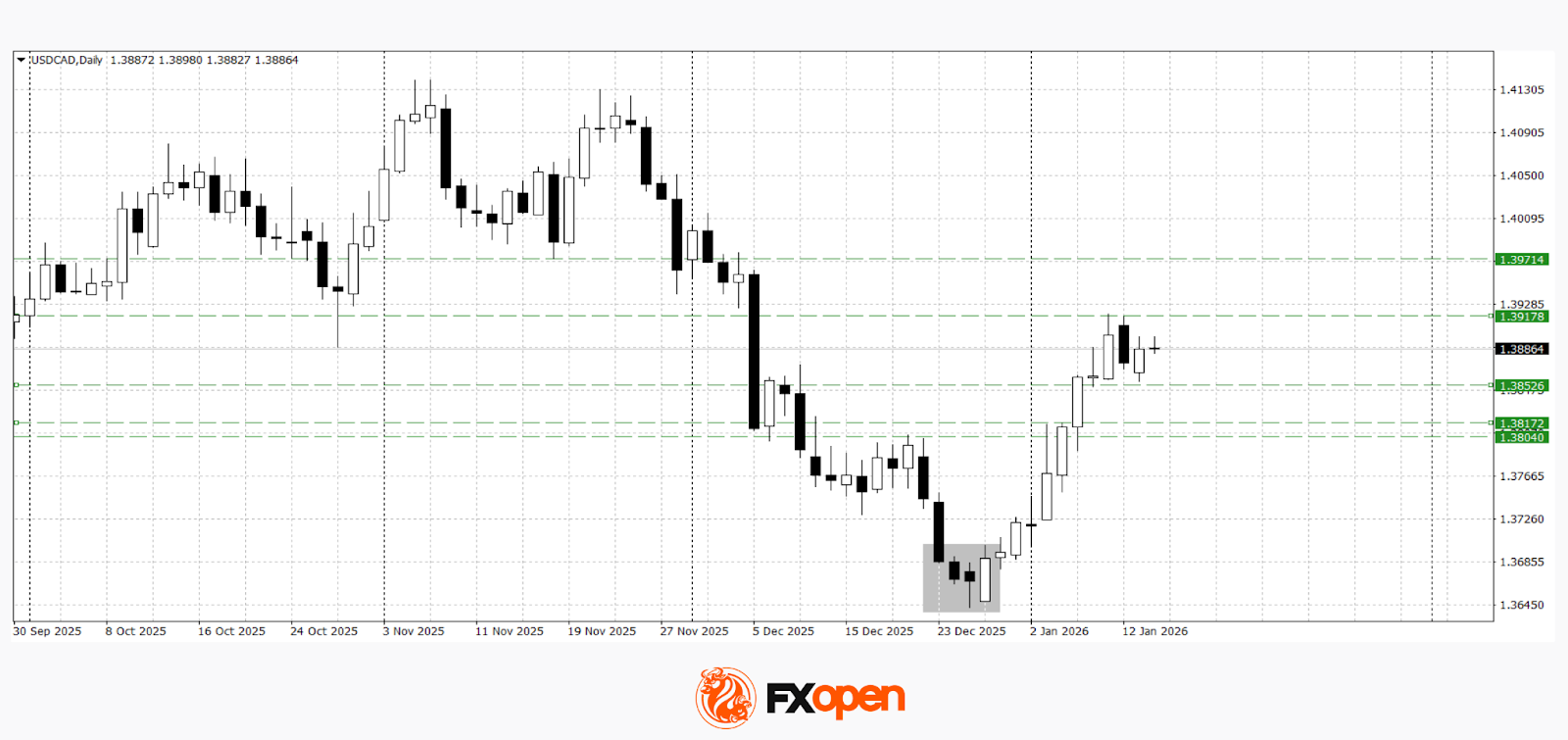

USD/CAD

A rebound from support at 1.3600 and the formation of a bullish engulfing pattern in late December pushed the pair higher towards key resistance at 1.3900. At present, the upward momentum is slowing, but if the price holds above 1.3850 in the coming sessions, a renewed test of 1.3900 is possible. A downside break below 1.3850 could trigger a resumption of the downward move towards the 1.3700–1.3600 area.

In the coming trading sessions, the following events may influence USD/CAD pricing:

- today at 17:30 (GMT+2): US crude oil inventories;

- today at 18:00 (GMT+2): Thomson Reuters/Ipsos Primary Consumer Sentiment Index (PCSI) for Canada.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.