FXOpen

The US dollar is consolidating after reaching new local highs, holding near key technical levels amid mixed macroeconomic data. The Dollar Index remains close to the upper boundary of its recent range, reflecting a balance between weak domestic indicators and steady demand for safe-haven assets as uncertainty surrounding the US government shutdown persists.

Data released on Wednesday by ADP showed employment growth of just 42K, signalling a cooling labour market and potential slowdown in private-sector activity. The ISM business activity indices for the services and manufacturing sectors displayed mixed trends, reinforcing concerns about the pace of the economic recovery.

USD/CAD

Technical analysis of USD/CAD suggests a possible start of a downward correction, as a “doji” pattern has formed on the daily chart. If the pair closes below 1.4100, it may decline towards the 1.4000–1.4050 area. A move above yesterday’s high, however, could trigger a new upward impulse.

Key upcoming events that may influence USD/CAD pricing:

- 15:30 (GMT+3): Canada trade balance

- 16:50 (GMT+3): Speech by Bank of Canada Deputy Governor Gravel

- 18:00 (GMT+3): Ivey Purchasing Managers Index (PMI)

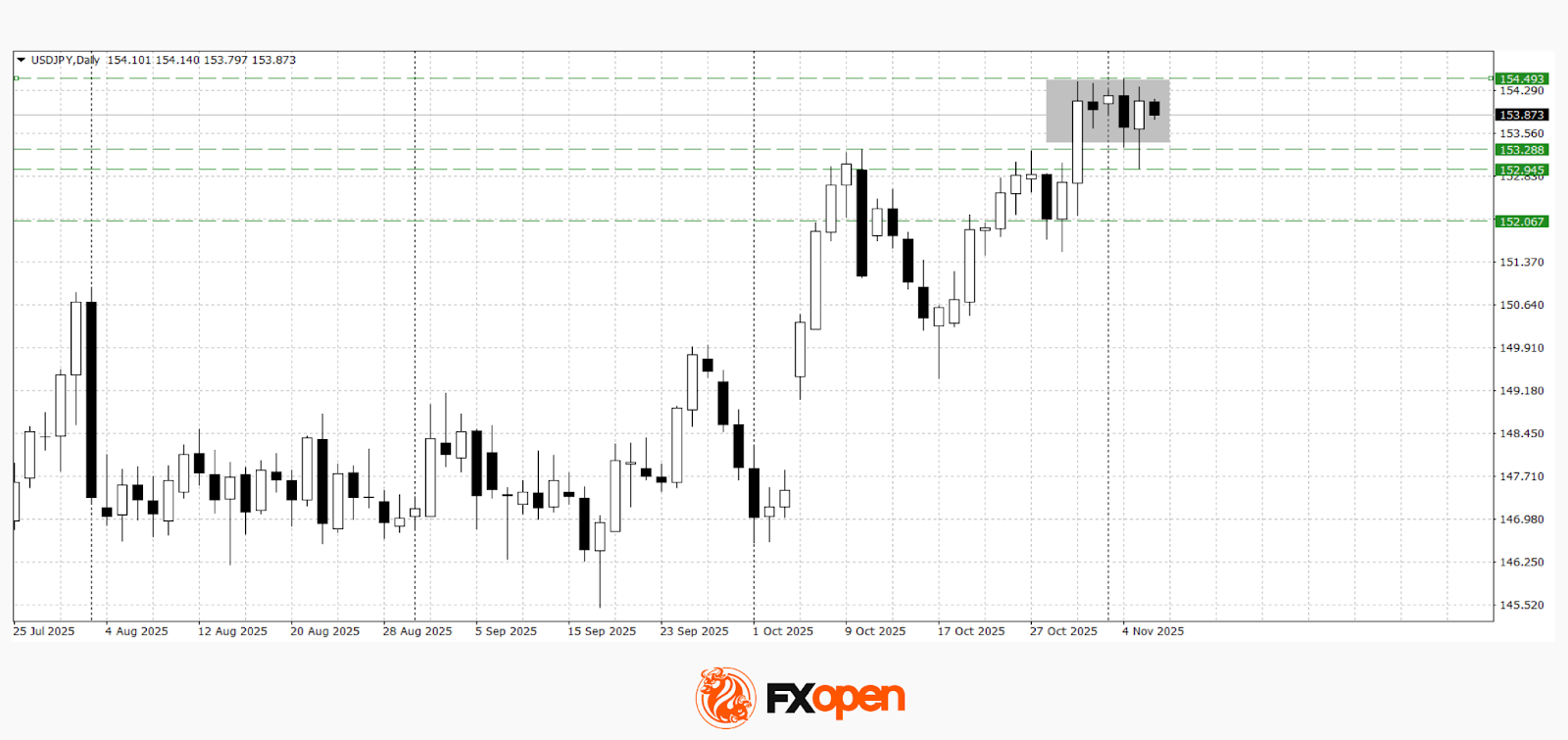

USD/JPY

The USD/JPY pair has been trading sideways in a range between 153.30 and 154.50 over the past few sessions. Sellers attempted to break below the lower boundary yesterday, but without success. If the price holds above 154.00, the pair could extend its rise towards 155.00–156.00. Conversely, a break below yesterday’s low may lead to a deeper downward correction.

Upcoming events that could impact USD/JPY dynamics:

- 19:00 (GMT+3): Speech by Michael S. Barr, Federal Reserve Vice Chair for Supervision

- 20:00 (GMT+3): GDPNow indicator from the Atlanta Federal Reserve

- Tomorrow, 02:30 (GMT+3): Japan household spending index

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.