FXOpen

The euro and the pound maintained their upward momentum after the Federal Reserve meeting, despite interest rates being left unchanged. At the start of the week, both pairs rose sharply: EUR/USD tested the area above the psychological 1.2000 level, while GBP/USD climbed towards 1.3870, after which a moderate correction followed as profits were taken.

However, after Jerome Powell’s speech, demand for European currencies strengthened again, as the Fed Chair’s rhetoric was perceived by the market as a signal in favour of future easing and the regulator maintaining a cautious stance, with no need to return to tightening.

An additional source of pressure on the dollar remains the geopolitical and trade backdrop. Statements by Donald Trump on tariff policy towards Europe have increased uncertainty around the outlook for external trade and added to market nervousness, periodically boosting volatility and supporting demand for alternatives to the dollar. Against this background, gains in the euro and the pound are being driven both by interest rate expectations and by a broader reassessment of risks related to tariffs and political rhetoric.

EUR/USD

After testing 1.2080, the EUR/USD pair corrected by more than 150 pips. However, the weakening of the dollar following Jerome Powell’s comments allowed buyers to find support near 1.1900 and resume the upward move.

The pair continues to receive support amid expectations of further steps by the Fed towards easing, provided inflation expectations remain stable. At the same time, yesterday’s pullback allowed sellers to form a “bearish harami” pattern. Confirmation of this formation on the daily close could trigger a deeper downward correction.

Key events for EUR/USD:

- today at 10:00 (GMT+2): retail sales volume in Spain;

- today at 13:00 (GMT+2): total number of unemployed in France;

- today at 15:30 (GMT+2): US initial jobless claims.

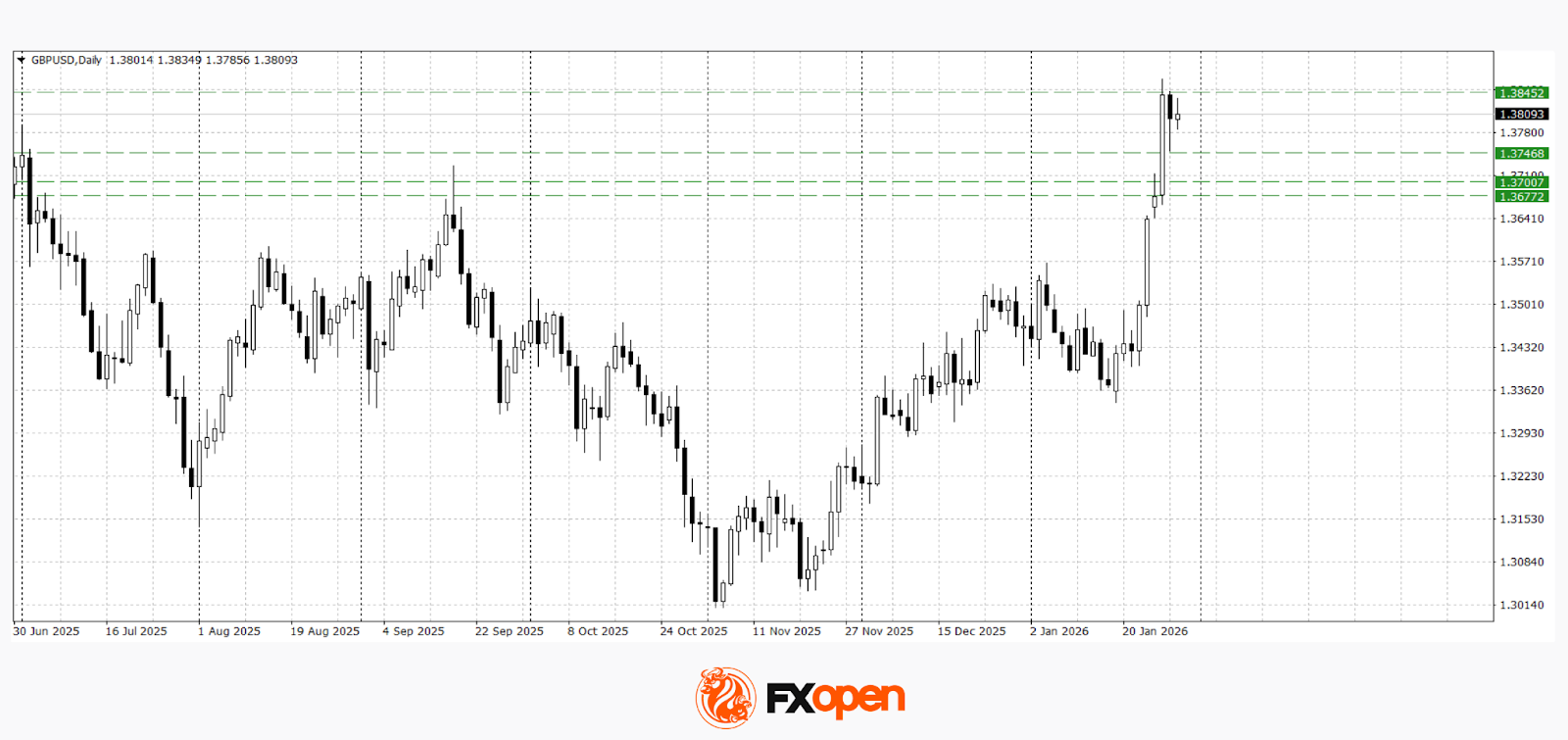

GBP/USD

Buyers of GBP/USD managed to обновить last year’s high this week. Ahead of the Fed meeting, the pair corrected towards 1.3750, but then resumed its rise and closed the day above 1.3800.

If the price holds above the 1.3750–1.3800 range over the next trading sessions, a retest of 1.3870 is possible. A break below the 1.3750 support would open the way for a deeper correction towards the 1.3670–1.3700 area.

Key events for GBP/USD:

- today at 15:30 (GMT+2): US non-farm productivity;

- today at 19:00 (GMT+2): Atlanta Fed GDPNow indicator;

- tomorrow at 11:30 (GMT+2): number of approved mortgage loans in the UK.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.