FXOpen

At the upcoming meeting, the American department is not expected to take steps aimed at changing monetary parameters. At the same time, officials will likely abandon overly hawkish or dovish rhetoric and focus on incoming macroeconomic data. November inflation statistics were published yesterday: as expected, the rate of growth in consumer prices accelerated from 0.0% to 0.1% in monthly terms and slowed down from 3.2% to 3.1% in annual terms, and the figure does not take into account prices for food and energy adjusted from 0.2% to 0.3%. During the day, November statistics on manufacturing inflation will be published in the US: forecasts suggest a further slowdown in annual dynamics from 1.3% to 1.0%, while in monthly terms the indicator may show an increase of 0.1% after -0.5% in the previous month.

EUR/USD

The EUR/USD pair shows mixed trading dynamics, consolidating near the 1.0785 mark. According to the EUR/USD technical analysis, immediate resistance can be seen at 1.0822, a break higher could trigger a move towards 1.0842. On the downside, immediate support is seen at 1.0750, a break below could take the pair towards 1.0695.

Market activity remains subdued as market participants are hesitant to open new positions ahead of the US Federal Reserve's interest rate decision. The ECB will meet on Thursday. It is assumed that the regulator will also not change the parameters of monetary policy, but will indicate further maintaining the key interest rate at 4.50% for a long time. Today, investors will pay attention to the October statistics on industrial production in the eurozone: the indicator is expected to decline by 0.3% after -1.1% in the previous month, and in annual terms it may change from -6.9% to -4.6%.

During the week, a trading range formed with boundaries of 1.0723 and 1.0827. Now, the price has moved away from the upper limit and may continue to decline.

GBP/USD

On the GBP/USD chart, the pair is declining slightly, testing the 1.2545 mark for a breakdown downwards. Immediate resistance can be seen at 1.2604, a break higher could trigger a rise towards 1.2614. On the downside, immediate support is seen at 1.2505, a break below could take the pair towards 1.22427.

Labour market data put some pressure on the pound the day before: the number of applications for unemployment benefits in November increased from 8.9k to 16.0k, while analysts expected 20.3k, the employment level in October adjusted from 54.0k to 50.0k, and unemployment remained at 4.2%. At the same time, the average salary excluding bonuses in October decreased from 7.8% to 7.3%, which turned out to be slightly lower than market expectations of 7.4%. The slowdown in wage growth indirectly indicates a further weakening of inflationary pressure in the country, which may push the Bank of England to more decisive actions aimed at easing monetary policy. However, analysts do not yet predict a quick softening of the British regulator’s position, emphasising that it may begin to lower interest rates after the US Federal Reserve and the ECB.

Today, the focus of investors' attention is on statistics on UK GDP dynamics. The national economy slowed by 0.3% in October after growing by 0.2% in the previous month, with expectations at -0.1%. In addition, industrial production volumes decreased by 0.8% after zero dynamics in September with a forecast of -0.1%, and in annual terms the dynamics slowed from 1.5% to 0.4%, while analysts expected 1.1%.

Since the end of last week, a range of prices has formed with boundaries of 1.2500 and 1.2615. Now, the price is at the bottom of the range and may continue to decline.

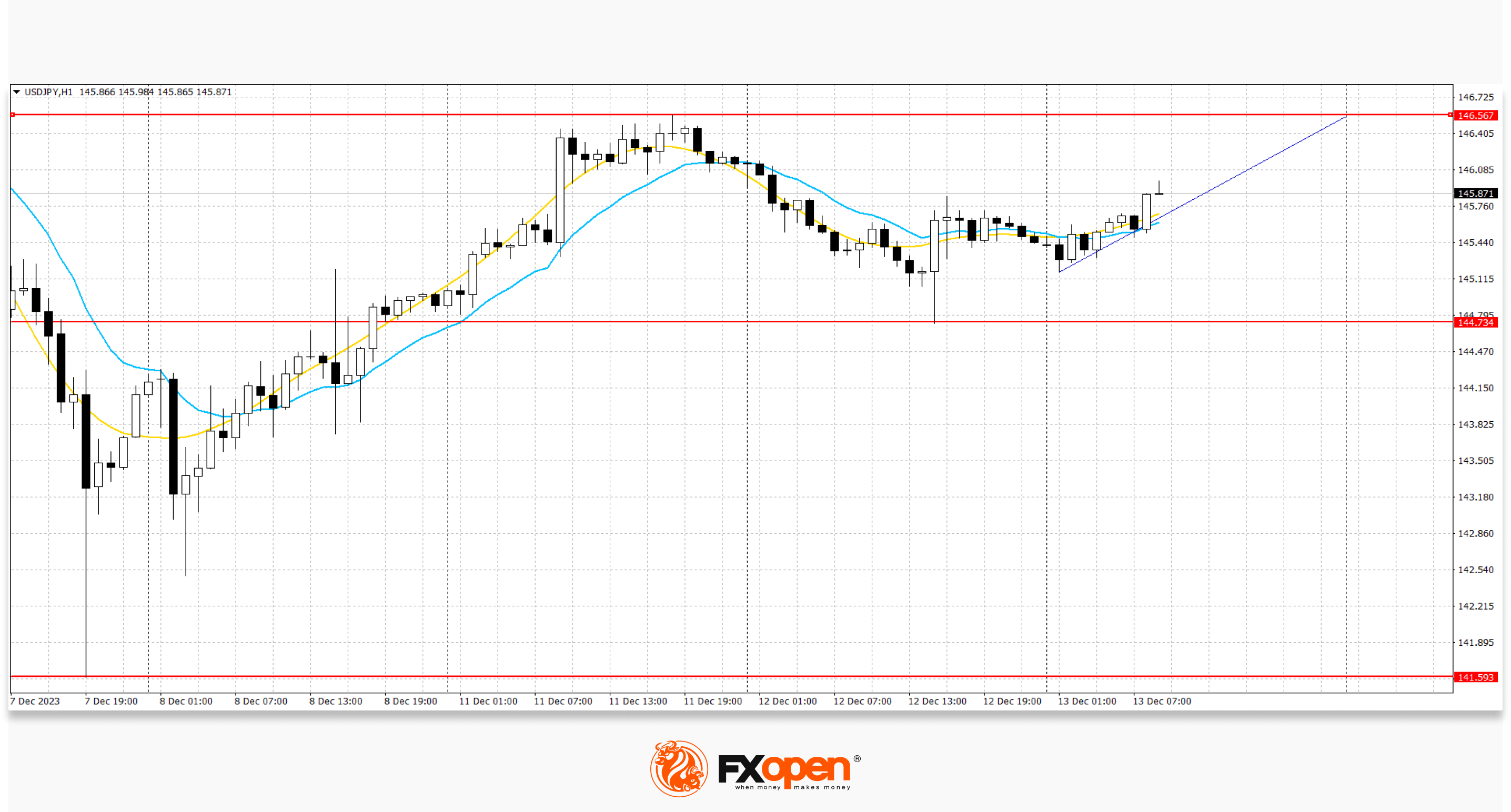

USD/JPY

On the USD/JPY chart, the pair shows slight growth, testing the 145.60 mark for an upward breakout. Strong resistance can be seen at 146.60, a break higher could trigger a rise towards 146.57. On the downside, immediate support is seen at 144.44. A break below could take the pair towards 144.00.

Investors are in no hurry to open new positions, despite active trading at the beginning of the week, preferring to wait for the US Federal Reserve's decision on interest rates, as well as updated forecasts regarding the vector of monetary policy for the coming years. The yen is moderately supported today by publications from Japan: the Tankan index of business activity for large enterprises of all industries in the fourth quarter decreased from 13.6% to 13.5%, while analysts expected 12.4%, the indicator of business conditions for large enterprises rose from 9.0 points to 12.0 points with a forecast of 10.0 points, and in the services sector - from 27.0 points to 30.0 points. Bloomberg analysts are confident that the Bank of Japan will continue its policy of negative interest rates, keeping the rate at -0.10%, since the regulator did not see sufficient evidence of wage growth to justify persistent inflation. Most likely, officials will keep the parameters of monetary stimulus unchanged at the meeting on December 19, despite investors' expectations of a change in course. Such rhetoric will continue to put pressure on the yen's position.

The previous range of prices remains with the boundaries of 141.60 and 147.50. The price is currently at the top of the range and may continue to rise.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.