FXOpen

European currencies remain under pressure for the third consecutive week: the euro is consolidating near the lower boundary of its range, while the pound continues to decline ahead of tomorrow’s Bank of England meeting. The pressure on both pairs persists amid growing uncertainty across global markets. An additional factor is the risk of the ongoing US government shutdown, which could delay the release of key data and influence assessments of the Federal Reserve’s monetary outlook.

Investors are maintaining a cautious stance: the Bank of England meeting, scheduled for tomorrow, could set the tone for the pound in the coming weeks. The market is divided in its expectations – some participants anticipate that the regulator will keep rates unchanged but adopt a softer tone in its comments, while others expect hints of a possible rate cut later in the year. Any signs of dovish rhetoric could further weigh on the pound, particularly in light of weak domestic data and growing evidence of economic cooling.

EUR/USD

Following last week’s ECB meeting, the EUR/USD pair rebounded from the key level of 1.1670, forming a bearish engulfing pattern. At the start of this week, the downward trend resumed: the pair not only consolidated below 1.1600 but also renewed its October low for the current year at 1.1540. Technical analysis of EUR/USD suggests the possibility of a decline towards the August lows around 1.1390–1.1400, should the 1.1500 mark turn into medium-term resistance.

Upcoming events likely to influence EUR/USD in the next trading sessions:

→ 10:00 (GMT+3): German factory orders;

→ 12:00 (GMT+3): Eurozone services PMI;

→ 13:00 (GMT+3): Speech by Bundesbank President Joachim Nagel.

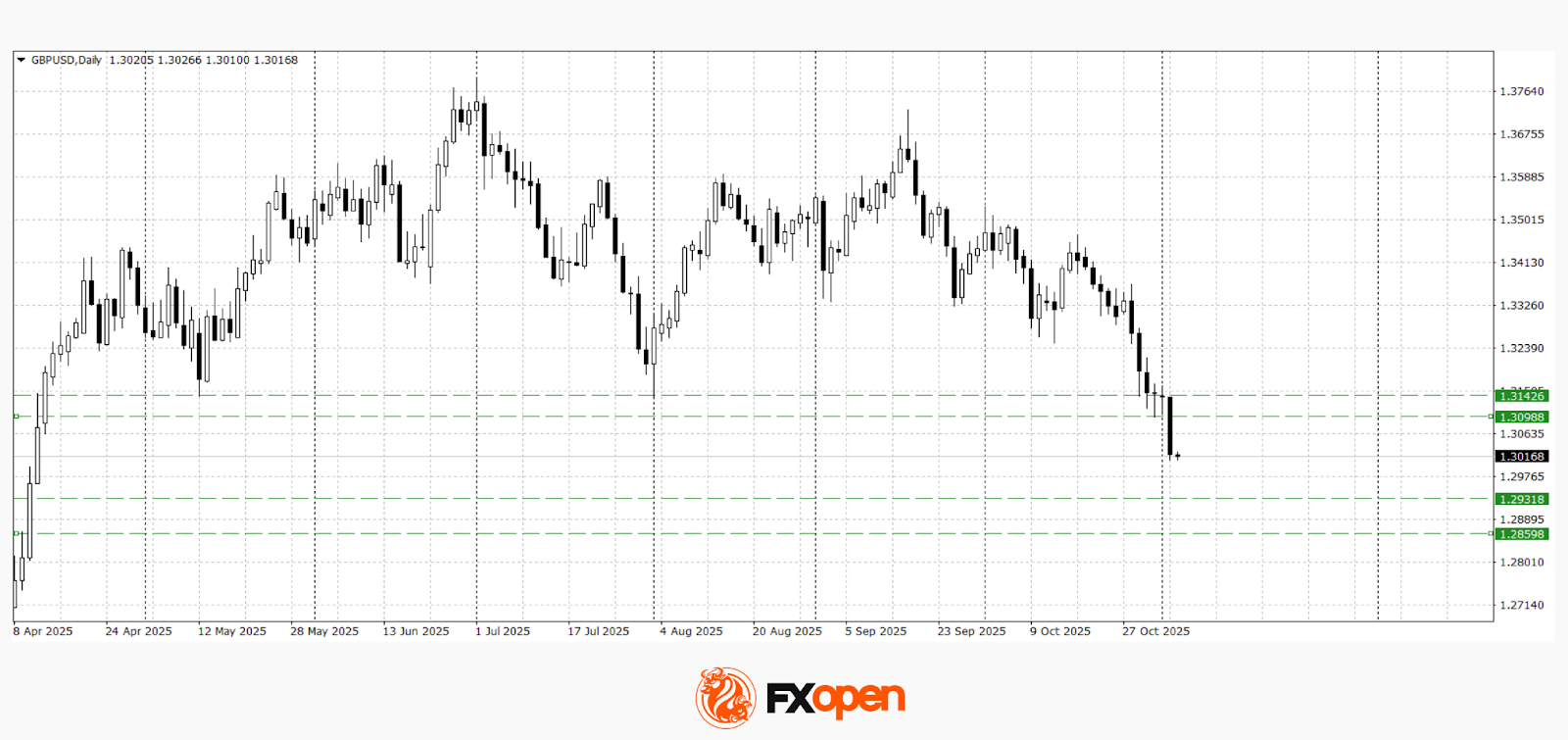

GBP/USD

The GBP/USD pair has been falling for the third consecutive week. The key range of 1.3100–1.3140, which had held off sellers for six months, has now been decisively broken. If buyers fail to regain ground above 1.3100 in the near term, the price could continue its downward move towards 1.2850–1.2930.

Upcoming events likely to affect GBP/USD in the next trading sessions:

→ 12:30 (GMT+3): UK services PMI;

→ 17:00 (GMT+3): US ISM Non-Manufacturing PMI;

→ 15:00 (GMT+3) tomorrow: Bank of England interest rate decision.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.