FXOpen

The euro is edging higher after last week’s pullback, as buyers hold the price near key levels in anticipation of fresh inflation data. Market participants are cautiously rebuilding long positions in the single currency, hoping for confirmation that price pressures in the region are stabilising.

The US dollar remains under moderate pressure following the release of weak labour market data and amid the ongoing government shutdown, which heightens uncertainty surrounding budget negotiations. Nevertheless, the dollar’s fundamental position remains solid, supported by relatively robust business activity figures and expectations of fresh guidance from Federal Reserve officials.

Today, investors’ attention will be focused on the release of inflation indicators from Germany and speeches by representatives of the Federal Reserve and the European Central Bank, including Isabel Schnabel and Luis de Guindos. The euro’s further trajectory will depend on whether the market receives clear signals of a recovery in price pressures across the euro area.

EUR/USD

At the end of last week, EUR/USD buyers managed to defend the key 1.1500 support level and form a bullish “piercing line” pattern on the daily chart. Technical analysis suggests that this formation may continue to play out, with the potential for a rise towards 1.1650–1.1700. A break below the 1.1540 support could lead the pair to revisit the current month’s lows.

In the coming trading sessions, the following events may influence EUR/USD price dynamics:

- 10:00 (GMT+3) – Germany CPI (Consumer Price Index);

- 13:00 (GMT+3) – Eurogroup meeting;

- 13:45 (GMT+3) – Speech by ECB Executive Board member Isabel Schnabel.

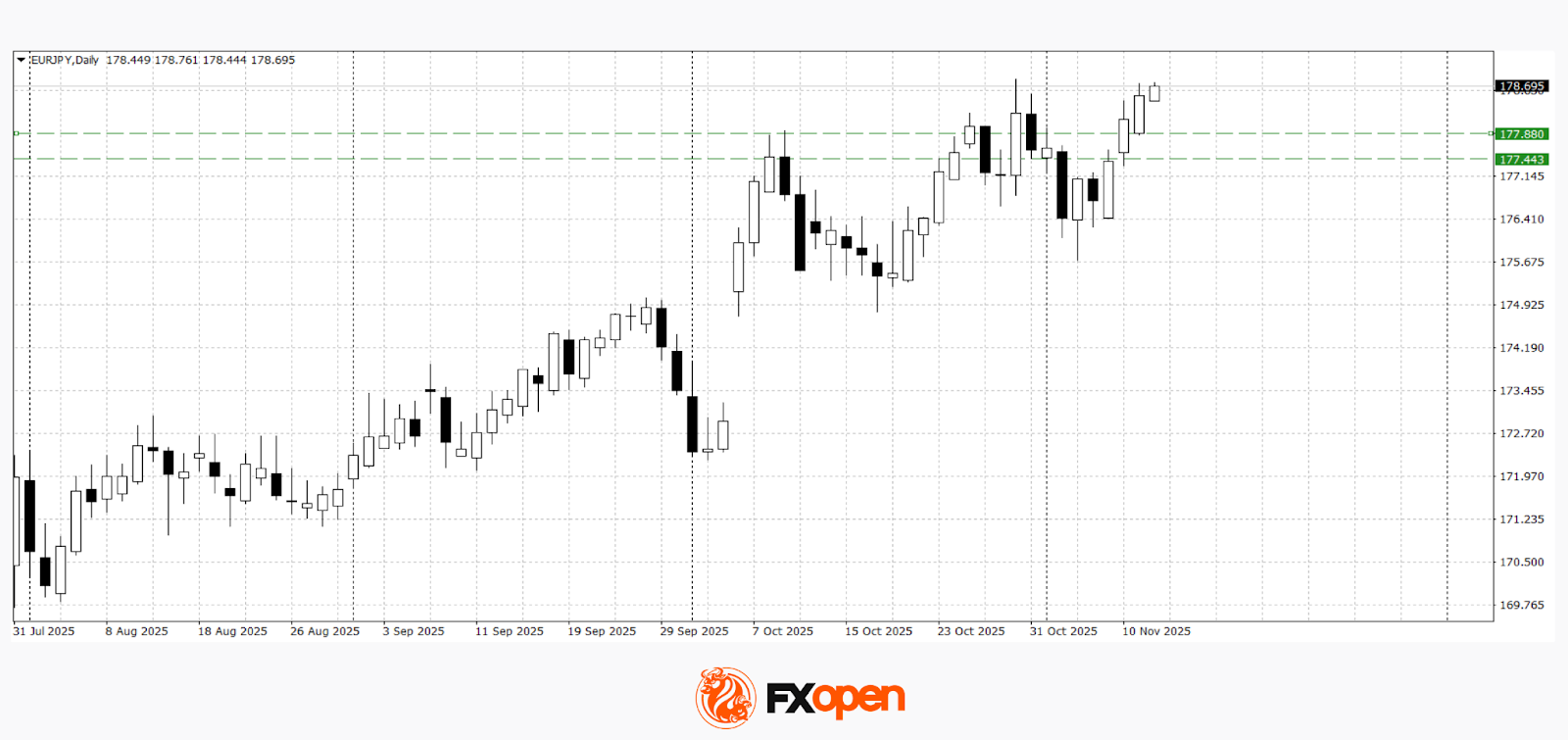

EUR/JPY

The EUR/JPY pair has once again approached recent highs around 178.80. If the upward momentum persists, a test of the round levels at 179.00–180.00 is possible. A corrective pullback may occur towards the 177.40–177.90 area. A firm move below 177.40 could trigger a deeper downward retracement.

In the coming sessions, the following events may affect EUR/JPY price action:

- 16:00 (GMT+3) – Germany’s current account balance (non-seasonally adjusted);

- 02:50 (GMT+3) tomorrow – Japan’s Corporate Goods Price Index (CGPI);

- 12:00 (GMT+3) tomorrow – ECB Monthly Report.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.