FXOpen

As expected, the decision on the interest rate had a powerful impact on the markets. Thus, the euro/US dollar pair lost more than 100 pp in just a couple of hours and updated its recent low at 1.0630, the US dollar/yen pair is trading above 148, and the pound/US dollar is awaiting a verdict from the Bank of England near 1.2300. We can also see the breakdown of ascending combinations in commodity currencies and gold.

The main driver for the sharp rise in the US dollar was that most members of the US Federal Reserve are expecting another rate increase this year. It also turned out that there will be no aggressive rate cuts in 2024; the median forecast for next year increased to 5.1%.

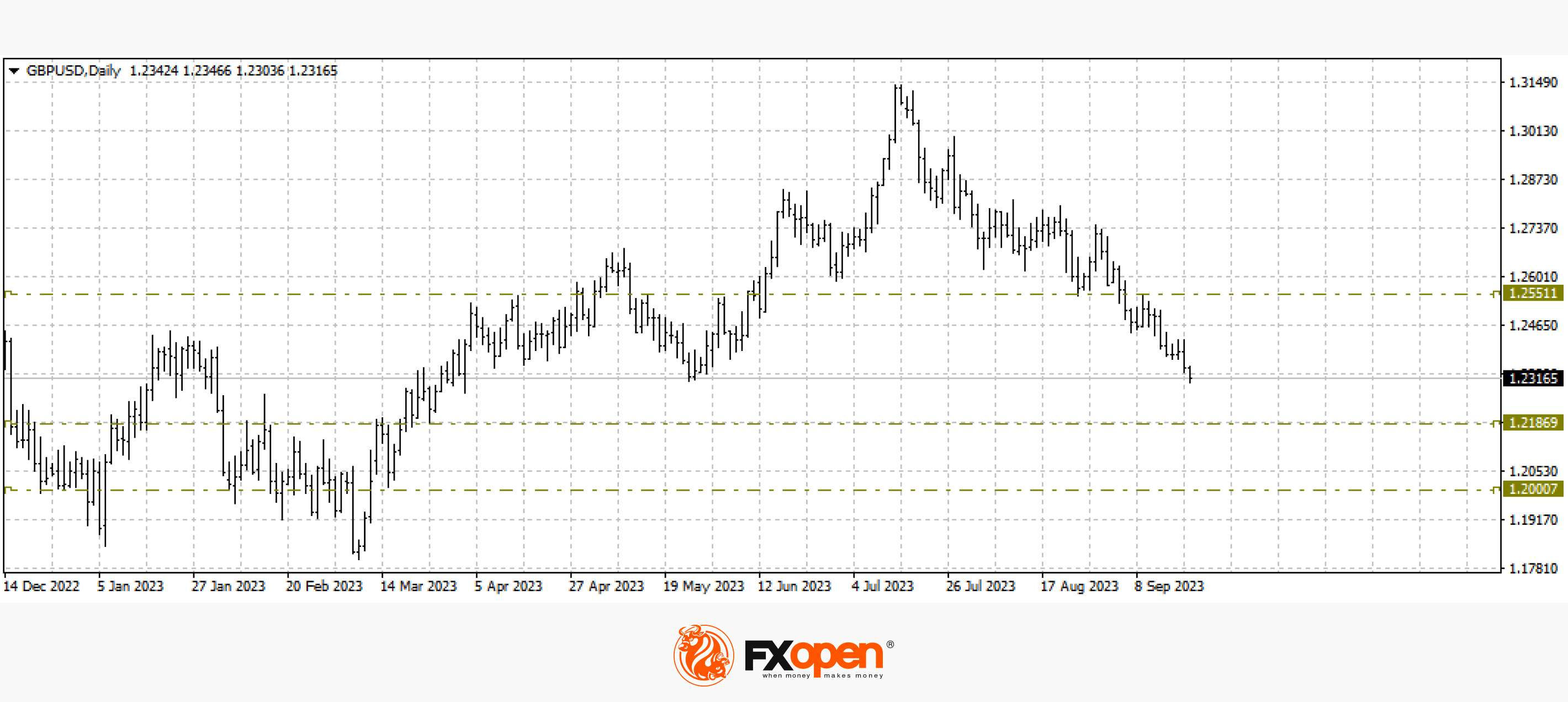

GBP/USD

After Jerome Powell's hawkish statements, the pound/US dollar pair updated the May low and tested 1.2300. At the moment, we are seeing a slight rebound from yesterday’s extremes, but if the Bank of England’s decision disappoints pound buyers, the pair may resume its downward movement in the direction of 1.2200-1.2000. Cancellation of the downward scenario can only be considered after a confident strengthening above 1.2500.

Analysts suggest that officials will raise the base rate by 0.25% today, but apparently, market participants are more interested in the future plans of the British regulator. And if a slowdown or problems in the British economy are announced, the GBP/USD pair will likely continue its downward trend.

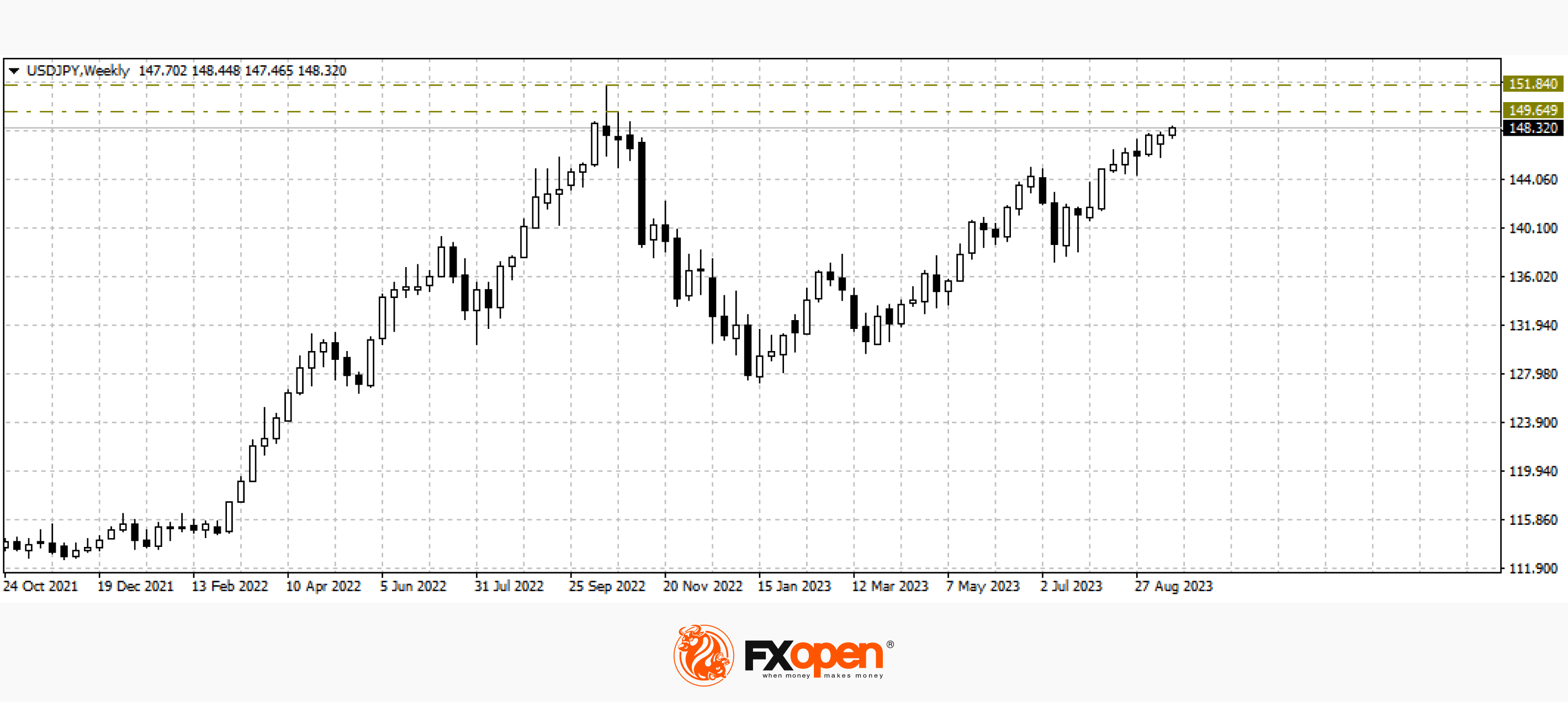

USD/JPY

The US dollar/yen currency pair is steadily growing towards the extremes of last year at 150.00-151.00. Without a test of this area or without confirmed reversal combinations on higher timeframes, the beginning of a corrective rollback is unlikely.

From the point of view of fundamental analysis, today at 15:30 GMT+3, we are waiting for data on the manufacturing activity index from the Philadelphia Fed for September. Weekly data on applications for unemployment benefits will also be released.

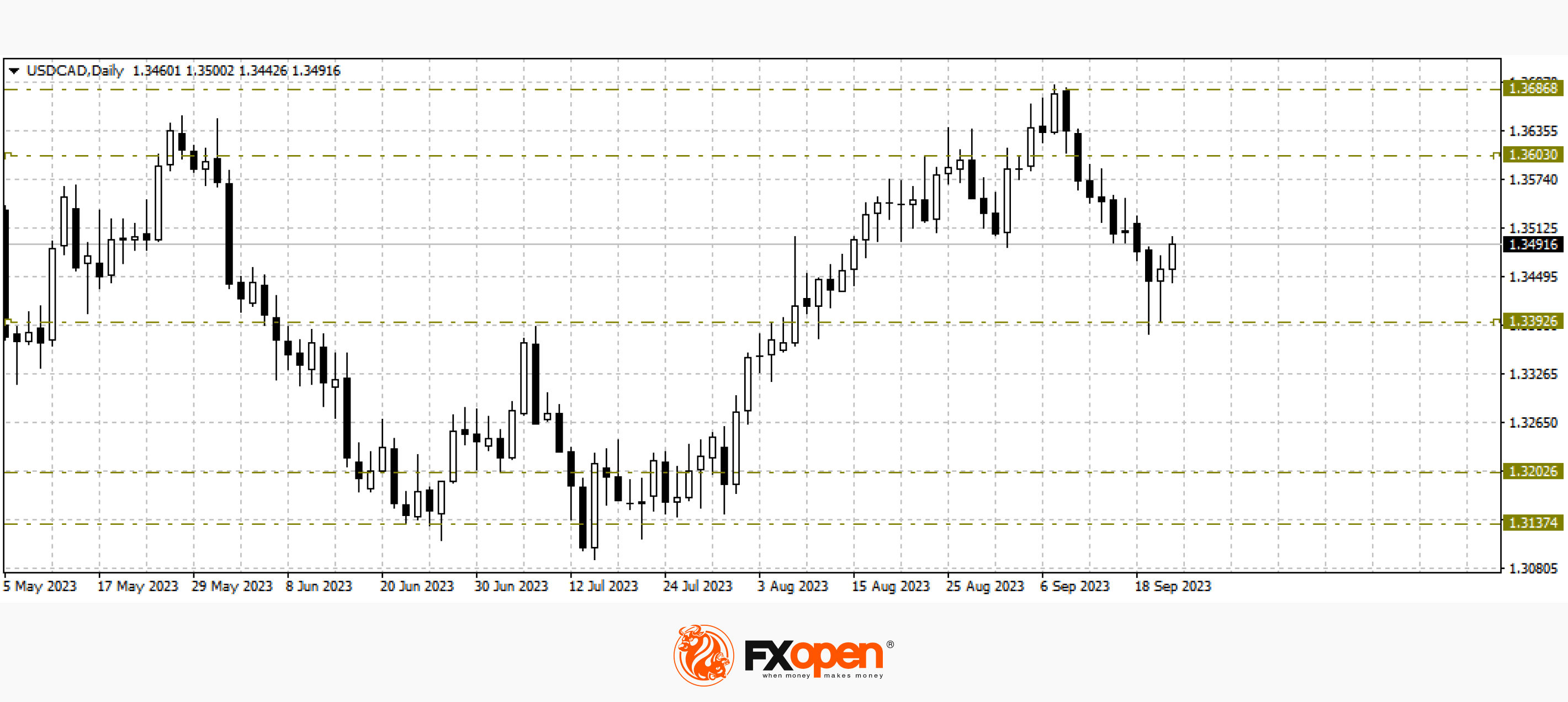

USD/CAD

As expected, the US dollar/Canadian currency pair retested the support at 1.3400 and resumed growth. The nearest levels where growth may slow down are located at 1.3600-1.3700.

Today at 15:30 GMT+3, we are waiting for the price index for new housing in Canada. Tomorrow, at the same time, the volume of sales in the manufacturing sector will be published.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.