FXOpen

The sharp decline in commodity currencies, which could be observed in early September, slowed down somewhat last week. Sellers of the American currency were able to take advantage of this, which in turn led to the beginning of a corrective pullback in such pairs as AUD/USD, USD/CAD, and NZD/USD. Yesterday, European currencies retested important supports, but so far, no confirmed reversal combinations have been observed. But whether the new trends will continue or whether it is worth preparing for another upward impulse in the US dollar will become clear after today's verdict on the rate from the Fed.

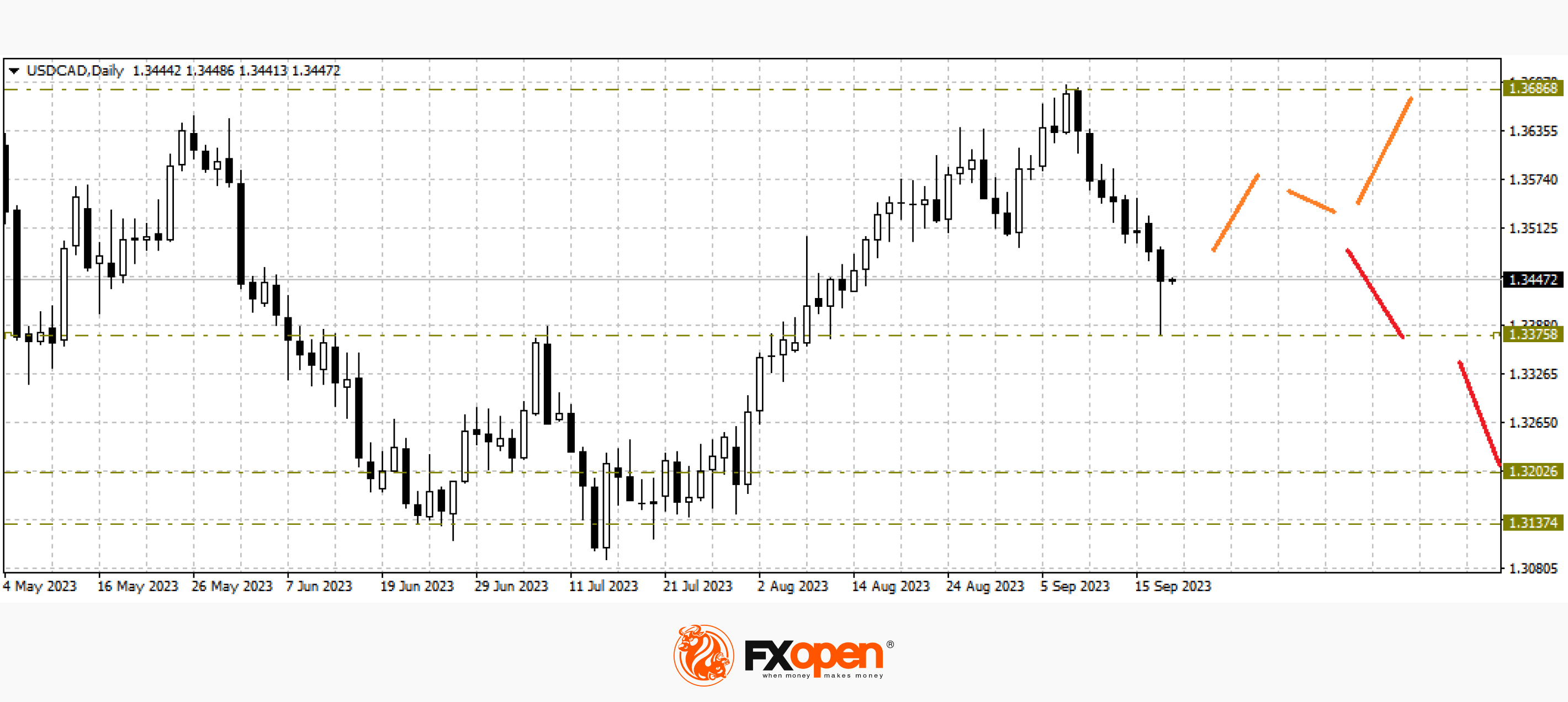

USD/CAD

In the dollar/loonie pair, we are observing the development of the bearish engulfing from September 8th. After forming a sell combination, the pair fell by more than 200 pp and tested important support at 1.3400. After breaking the specified level, the price sharply rebounded back. If 1.3400-1.3370 remains in support status, another approach to 1.3700 may occur; otherwise, the development of a downward impulse towards 1.3200-1.3000 may happen.

From the point of view of fundamental analysis, today at 17:30 GMT+3, it is worth paying attention to the publication of data on crude oil reserves in the United States. Also, at 20:30 GMT+3, a summary of the Bank of Canada's discussions will be published.

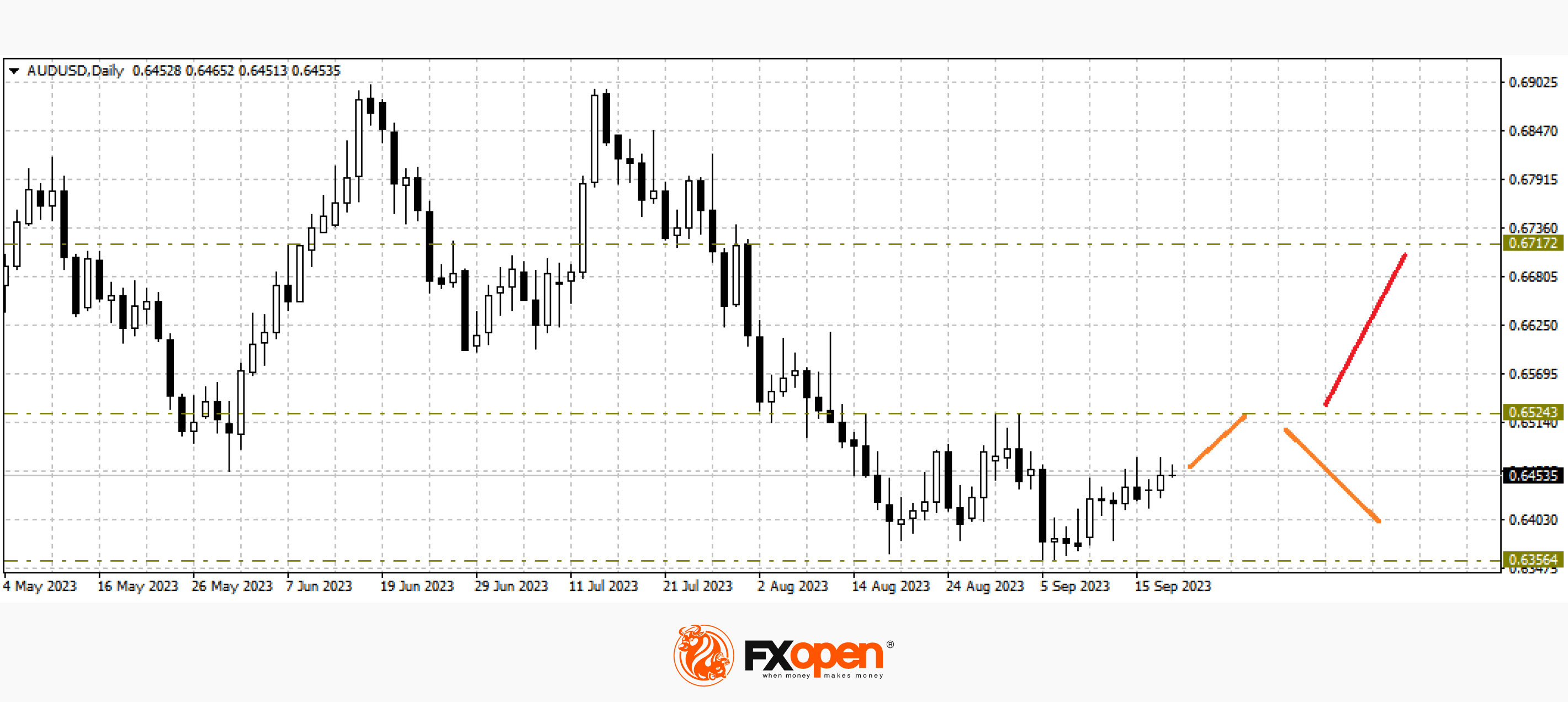

AUD/USD

At the beginning of September, the AUD/USD currency pair retested the support of 64, thereby laying the foundation for the formation of a double-bottom combination on the daily timeframe. If Aussie buyers manage to escape and consolidate above 0.6530, a resumption of medium-term growth in the direction of 0.6700-0.6800 may happen, while a breakdown of 0.6400 may open the way to 0.6200-0.6000.

In addition to today's Fed meeting, early tomorrow morning, it is worth paying attention to the publication of the RBA monetary policy report.

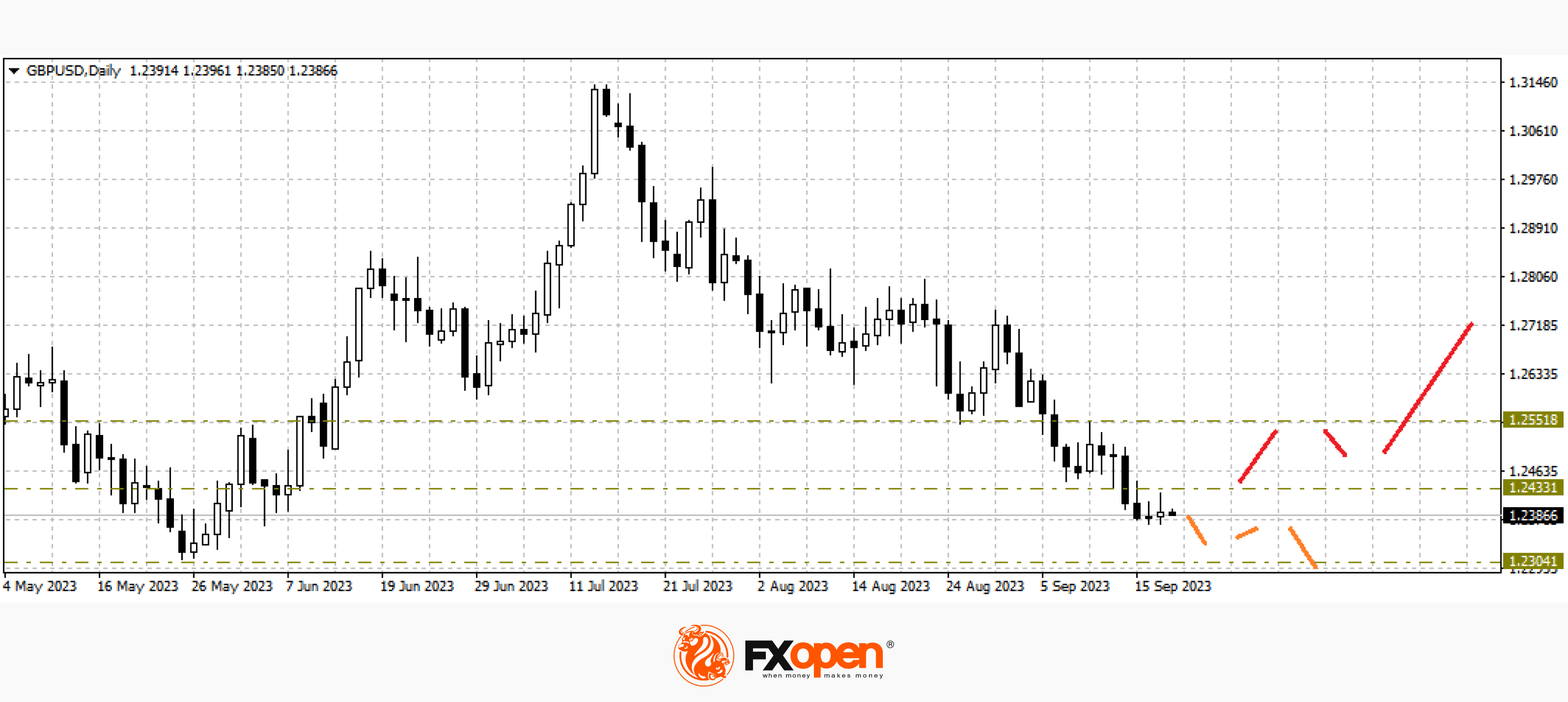

GBP/USD

The range of movement of the pound/US dollar pair has narrowed even more than at the beginning of the week. The pair will have important news in the coming trading sessions. Today, the Fed will announce its verdict, and tomorrow, according to analysts’ forecasts, the interest rate will be raised by the Bank of England. A sharp surge in volatility with possible false breakouts and multidirectional spikes may occur. At the moment, there are no reversal combinations for growth; a decline to 1.2300-1.2200 may occur.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.