FXOpen

The US dollar has resumed growth in almost all directions, but key levels have not yet been broken. Thus, the AUD/USD currency pair is approaching October lows just below 0.6300, the pound/US dollar has retested 1.2100, and the US dollar/yen is consolidating near 150.00.

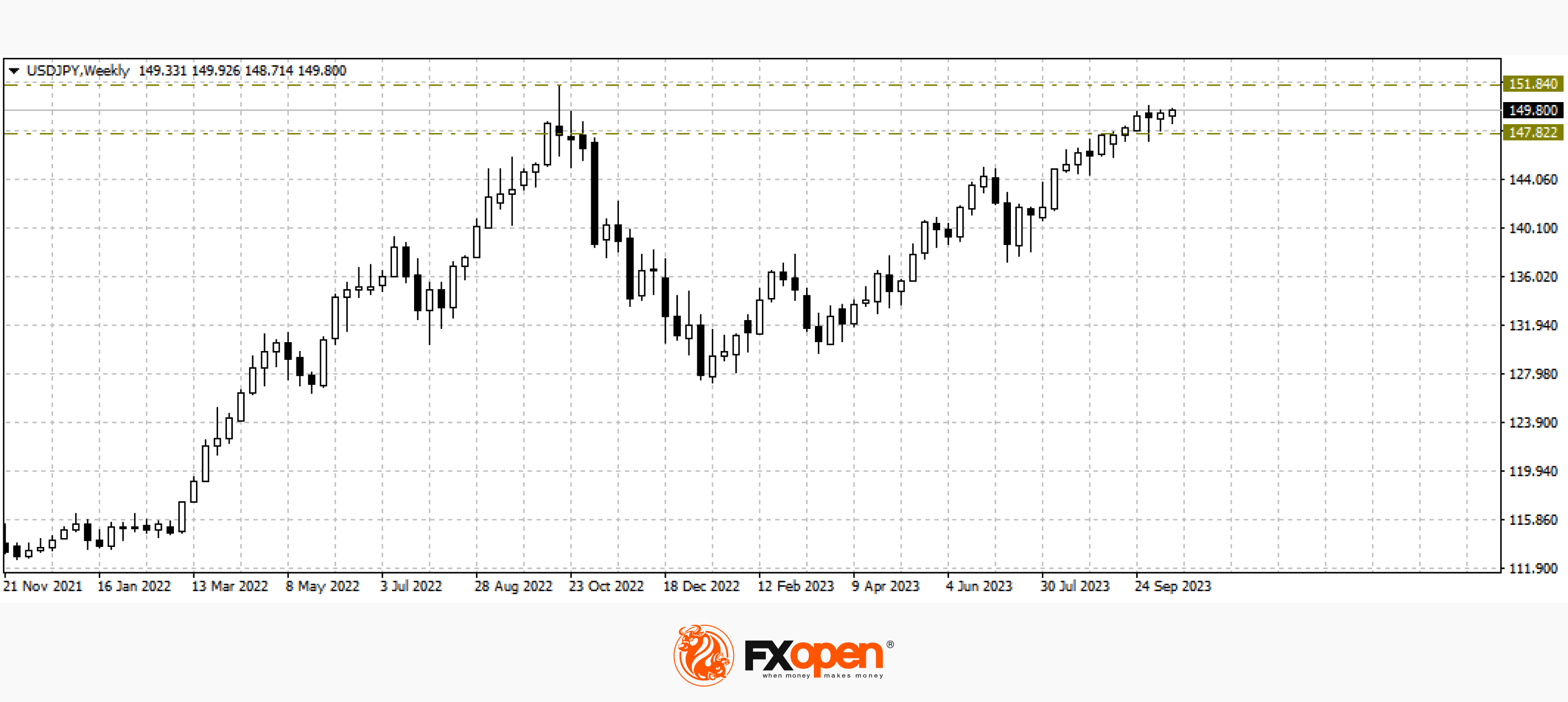

USD/JPY

A possible Fed rate hike due to rising inflation, as well as good data on the core retail sales index and industrial production in the US, published at the beginning of the week, keep the pair from developing a full-fledged downward correction. At the same time, as we see, incoming data is not yet enough to consolidate above 150.00. Most likely, buyers need an additional news background to resume impulse growth. If the foundation of the next trading sessions is positive for the American currency, a renewal of the recent high at 150.20 and a resumption of growth in the direction of last year’s extremes at 151.80m may occur. We could consider cancelling the upward scenario if the pair falls below 147.80.

Today's speech by Fed Chairman Jerome Powell will be important for the pair's pricing. Tomorrow morning, you should pay attention to the publication of data on the national core consumer price index (CPI) in Japan.

GBP/USD

The British currency continues to trade in a narrow flat corridor between 1.2210 and 1.2100. This morning, the pair’s sellers once again tried to strengthen lower, but so far without success. On the daily timeframe, the pair is below the alligator lines, the AO and AC oscillators are red, which may additionally indicate sales. However, until the price breaks the low of the October 4 reversal bar at 1.2040, the probability of renewed growth towards 1.2340 is quite high.

Tomorrow, pay attention to the publication of data on the core retail sales index in the UK (m/m) for September.

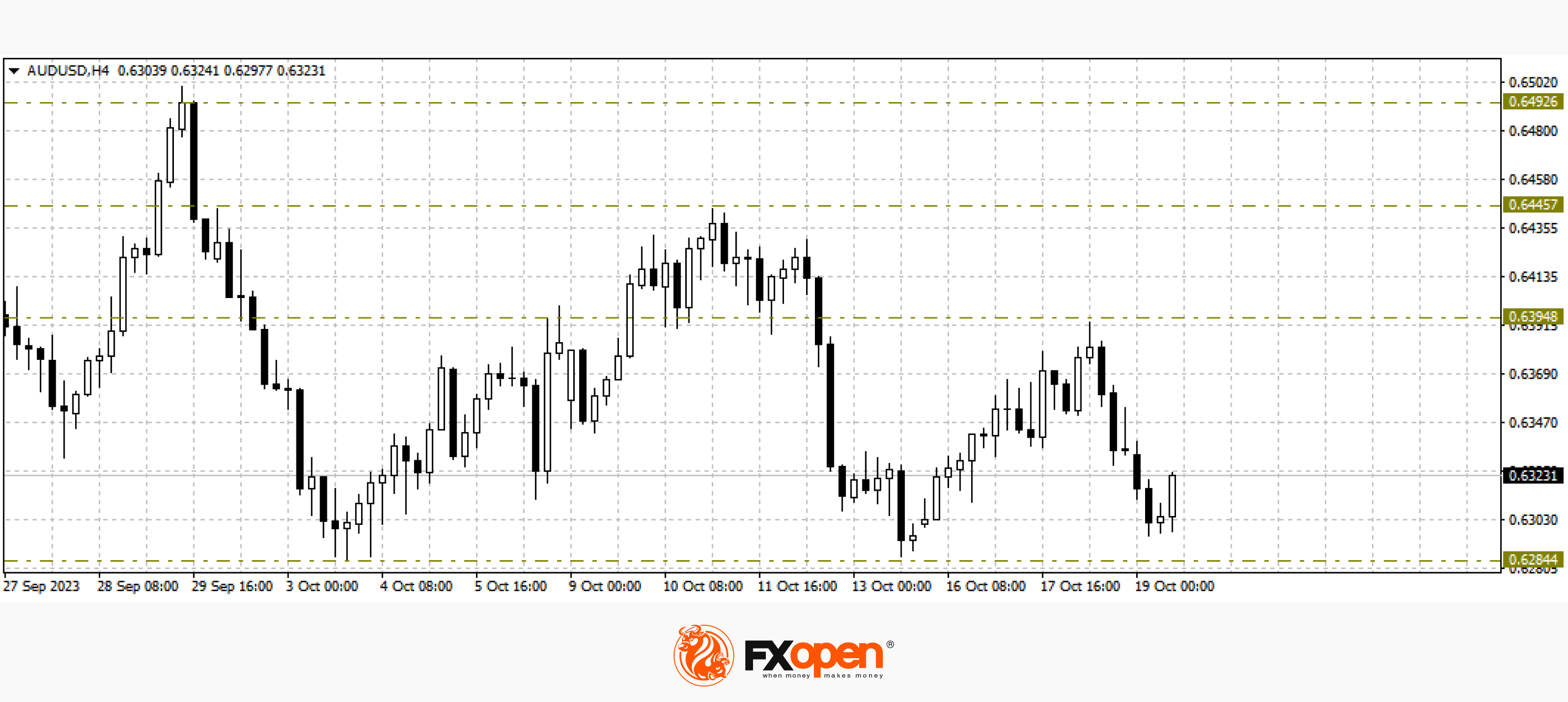

AUD/USD

The decrease in risk appetite in the market interrupted the upward correction in commodity currencies. The AUD/USD currency pair, after testing 0.6400, lost about 100 points, and this morning was trading below significant support at 0.6300. At the moment, the price is at critical levels, the reaction of market participants to the speech of the head of the Fed may become decisive for the medium-term direction of the pair. A move below 0.6280 could open the way to 0.6000. A consolidation above 0.6400 may mark the beginning of a full-scale upward correction.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.