FXOpen

In the US, the August budget report will be published today, followed by September data on retail sales and industrial production tomorrow. Experts expect a slowdown in production dynamics from 0.4% to 0.1%. Sales data could decline from 0.6% to 0.2%, while the ex-automotive figure could slow from 0.6% to 0.1%. The monthly budget report from the US Federal Reserve expects a deficit of USD 78.6 billion in August after a surplus of USD 89.0 billion the month before. Hawks do not rule out another increase in borrowing costs in November, but the main scenario at the moment seems to be maintaining a wait-and-see attitude, given the gradual decline in inflationary pressure.

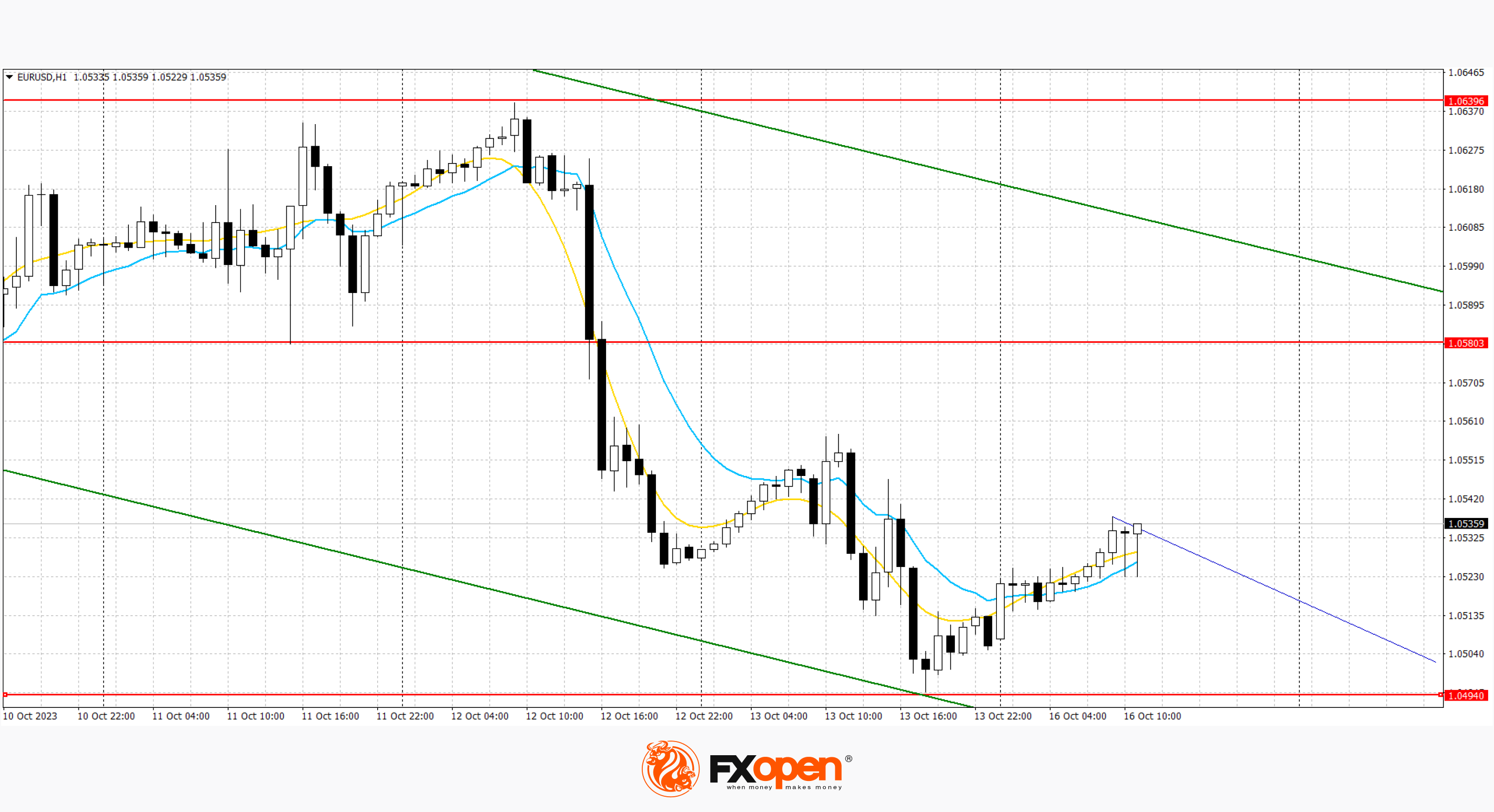

EUR/USD

EUR/USD is showing weak growth, correcting after last week's bearish end, as a result of which the euro retreated from local lows of September 25. The pair is testing the 1.0525 mark for a breakout upward in anticipation of the emergence of new drivers on the market.

The focus of investors today will be the September statistics on the consumer price index in Italy: forecasts suggest that the indicator will remain at 0.2% monthly and 5.3% annual. Also, during the day, the EU will present August data on the dynamics of the trade balance. Investors are still trying to assess the prospects for further tightening of monetary policy by European and American regulators.

The downward channel is maintained. Now, the price is in the middle of the channel and may continue to decline.

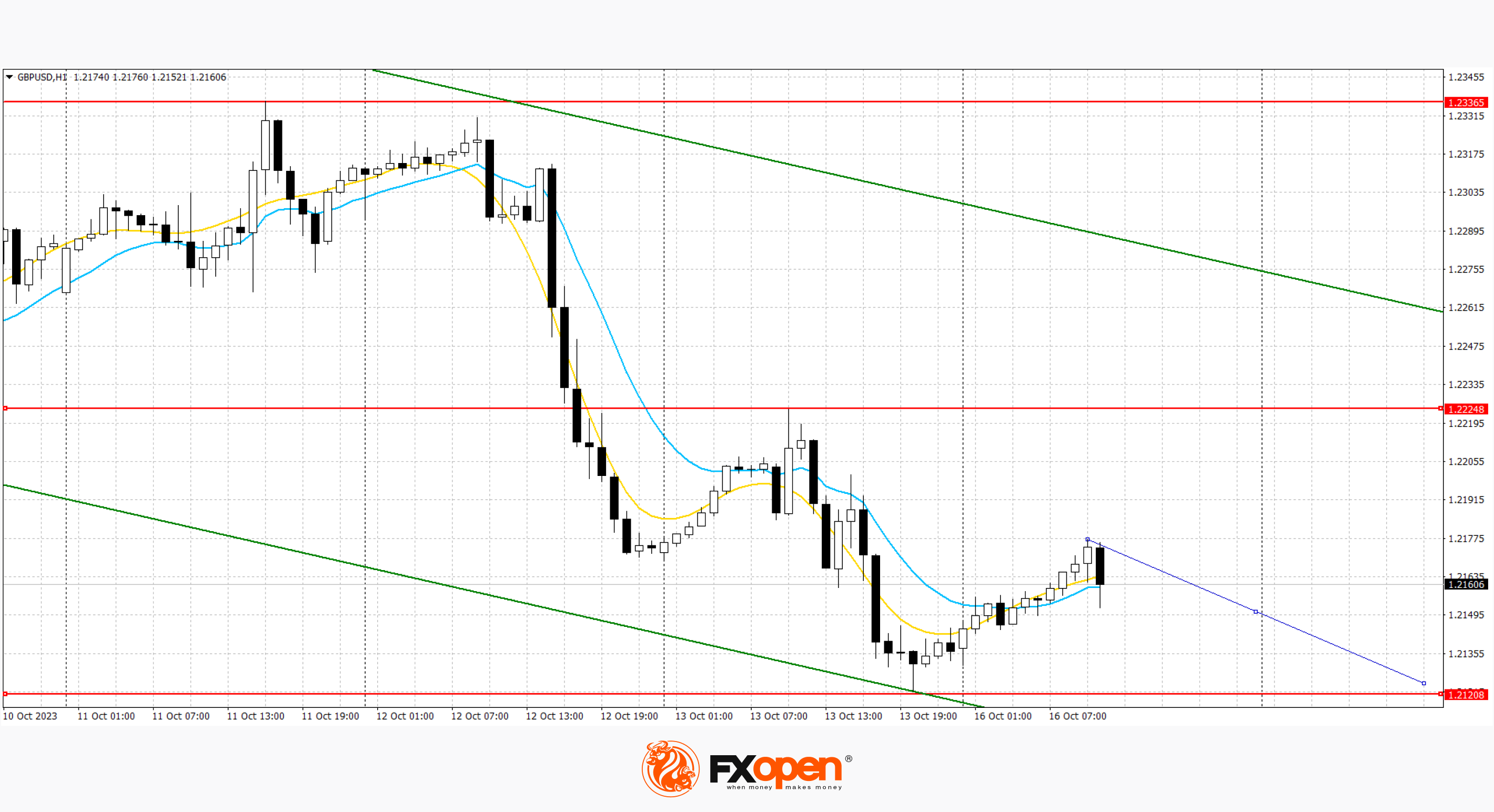

GBP/USD

The GBP/USD pair is trading slightly higher, recovering from a fairly active decline at the end of last week. The instrument is again testing the 1.2160 level for an upward breakout; however, activity in the market remains quite low.

Trading participants are in no hurry to open new positions ahead of tomorrow's publication of UK labour market statistics for August. Forecasts suggest a further decline in employment by 195.0k after -207.0k in the previous month. The unemployment rate may remain at 4.3%. The average salary, including bonuses, may be adjusted from 8.5% to 8.3%, and without bonuses, it may remain at 7.8%. In addition, inflation data will be presented in the UK on Wednesday. In September, the consumer price index may rise from 0.3% to 0.4%, and in annual terms, analysts expect a slowdown in dynamics from 6.7% to 6.5%.

The previous downward channel remains. Now, the price has moved away from the lower border of the channel but may continue to decline.

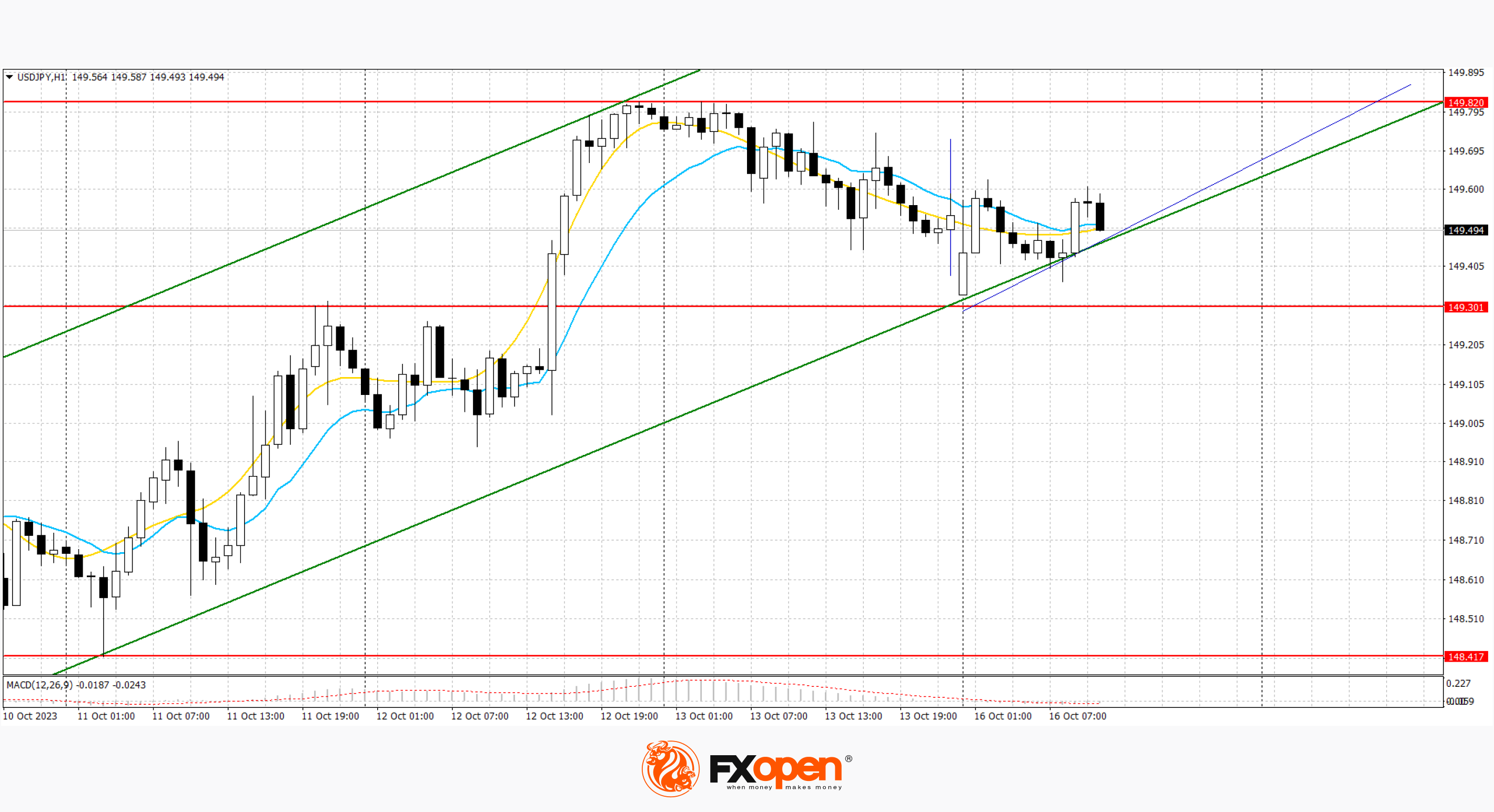

USD/JPY

The USD/JPY pair shows mixed dynamics, holding around 149.40. The dollar is once again retreating from the psychological level of 150.00, although at the end of last week it failed to begin testing it.

In addition to technical factors, weak macroeconomic statistics put pressure on the position of the American currency. Thus, the October consumer confidence index from the University of Michigan showed a decrease from 68.1 points to 63.0 points, while analysts expected 67.4 points. In addition, investors are afraid of quotes consolidating above the level of 150.00, expecting intervention from the Bank of Japan. Last year, the regulator took similar actions, which ultimately allowed the yen to recover, but for now, the bank maintains a wait-and-see attitude.

Macroeconomic data from Japan, published today, failed to support the national currency. Thus, industrial production volumes in August decreased by 0.7%, while experts expected that the dynamics would remain at zero, and in annual terms, the indicator accelerated the decline from -3.8% to -4.4%. At the same time, capacity utilisation increased by 0.5% after -2.2% in the previous month.

An ascending channel has formed based on the highs of last week. Now, the price is moving up along the lower border of the ascending channel.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.