FXOpen

Federal Reserve Chairman Jerome Powell's comments at the economic forum were seen as generally dovish. The strength of the US economy and ongoing tight labour markets could justify further rate hikes, Powell said. But he also noted that the recent market rise in bond yields has helped tighten overall financial conditions significantly.

The official's speech turned out to be quite cautious, and, in general, signalled more in favour of maintaining monetary policy without changes. However, answering questions, the chairman did not rule out the possibility of an additional increase in the interest rate, emphasising that the current value is not the maximum.

In addition, the day before the market paid attention to a block of macroeconomic statistics from the United States. Thus, the number of initial applications for unemployment benefits for the week of October 13 decreased from 211.0k to 198.0k, while analysts expected 212.0k, and the number of repeated applications for the week of October 6 rose from 1.705 million to 1.734 million, which turned out to be significantly higher than forecasts of 1.710 million.

Investors were also somewhat disappointed by sales in the secondary housing market: in September the figure decreased by 2.0% after -0.7% in the previous month, and in absolute terms the dynamics slowed down from 4.04 million to 3.96 million, while experts expected 3.89 million. The dollar index was last down 0.27% on the day at 106.24.

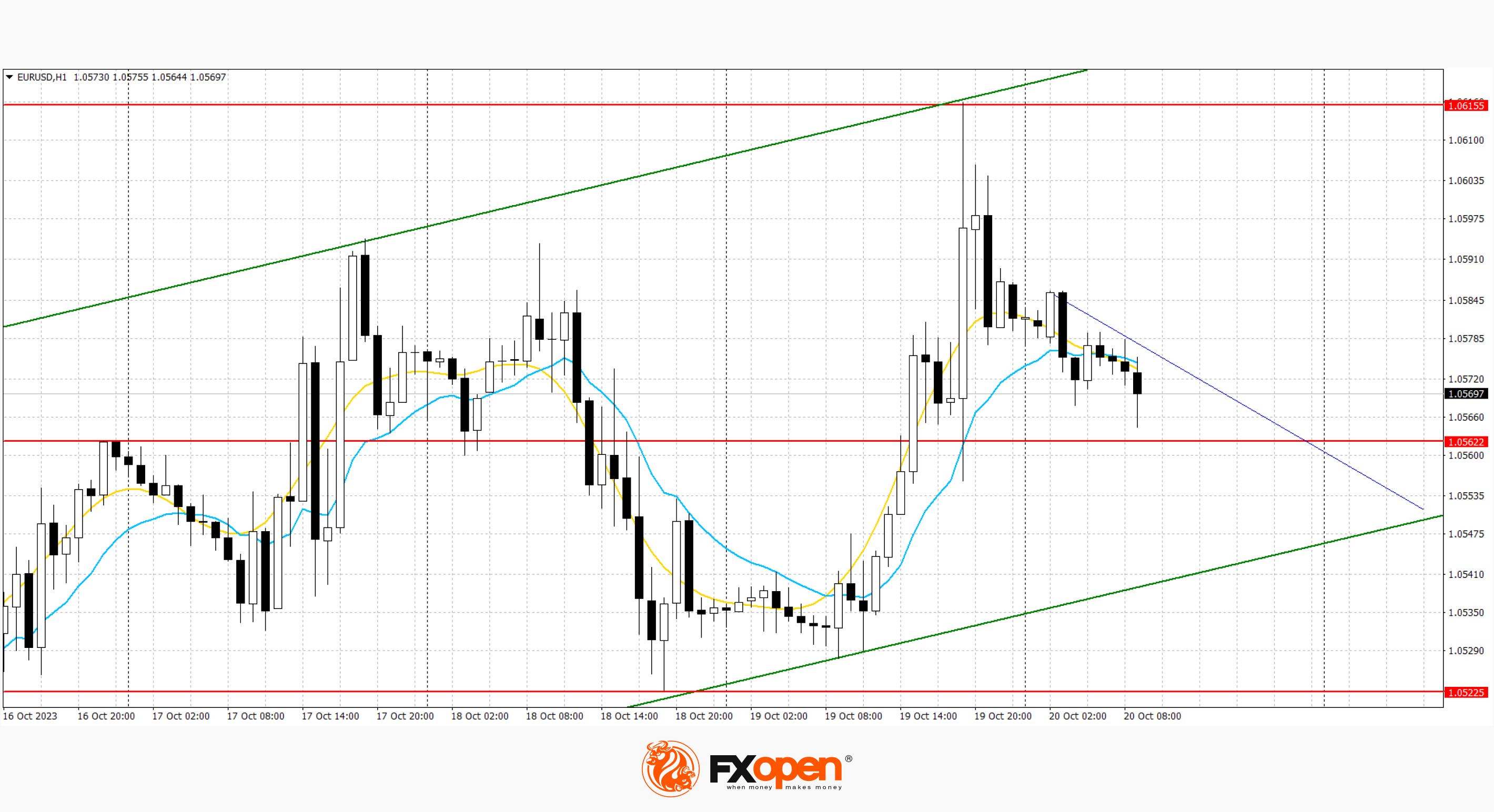

EUR/USD

The EUR/USD pair is declining slightly, consolidating near the 1.0575 mark. The day before, the pair showed active growth, having managed to update local highs from October 12, which was associated with the speech of the head of the US Federal Reserve, Jerome Powell. The euro added 0.42% to $1.0581. The immediate resistance can be seen at 1.0591, a breakout to the upside could trigger a rise towards 1.0601. On the downside, immediate support is seen at 1.0525, a break below could take the pair towards 1.0442.

The focus of investors today will be on September statistics on the dynamics of manufacturing inflation in Germany: in monthly terms the index is expected to slightly accelerate from 0.3% to 0.4%, and in annual terms — a decrease of 14.2% after -12.6% in the previous month.

At the highs of the week, a new ascending channel has formed. Now, the price has moved away from the upper border of the channel and may continue to decline.

GBP/USD

The British pound is declining today after yesterday's rise to 1.2190.

UK inflation unexpectedly held at 6.7% in September, raising the prospect of another interest rate hike. Domestically, traders are still scrutinising wage data and inflation data. The better-than-expected consumer price data followed data showing UK workers' regular pay growth slowed from a previous record high and job vacancies also fell, while inflation figures showed the opposite.

The nearest resistance can be seen at 1.2218, a breakout to the upside could trigger a rise to 1.2261. On the downside, immediate support is seen at 1.2099, a break below could see the pair fall towards 1.2051.

The downward channel is maintained. Now, the price is in the middle of the channel and may continue to decline.

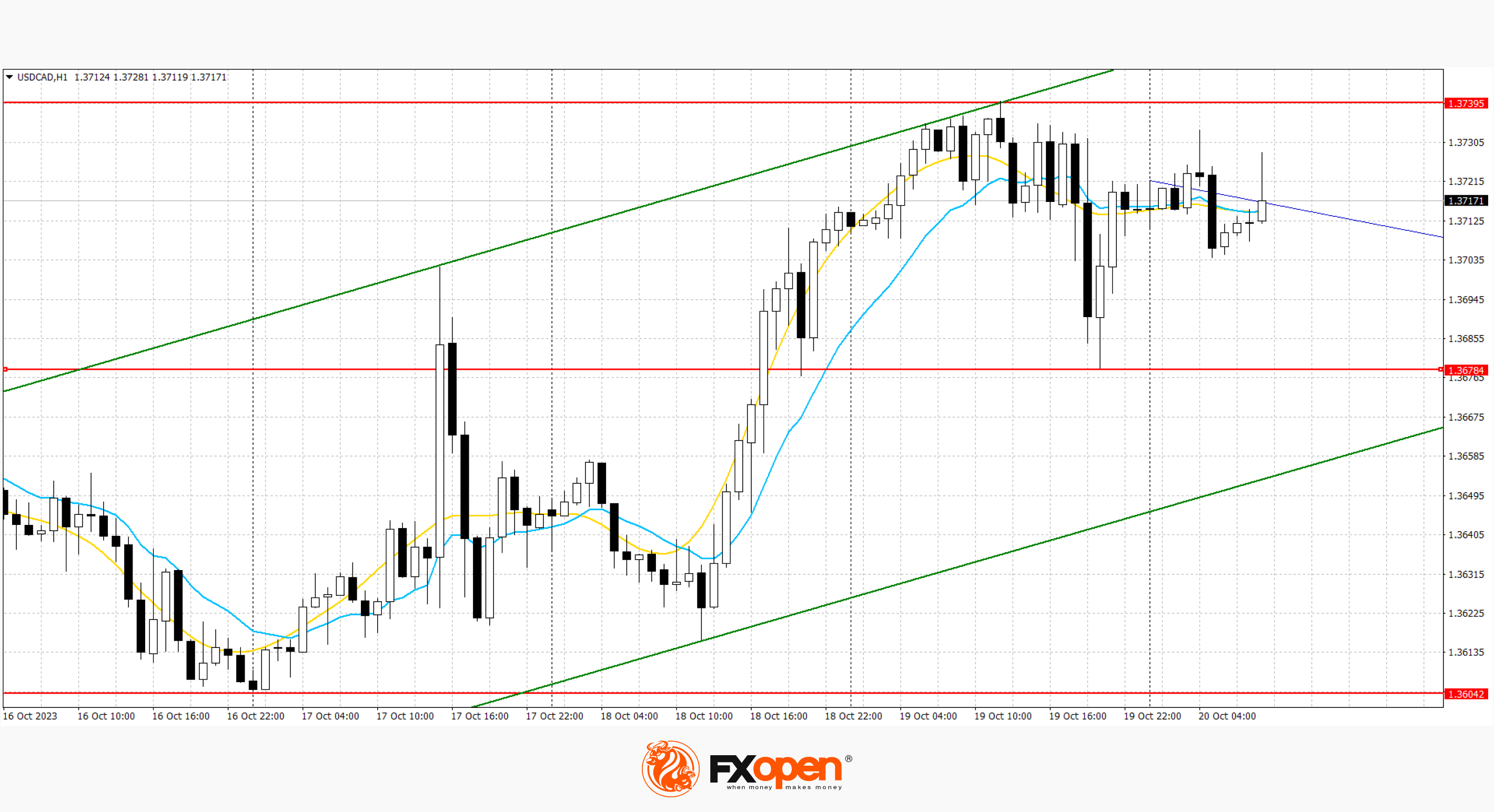

USD/CAD

The Canadian dollar was little changed against the US dollar, holding near its lowest level in 13 days. The higher price of oil, one of Canada's main exports, did little to help the loonie. U.S. crude oil futures rose 1.2% to $89.37 a barrel as traders remained nervous that Israel's military campaign in the Gaza Strip could escalate into a regional conflict.

The Canadian dollar was trading nearly unchanged at 1.3719 against the greenback, or 72.89 US cents, after earlier hitting its lowest intraday level since Oct. 6 at 1.3740. The immediate resistance can be seen at 1.3746, a breakout to the upside could trigger a rise towards 1.3786. In the fall, the nearest support is seen at 1.3682, a break below could take the pair to 1.3657.

An ascending channel has formed at the week's highs. Now, the price is in the middle of the channel and can continue its horizontal movement.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.