FXOpen

In the middle of the current five-day period, the main currency pairs continue to trade in rather narrow ranges. Most likely, investors and market participants are waiting for comments from Jerome Powell on further monetary policy as inflation continues to rise in the United States. The head of the Fed will speak tomorrow at 19:00 GMT+3; his statements on the economic situation in the United States and around the world may enhance or change existing market trends.

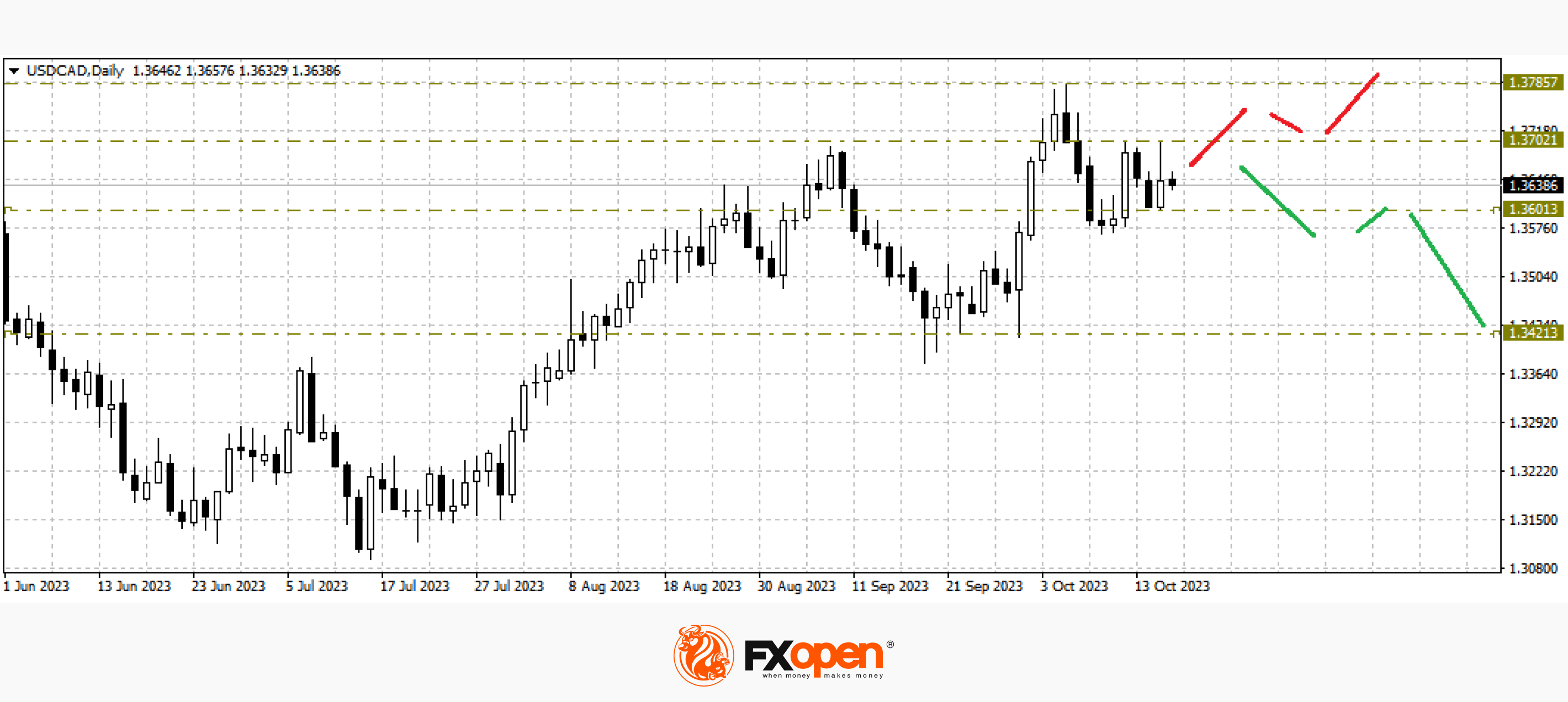

USD/CAD

The USD/CAD currency pair has been trading in a narrow corridor of 100 pips between 1.3700 and 1.3600 in recent trading sessions. The rise in oil prices is strengthening the Canadian dollar, while the hawkish Fed policy is keeping the pair close to the extremes of the current year. Technically, a price move below 1.3600 could contribute to a retest of the important 1.3420-1.3400 range. If greenback buyers break the resistance at 1.3780, the price may resume growth in the direction of 1.3900-1.4000.

Today at 15:30 GMT+3, we are waiting for data on the number of building permits issued in the United States for September. Weekly data on crude oil inventories will be published a little later. Also, at 19:00 GMT+3, it is worth paying attention to the speech of Christopher Waller from the Fed.

EUR/USD

The single European currency has not yet managed to strengthen above 1.0600. Buyers are still testing the resistance at the alligator lines on the daily timeframe. If the pair goes above 1.0630, in the coming trading sessions a continuation of the upward correction in the direction of 1.0700-1.0800 may occur. A breakdown of support at 1.0480 could open the way to 1.0400-1.0300.

Today, at 12:00 GMT+3, the eurozone consumer price index for September will be published. ECB Chairman Christine Lagarde is also scheduled to speak at the same time.

GBP/USD

Weak data on average wages in the UK, published yesterday, led to a rebound in GBP/USD from 1.2200. The pair continues to trade between 1.2200 and 1.2130; a narrow flat corridor may indicate an imminent surge in volatility for the pair.

Today at 11:30 GMT+3, data on the house price index in the UK will be published.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.