FXOpen

The fairly positive US jobs report released last Friday ultimately led to a corrective pullback in almost all currency pairs. The US dollar fell against the yen, commodity currencies, the pound, and the euro. However, not all pairs managed to overcome the key ranges; the size of the corrective pullback and the possibility of a reversal will depend on the incoming fundamental events of the coming trading sessions.

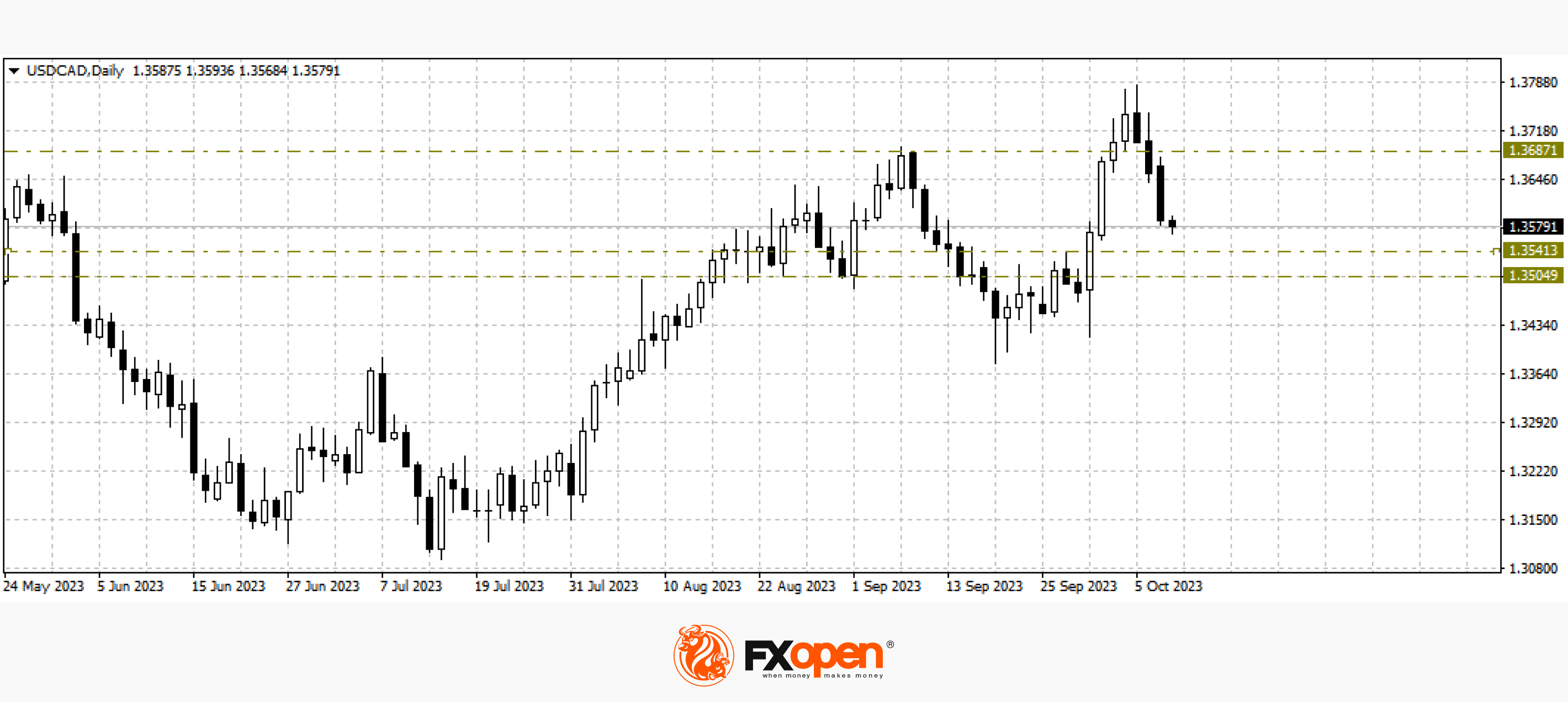

USD/CAD

In the US dollar/loonie pair, we are seeing the bearish tweezer pattern, formed on October 5, working out. The combination was confirmed the next day with a long black candle. The nearest range where the price can fall is from 1.3540 to 1.3500. Cancellation of the downward scenario may occur after a confident consolidation above 1.3700.

Several FOMC members are scheduled to speak today, in particular Neel Kashkari and Christopher Waller. Comments from these officials could have a significant impact on the pair's pricing.

GBP/USD

The British currency managed to find support just above the psychological level of 1.2000 and returned above 1.2200. On the daily timeframe, we have a bullish reversal bar from October 4. At the moment, the price has approached important resistance at the alligator lines on the daily timeframe. If buyers of the pair can strengthen above 1.2300-1.2380, the pair’s growth may continue in the direction of 1.2500-1.2600. Cancellation of the upward correction scenario may occur if the price goes below 1.2040.

Today at 12:30 GMT+3, the minutes of the Bank of England Financial Policy Committee will be published.

EUR/USD

The euro/US dollar currency pair, taking advantage of Friday's correction in the US dollar, managed to strengthen by more than 100 points. At the moment, the pair is trading near the alligator lines on the daily timeframe. Price action at 1.0600-1.0620 may give more clues regarding further pricing of the pair. A sharp rebound from current levels could contribute to a fresh update of the recent low. Consolidation above 1.0620 may contribute to further growth in the direction of 1.0700-1.0800.

Today at 15:00 GMT+3, ECB Chairman Christine Lagarde is scheduled to speak. A little later, Burkhard Balz from the Bundesbank will speak.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.