FXOpen

In the middle of this week, the main currency pairs continued their upward correction against the US dollar. Buyers of the EUR/USD pair managed to pass the level of 1.0600, the GBP/USD currency pair tested the important level of 1.2300, and sellers of USD/JPY yesterday tried to break through the support level at 148.00. However, the current market situation may change at any time, as very important macroeconomic data is expected to be published in the coming trading sessions.

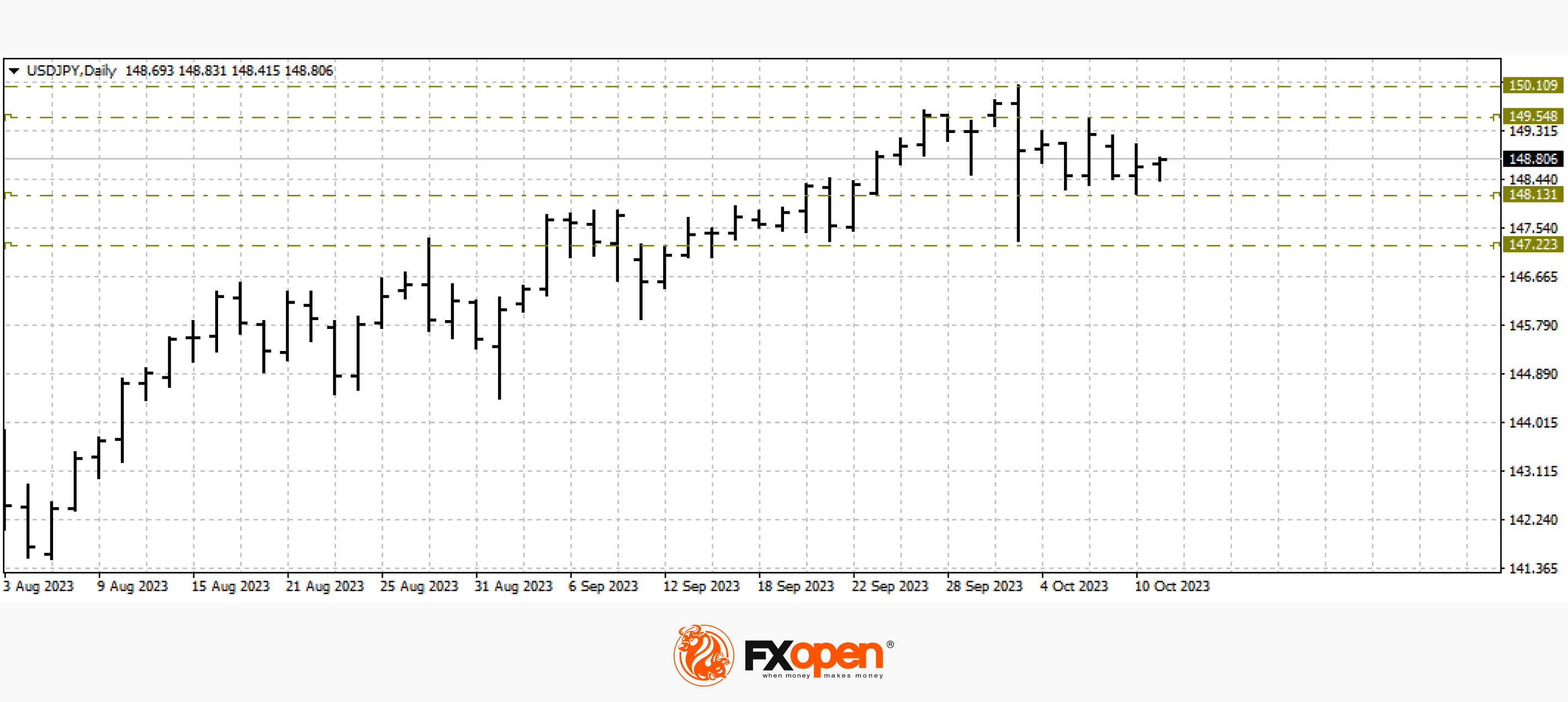

USD/JPY

The USD/JPY currency pair is trading in a narrow sideways range between 148.20 and 149.50. Investors are wary of currency interventions by the Bank of Japan, which may become relevant if the price passes the level of 150.00. However, sellers are in no hurry to enter into transactions since the Fed most likely does not plan to change monetary policy in the coming months. The large gap between yen and dollar interest rates makes this pair very attractive to buy and prevents it from falling below 148.00-147.00. Any hints of a change in monetary policy by the American regulator or disappointment in the fundamental indicators of the dollar could cause a sharp decline in the pair.

Today at 15:30 GMT+3, the publication of data on producer prices (PPI) in the United States for September is expected. At 21:00 GMT+3, the minutes of the last Fed meeting will be published. Alsoб early the next morning, it is worth paying attention to the speech of a member of the board of directors of the Bank of Japan, Asahi Noguchi.

GBP/USD

The GBP/USD pair is observing a reversal bar from October 4. The price is trying to break through the alligator lines, and if this attempt is successful, we can expect further growth in the direction of 1.2500-1.2600. The coming trading sessions are critical to determining the future direction of the pair.

In addition to the factors already mentioned, tomorrow morning, the UK's GDP for August and manufacturing output for the same period will be published. Also, at 12:00 GMT+3, a speech by a member of the Bank of England Monetary Policy Committee, Huw Pill, is scheduled.

EUR/USD

The single European currency continues its sluggish strengthening. Yesterday, buyers managed to pass the level of 1.0600, but so far, there are no clearly defined upward dynamics.

Today at 12:00 GMT+3, it is worth paying attention to the speech of the representative of the German Federal Bank, Sabine Mauderer. The minutes of the last meeting of the ECB are scheduled to be published tomorrow.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.