FXOpen

Corrective sentiment prevails in the market, as traders take profits on long positions against the backdrop of a rapid decline in the US dollar after the publication of October inflation statistics. Thus, the consumer price index in October showed zero dynamics on a monthly basis, while analysts expected an increase of 0.1%, and in the previous period the value was 0.4%. In annual terms, the indicator slowed from 3.7% to 3.2%, which was below expectations at 3.3%, and core inflation adjusted from 0.3% to 0.2% and from 4.1% to 4. 0%, respectively. Published data confirmed investors' assumption that the US Federal Reserve will not increase borrowing costs either this year or next. At the same time, experts note that it is still somewhat premature to talk about the possible timing of the start of the interest rate reduction cycle. The approach of inflation to the target levels of the US Federal Reserve was regarded as another signal to the end of the cycle of tightening monetary policy. Real macroeconomic statistics are more important for the market than the hawkish statements of the head of the regulator, Jerome Powell, who last week reiterated the potential for higher borrowing costs.

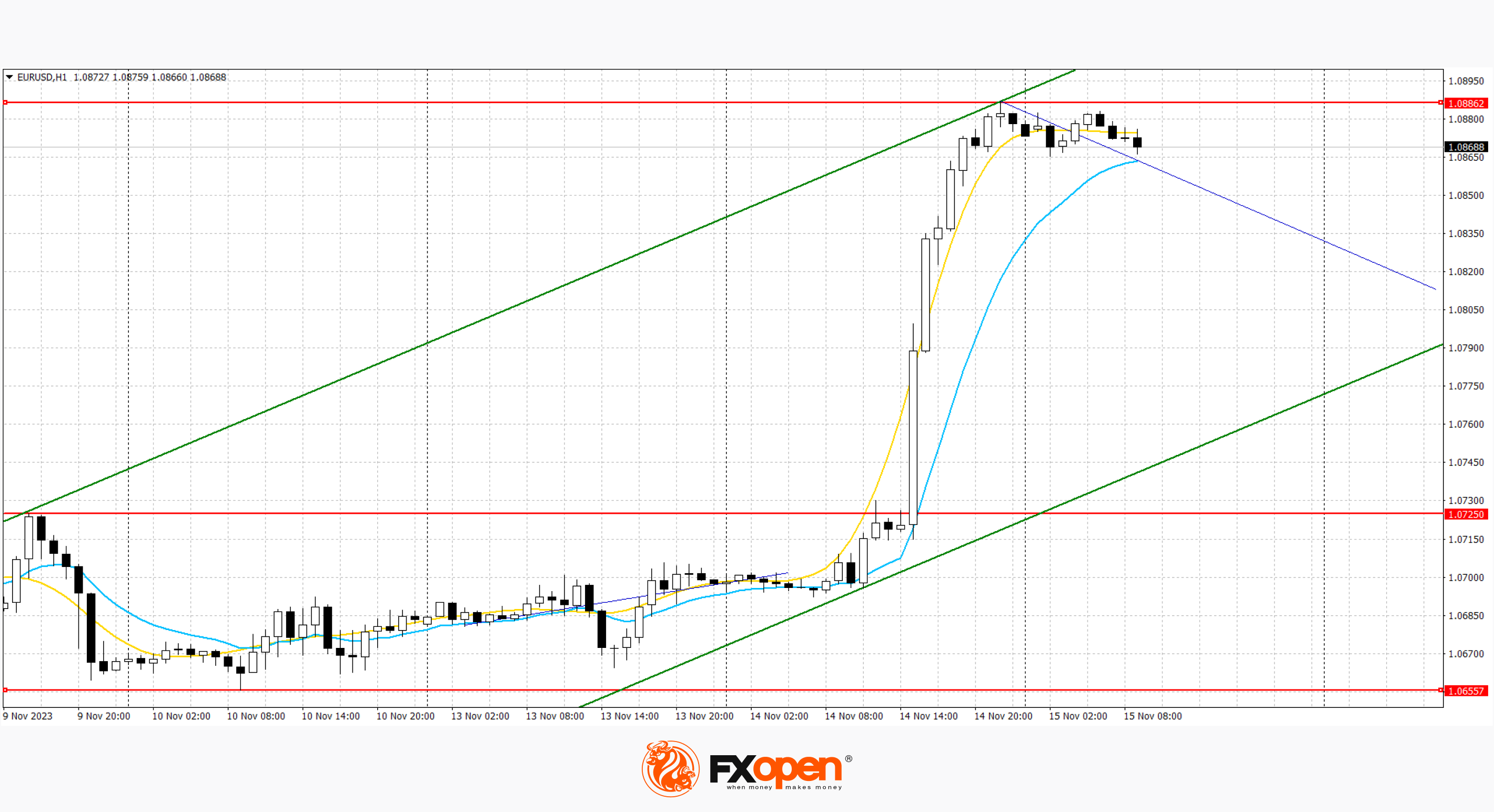

EUR/USD

The EUR/USD pair is trading in different directions, holding near the local highs of early September at 1.0872. The day before, the single currency showed its strongest growth in recent months, which was the market’s reaction to a significant slowdown in inflationary pressure in the United States.

The day before, the eurozone published statistics on gross domestic product (GDP) for the third quarter, which remained at -0.1% in quarterly terms and 0.1% in annual terms. In addition, the region's employment rate rose marginally from 0.2% to 0.3% and 1.3% to 1.4%, respectively, and the Center for European Economic Research (ZEW) Business Sentiment Index rose from -1.1 points to 9.8 points with a forecast of 5.0 points.

Based on the highs of last and this week, a new ascending channel has formed. Now the price has moved away from the upper border of the channel and may continue to decline.

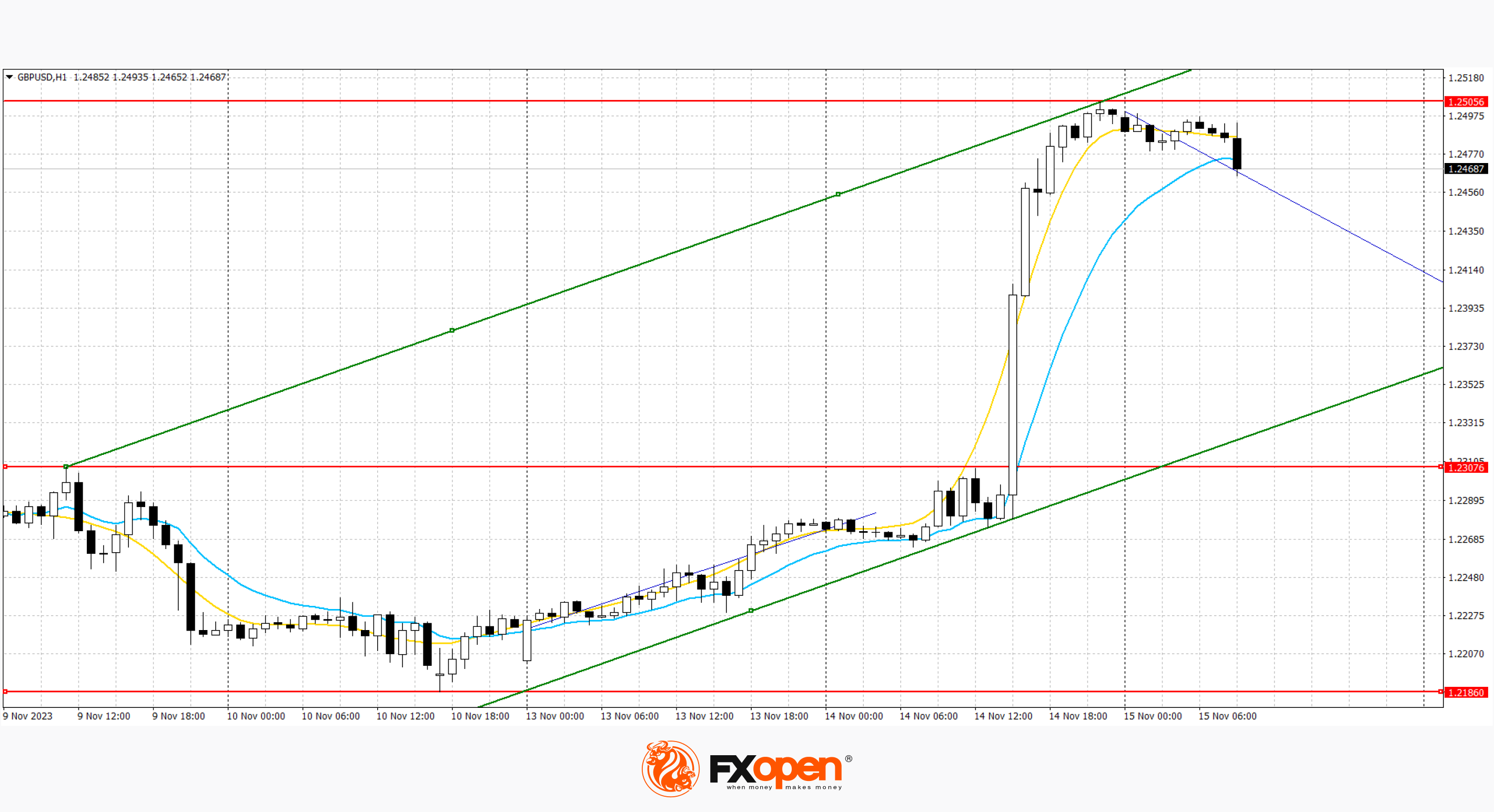

GBP/USD

The GBP/USD pair is slightly correcting near the 1.2500 mark and local highs from September 14. Yesterday, investors assessed macroeconomic statistics from the UK, which did not have a noticeable impact on the dynamics of the GBP/USD pair.

Average wages including bonuses in September decreased from 8.2% to 7.9%, while analysts expected 7.4%. Representatives of the Bank of England are monitoring the dynamics of the indicator, assessing how raising the interest rate 14 times in a row will affect domestic consumption, an increase in which could act as a catalyst for inflation to return to its maximum and, as a result, reconsider the regulator’s position regarding adjusting the cost of borrowing despite the fact that in the last meeting the value remained at the current level. The employment indicator decreased by 207.0 thousand after -82.0 thousand in the previous month, and unemployment over the past 3 months remained at 4.2%. According to the Office for National Statistics (ONS), the industrial sector has seen the biggest year-on-year decline in job vacancies, losing 35,000 compared to the same period last year. Today data on consumer inflation in the UK will be published: forecasts suggest a sharp slowdown in October from 6.7% to 4.8%.

At the highs of the week, a new ascending channel has formed. Now the price has moved away from the upper border of the channel and may continue to decline.

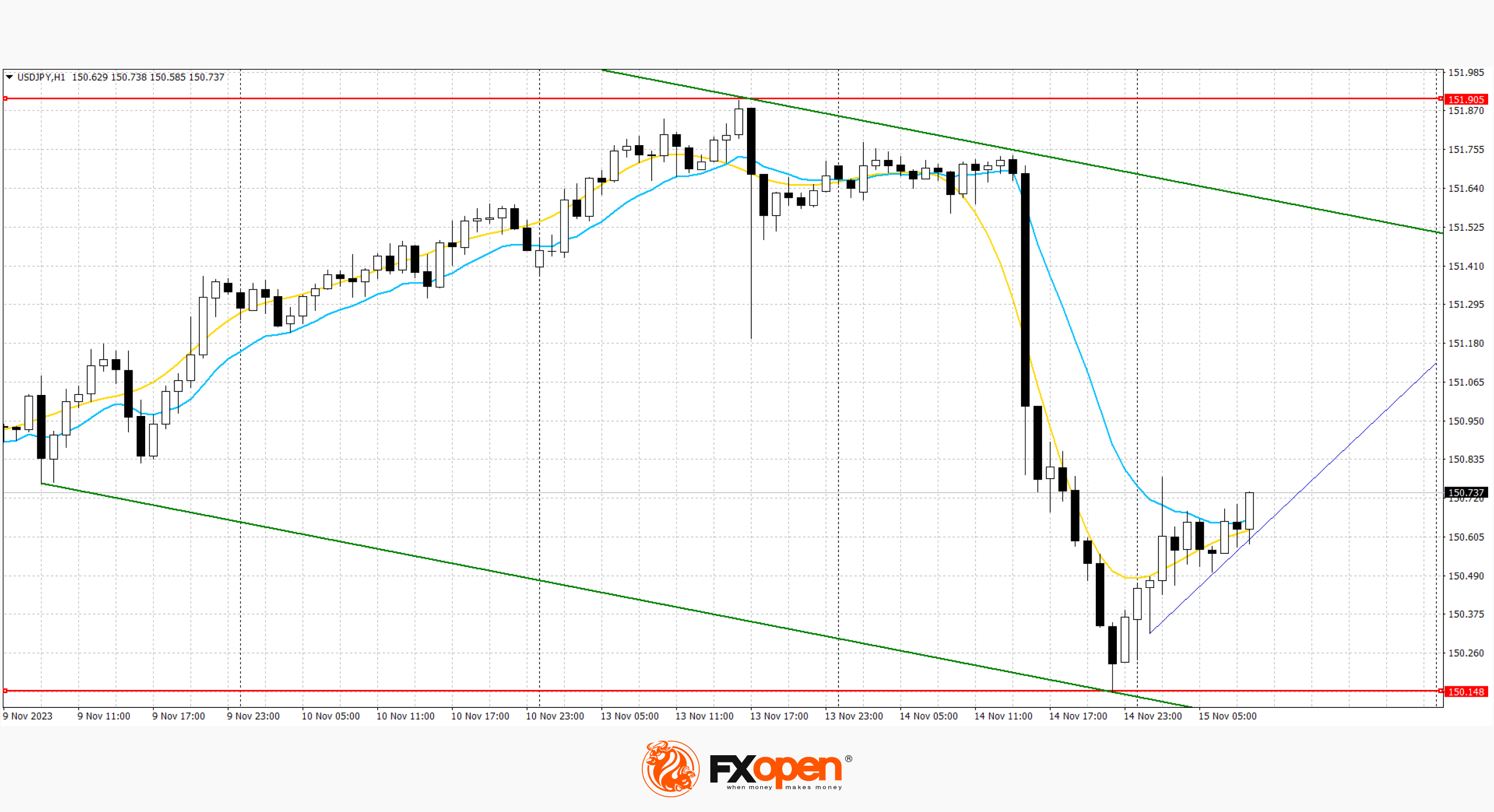

USD/JPY

The USD/JPY pair is holding at 150.70, recovering from a sharp corrective decline the day before. The position of the American currency came under pressure after the publication of October statistics on consumer inflation, which slowed down more than analysts' forecasts.

Statistics from Japan put pressure on the yen: GDP in the third quarter amounted to -0.5% after growing by 1.2% in the previous period, while experts expected -0.1%. In annual terms, the national economy lost 2.1% after increasing by 4.8%, with expectations at -0.6%. Industrial production volumes in September increased from 0.2% to 0.5% in monthly terms and from -4.6% to -4.4% in annual terms. Japanese Finance Minister Shinichi Suzuki said yesterday that the government will take the necessary measures to respond to changes in the yen exchange rate, emphasising that excessive fluctuations in quotations are extremely undesirable, but they must be established by the market taking into account fundamental indicators. Therefore, authorities will continue to monitor incoming data and respond to changes accordingly. However, the minister did not say whether the government intends to carry out additional interventions. Officials are already taking steps to support households pressured by rising costs of living due to higher import prices for fuel and food.

Based on recent lows, a new downward channel has formed. Now the price has moved away from the lower boundary and may continue to rise.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.