FXOpen

Yesterday, statistics on consumer inflation in the United States were published. The September level of price growth decreased from 0.6% to 0.4% month-on-month, which is 0.1% worse than expert forecasts, and remained at 3.7% year-on-year, while analysts expected it to slow down to 3.6%. This suggests a longer period of the US Federal Reserve maintaining high interest rates and also increases the likelihood of another tightening of monetary policy this year. On Friday, investors expect the publication of the monthly report on the state of the American budget for August, as well as the consumer confidence index from the Michigan Institute for October: according to preliminary estimates, it will decrease from 68.1 points to 67.4 points.

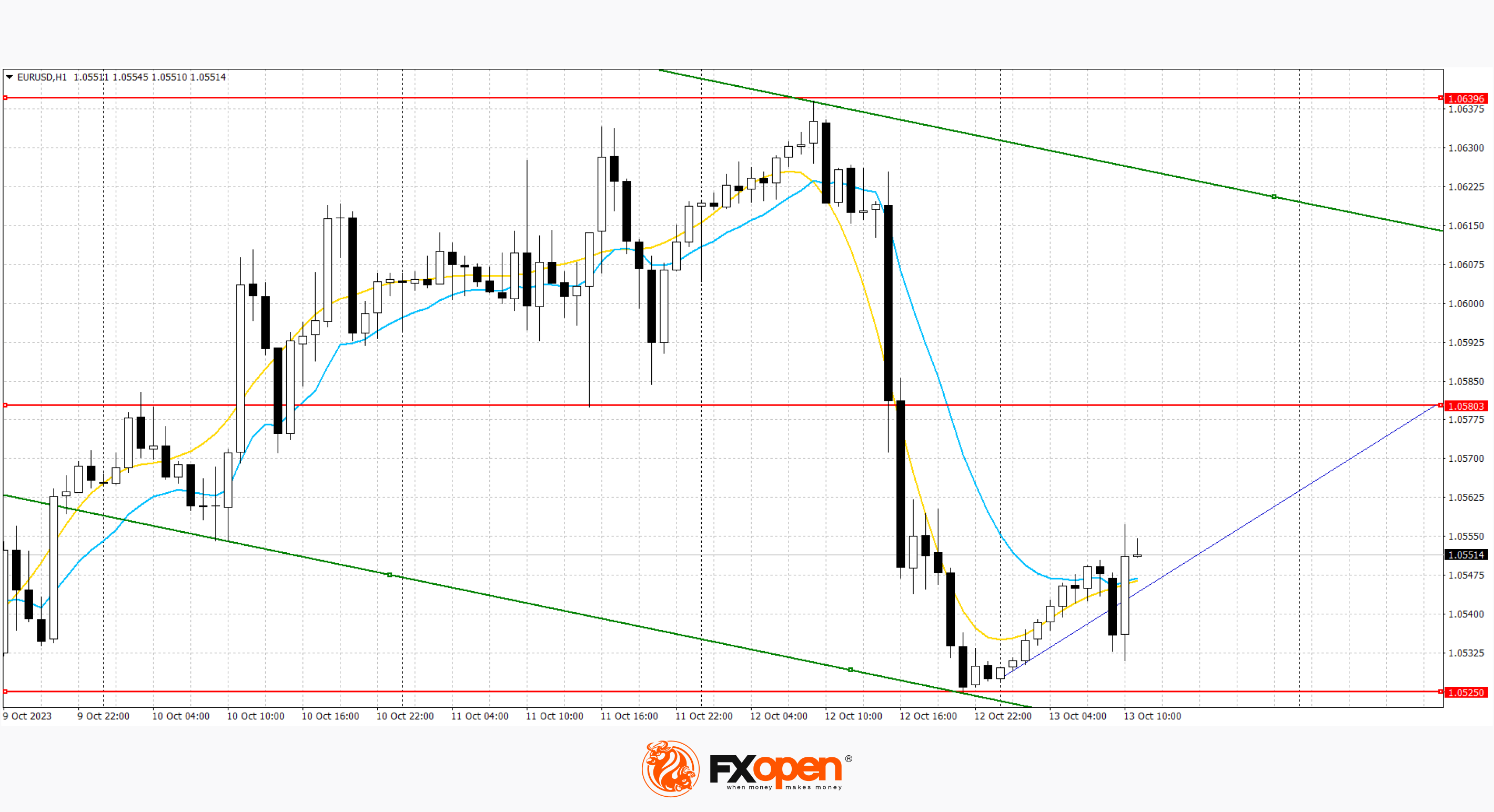

EUR/USD

The EUR/USD pair is showing slight corrective growth, recovering from a sharp decline the day before, as a result of which the single currency retreated from the local highs of September 25. The pair is again testing the 1.0550 mark for an upward breakout, awaiting the emergence of new drivers on the market. The nearest resistance can be seen at 1.0571, a breakout to the upside could trigger a rise to 1.0593. On the downside, immediate support is seen at 1.0535, a break below could take the pair towards 1.0458.

The focus of investors' attention today is on inflation statistics from France and Spain: the French consumer price index added 5.7%, which was 0.1% higher than the previous value, and the Spanish one, 3.5%, coinciding with analysts' expectations. In addition, today, the eurozone will publish August data on industrial production dynamics, forecasts for which suggest an acceleration of negative dynamics from -2.2% to -3.5%. Also, during the day, investors expect a speech from ECB head Christine Lagarde.

Based on the lows of two days, a new downward channel has formed. Now, the price has moved away from the lower border of the channel and may continue corrective growth.

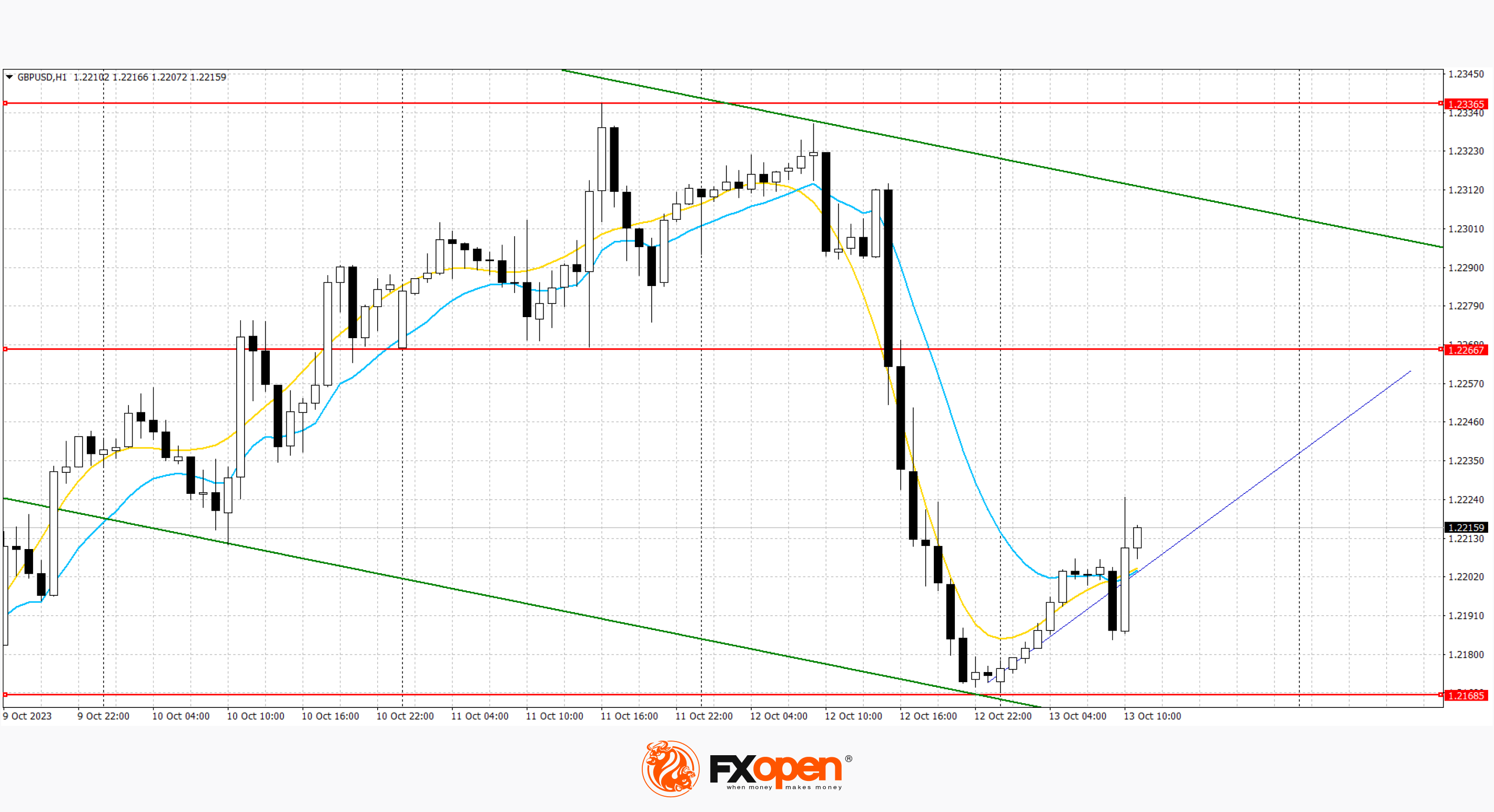

GBP/USD

The GBP/USD pair is showing moderate growth, again trying to consolidate above the 1.2200 mark after a rather active decline the day before. The immediate resistance can be seen at 1.2253, a breakout to the upside could trigger a rise towards 1.2352. The nearest support is seen at 1.2174, a break below could take the pair to 1.2060.

The pound received minor support against the backdrop of macroeconomic statistics from the UK. Thus, the growth rate of gross domestic product in August added 0.2% after -0.6% in the previous month, the index of activity in the services sector increased by 0.1% after -0.1% in July, and the volume of industrial production decreased by 0.7% after -1.1%, while forecasts suggested -0.2%. At the same time, in annual terms, the indicator accelerated from 1.0% to 1.3%, which also turned out to be worse than the expected 1.7%.

Based on the lows of two days, a new downward channel has formed. Now, the price has moved away from the upper border of the channel and may continue its corrective decline.

USD/JPY

The USD/JPY pair shows a slight decline, remaining close to 149.60. Strong resistance can be seen at 150.00. The immediate support is visible at 149.13. A break below could take the pair towards 148.95.

Over the past three trading sessions, the American currency has again shown moderate growth against the yen, receiving support from expectations of another tightening of monetary policy by the US Federal Reserve before the end of this year. Thursday's Japanese statistics turned out to be ambiguous but did not have a noticeable impact on the pair's dynamics. Thus, the volume of bank lending in September adjusted from 3.1% to 2.9% with neutral forecasts, and the volume of orders for engineering products in August decreased by 0.5% after -1.1% a month earlier, while experts expected the emergence of positive dynamics at the level of 0.4%. In annual terms, the figure rose from -13.0% to -7.7%, which was close to the expected -7.3%.

Based on the lows of two days, a new downward channel has formed. Now, the price is near the upper border of the channel, from where it can continue to decline.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.