FXOpen

The American currency received support from strong data from the United States. Thus, in the third quarter, gross domestic product increased by 4.9% after increasing by 2.1% earlier, with a forecast of 4.2%, which was the largest increase since the fourth quarter of 2021, reflecting easing risks of a recession. At the same time, the positive dynamics of the indicator partially offsets the results of the hawkish policy of the US Federal Reserve: the regulator’s meeting will take place next week, which is also the reason for the current correction.

Optimism from faster growth rates of the American economy was partially offset by statistics on the labour market: the number of initial applications for unemployment benefits for the week of October 20 increased from 200.0k to 210.0k, while experts expected 208.0k, and the number repeated requests for the week of October 13 — from 1.727 million to 1.790 million, with expectations at 1.740 million.

EUR/USD

According to the EUR/USD technical analysis, the pair is consolidating near 1.0565, preparing to end the week with a slight decline. The day before, quotes managed to interrupt the active development of the bearish trend, while the news background remained ambiguous and investors assessed the results of the ECB meeting. As expected, the regulator left the interest rate unchanged at 4.50%, noting that further monetary policy will be determined by statistical data, which does not exclude a possible increase in the value in the future. At the same time, the ECB said that inflation in the region continues to decline, but will most likely remain above target levels for a long time.

The immediate resistance can be seen at 1.0581, a breakout to the upside could trigger a rise towards 1.0606. On the downside, immediate support is seen at 1.0517, a break below could take the pair towards 1.0500.

At the lows of the week, a new downward channel has formed. Now, the price is in the middle of the channel and may continue to decline.

GBP/USD

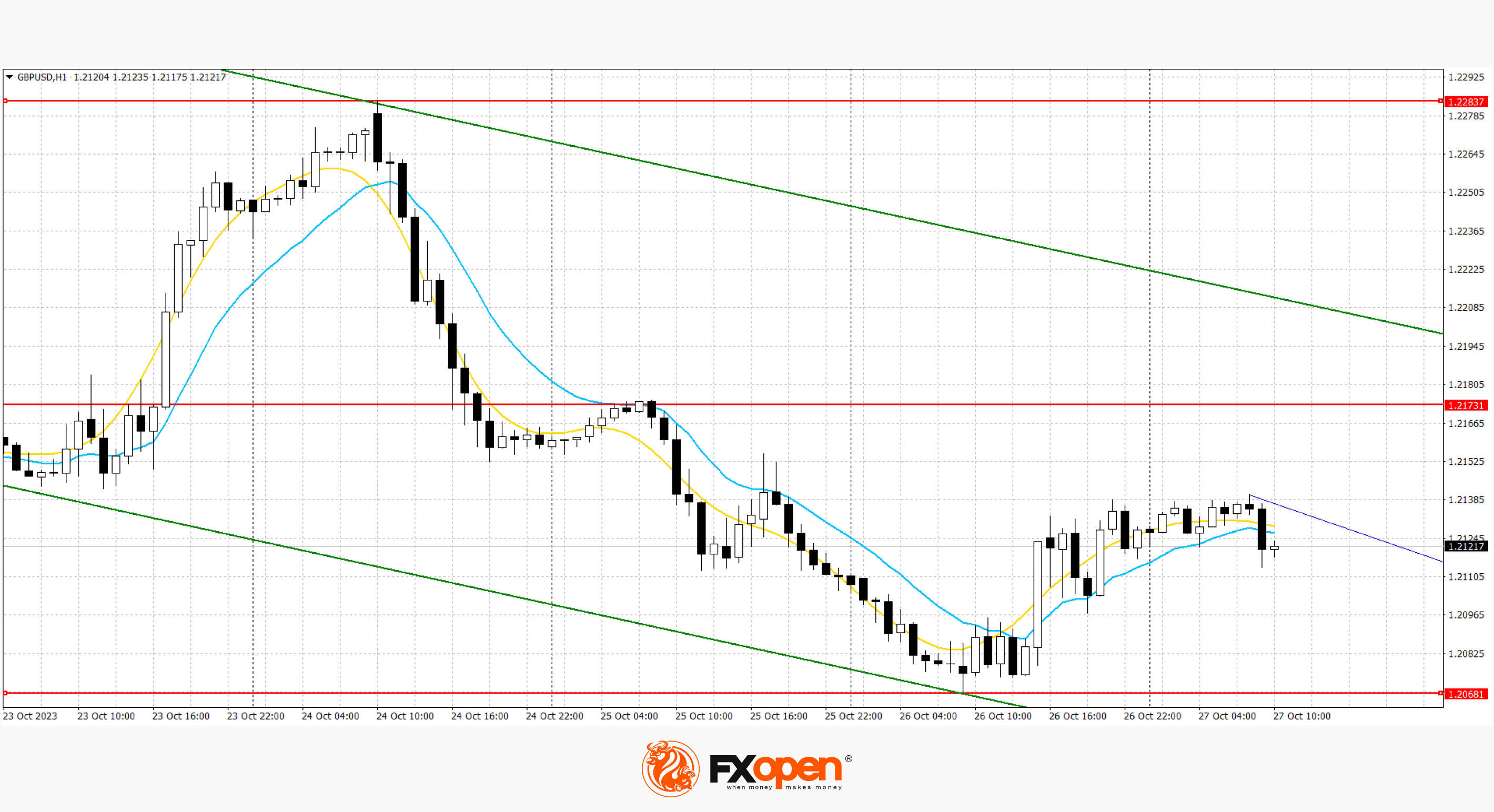

On the GBP/USD hourly chart, the pair is showing weak growth, developing the uncertain corrective impulse formed the day before. The instrument is testing the level of 1.2140 for an upward breakout, approaching the minimum levels of the beginning of the week. The British currency is moderately supported by optimism regarding the growth of business activity in the UK. Thus, the index in the manufacturing sector from S&P Global in October rose from 44.3 points to 45.2 points, with a forecast of 45.0 points, and the composite indicator — from 48.5 points to 48.6 points. Analysts are awaiting the results of the meetings of the US Federal Reserve and the Bank of England, which will be held next week. It is assumed that both regulators will leave the monetary policy parameters unchanged.

The nearest resistance can be seen at 1.2188, a break upward could trigger a rise to 1.2201. On the downside, immediate support is seen at 1.2076, a break below could take the pair towards 1.2041.

At the lows of the week, a new downward channel has formed. Now, the price is in the middle of the channel and may continue to decline.

USD/JPY

On the USD/JPY hourly chart, the pair is showing an uncertain corrective decline, retreating from record highs updated the day before. The instrument is testing the 150.15 mark for a breakdown downward, while the positions of the American currency remain quite strong amid the publication of strong statistics from the United States. In turn, the yen received some support today from data from Japan: the consumer price index in the Tokyo region increased by 3.3% in October after 2.8% in the previous month. At the same time, inflation excluding food and energy prices adjusted from 3.9% to 3.8% due to an upward revision of the September indicator.

Strong resistance can be seen at 150.83, a break higher could trigger a rise towards 151.01. On the downside, immediate support is seen at 149.85. A break below could take the pair towards 149.57.

At the highs of the week, a new ascending channel has formed. Now, the price is near the lower border of the channel, from where it can continue to grow.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.