FXOpen

Weak data on employment and GDP in the US, published yesterday, contributed to the continuation of the correction in the US currency. So, the British pound/US dollar pair managed to go above the significant level of 1.2700, the euro/US dollar is trading above 1.0900, and the formation of reversal combinations in commodity currencies is also observed. Nevertheless, many more important macroeconomic statistics will be released in the coming trading sessions, which will give more clues as to whether the downward correction on the greenback will continue or whether buyers of the US currency may return to the market.

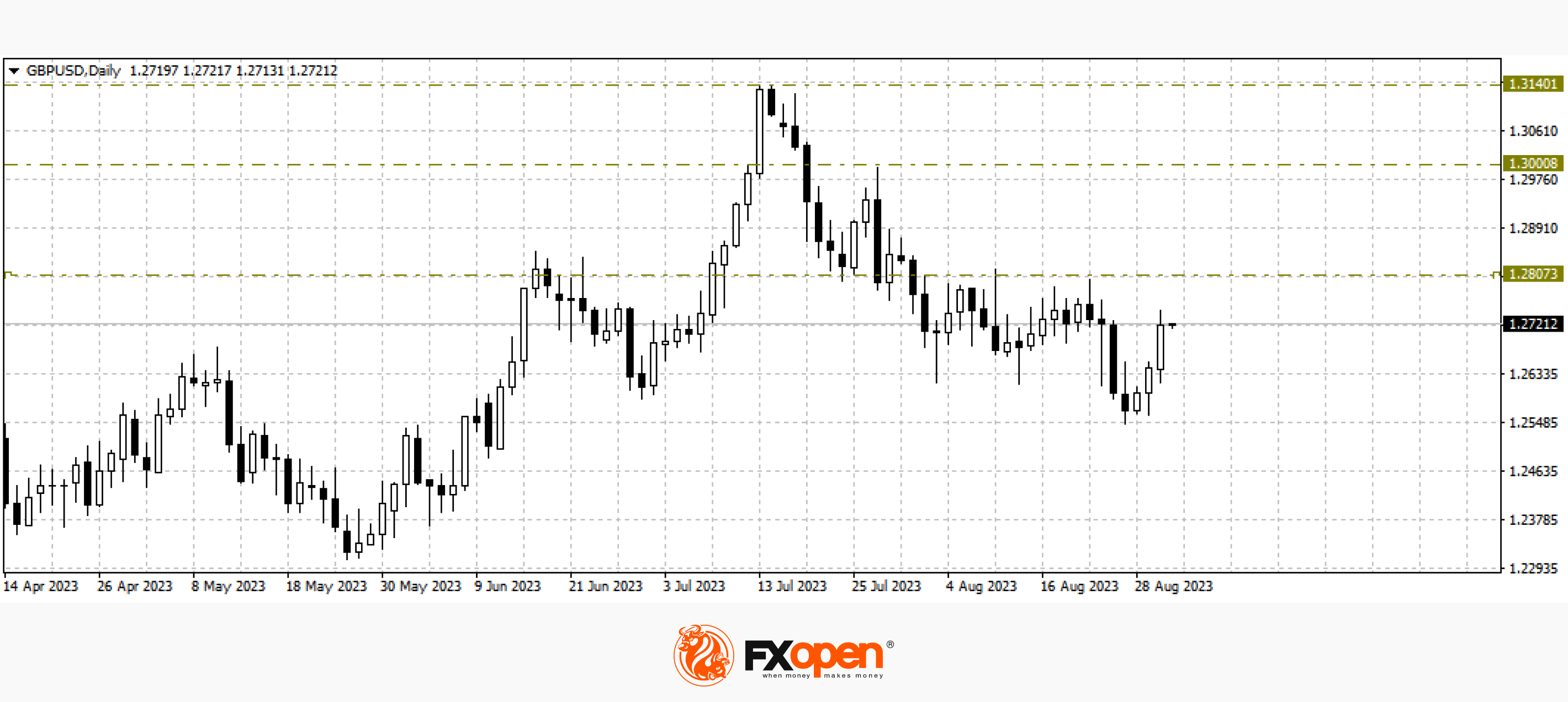

GBP/USD

The bulls coped with the first serious resistance at 1.2680-1.2720. If the price stays above these marks, continued growth to 1.3000-1.3100 may occur. Cancellation of the upward correction scenario is considered if the daily candle closes below 1.2600.

Today in the American session, at 15:30 GMT+3, the base price index for personal consumption expenditures in the US for July will be released.

EUR/USD

Today is a very important fundamental day for the European currency. At 12:00 GMT+3, data on the consumer price index in the eurozone for August will be released, and at the same time, the unemployment rate for July will be published. A little later, at 14:30 GMT+3, the minutes of the last ECB meeting will be released. In addition, speeches by Bundesbank representative Burkhard Balz and Vice President of the European Central Bank Luis De Guindos are scheduled for the evening. If officials declare the ECB's readiness to continue tightening monetary policy, the EUR/USD pair could instantly reach 1.1000.

Technically, we observe an important point in the pair: the v-shaped reversal combination is being worked out, but the price has come to the bottom of the combination, where there can be both an impulse continuation of growth and a rollback.

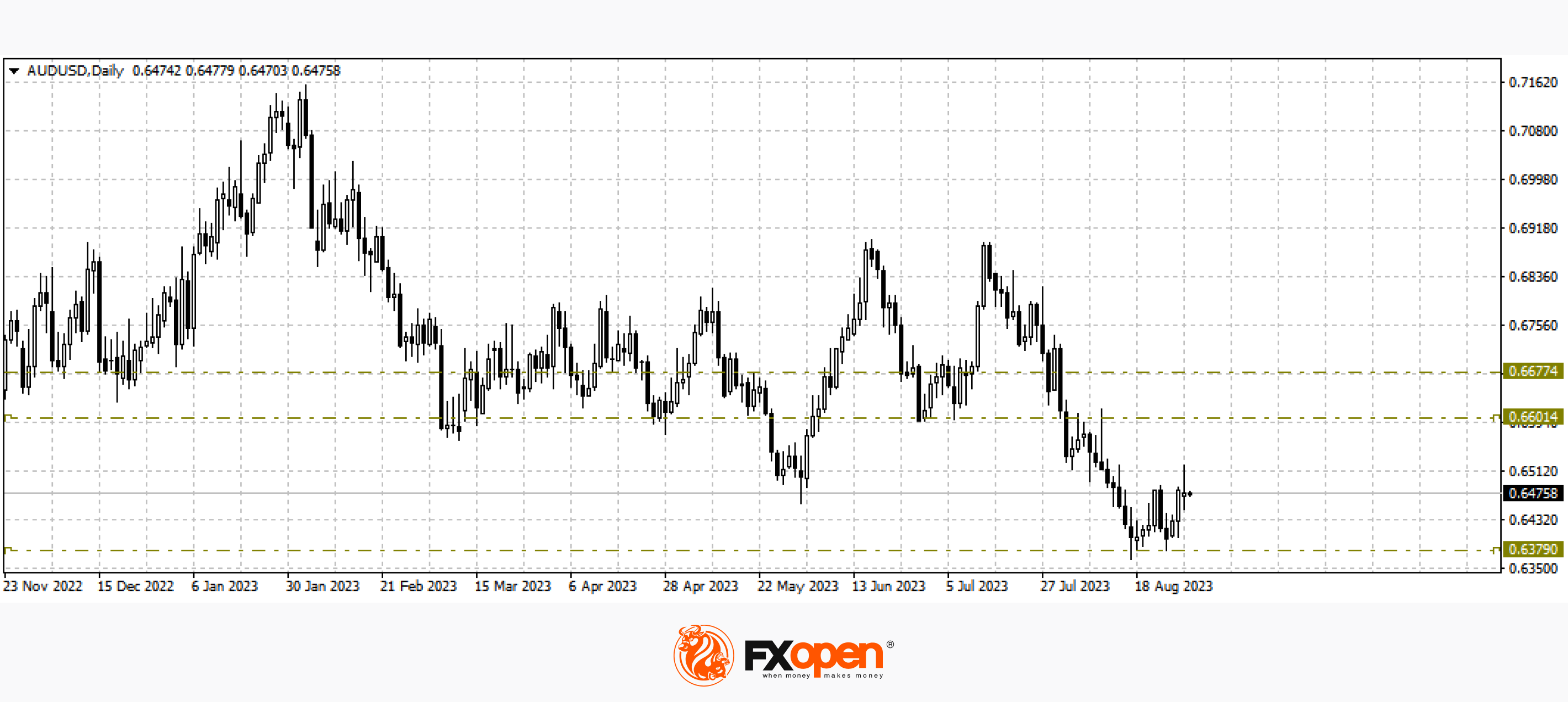

AUD/USD

The AUD/USD currency pair tested 0.6500 after retesting support at 0.6380. We can state the formation of a double bottom reversal pattern, which can work out after a confident strengthening above 0.6480. The nearest target for corrective growth is the range of 0.6600-0.6680.

Important for the pricing of the pair will be tomorrow's employment data in the US. If the number of new jobs turns out to be higher than the forecast, the price may once again fall.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.