FXOpen

Yesterday, it was possible to observe a breakthrough of important resistance levels in almost all directions in the currency market. Thus, the EUR/USD currency pair fell below 1.0760, the USD/JPY pair updated the maximum of August this year at 147.40, and the GBP/USD pair fixed below 1.2600. In the coming trading sessions, the upward trend in the greenback will likely intensify since the fundamentals for commodity and European currencies are rather disappointing.

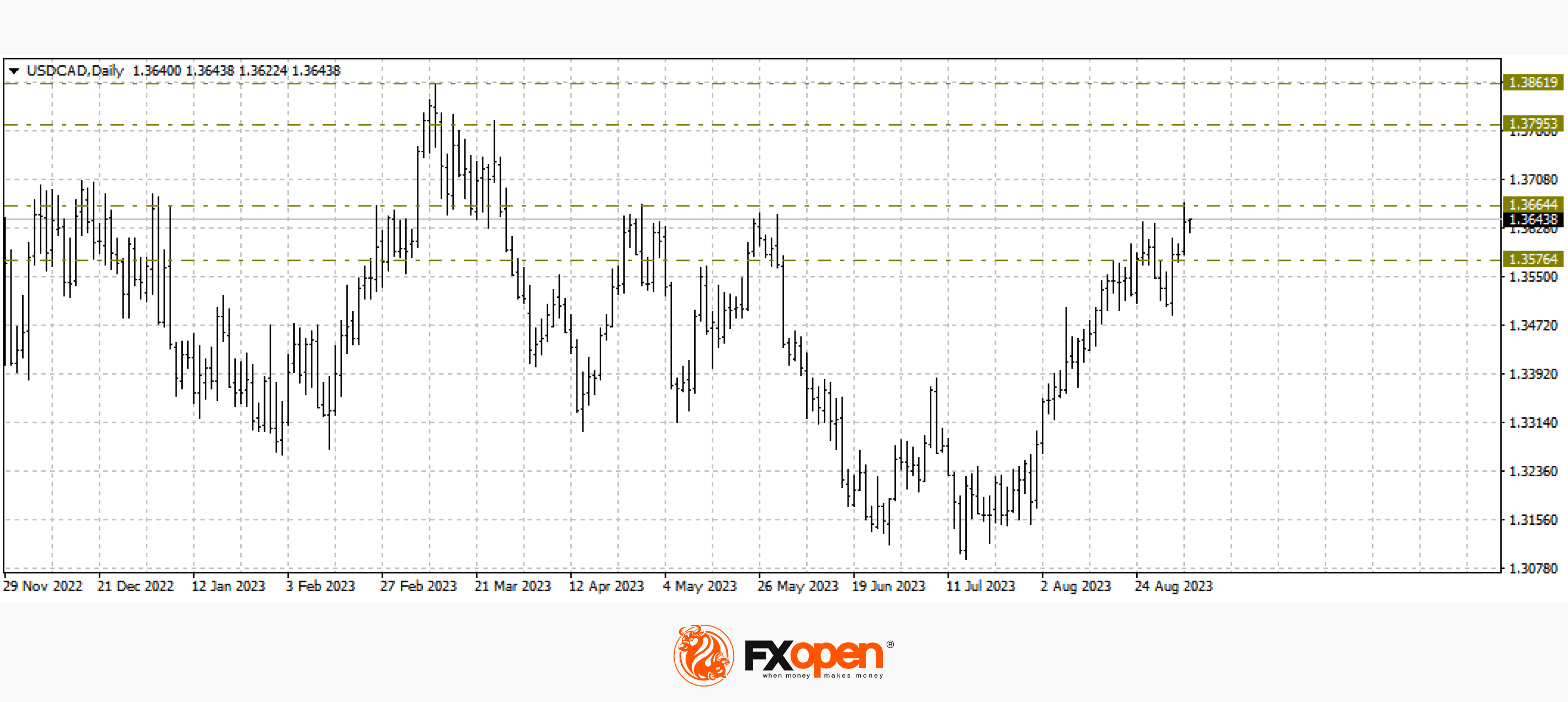

USD/CAD

As expected yesterday, the USD/CAD pair strengthened to the important range of 1.3640-1.3660. These marks did not give in to the buyers for more than five months. It is not surprising if the price fails to pass this resistance the first time. In the case of trading above 1.3660, we may expect further growth to 1.3800-1.3900. Rebound from the current levels may return the price to 1.3400-1.3300.

Today is an important day for the Canadian currency. At 17:00 GMT+3, a meeting of the Bank of Canada on monetary policy is scheduled. Analysts predict that officials will keep the rate unchanged, which could put additional pressure on the loonie.

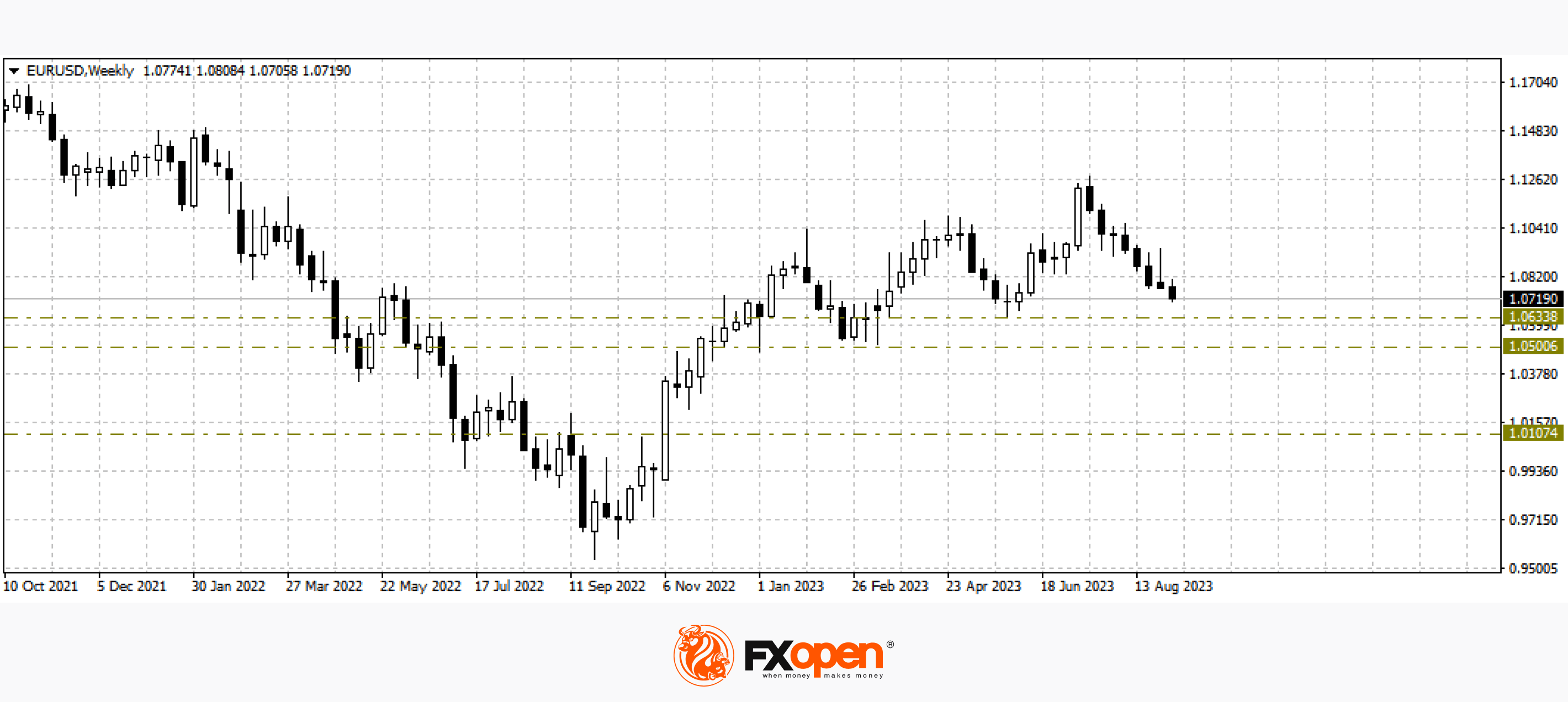

EUR/USD

The single European currency is inexorably approaching the May lows at 1.0600. Yesterday was quite a failure for the euro in terms of fundamentals. The Services PMI and Composite PMI for August were much lower than expected. The European currency did not receive support from the head of the ECB, Christine Lagarde. As a result, the pair tested the support at 1.0700; apparently, this is not the limit of the decline.

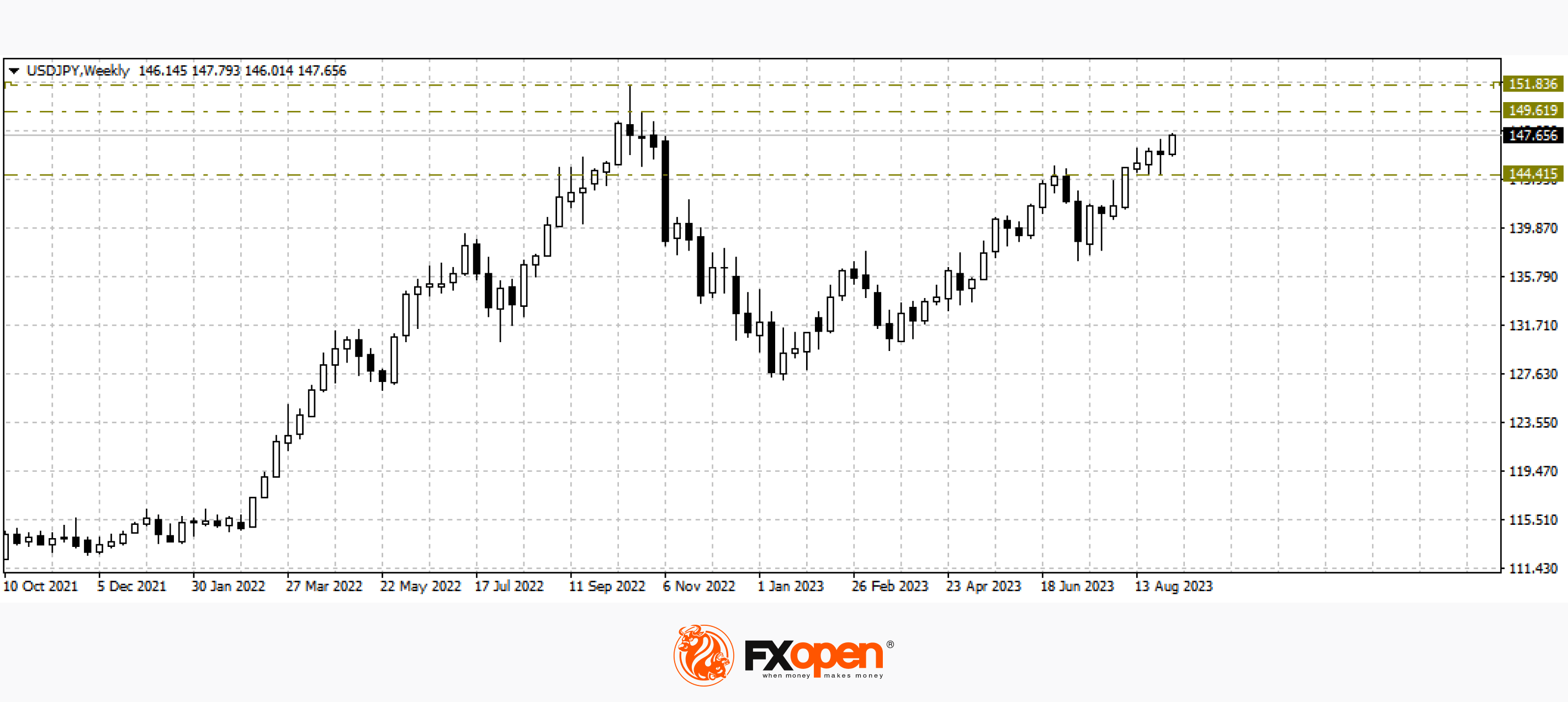

USD/JPY

In the USD/JPY pair, one can observe a sharp impulse growth. The important range of 147.00-146.00 is already in support status if the current situation does not change within a couple of weeks. We are waiting for a test of last year's high at 151.

Today at 16:45 GMT+3, we are waiting for data on the business activity index (PMI) in the US services sector for August. A little later, at 17:00 GMT+3, the Purchasing Managers Index for the non-manufacturing sector of the USA from ISM will be released.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.