FXOpen

Investors are preparing for the next meeting of the US Federal Reserve, which is scheduled to take place on September 19-20. So far, there is no consensus on the regulator’s further actions: the day before, the President of the Federal Reserve Bank of New York, John Williams, said that the question of a further increase in rates remains open, and against the backdrop of lower inflation and economic stability, the department’s decisions will depend on incoming economic data. The head of the Chicago Fed, Austan Goolsbee, noted the need to reduce price increases in the goods and housing sectors and confirmed that a recession could be avoided. Dallas Fed Chair Laurie Logan said it would be prudent to pause the tightening cycle in September, but another rate hike this year may still be necessary.

EUR/USD

The euro fell against the US dollar on Friday as investors grew nervous about the path of US interest rates and the outlook for the European economy. Despite weak data and inflation concerns, further rate hikes are likely. However, traders put the likelihood of a 25 bps hike this week at about 40%, which is up from 20% last week but still low. Inflation data will also be released this week ahead of the Federal Reserve's meeting later this month, with many expecting policymakers to keep interest rates unchanged. The immediate resistance can be seen at 1.0744; a breakout to the upside could trigger a rise towards 1.0788. On the downside, immediate support is seen at 1.0693; a break below could take the pair towards 1.0672.

Over the past week, a price range has formed with boundaries of 1.0685 and 1.0748. Now, the price has moved to the upper half of the range and may continue to rise.

GBP/USD

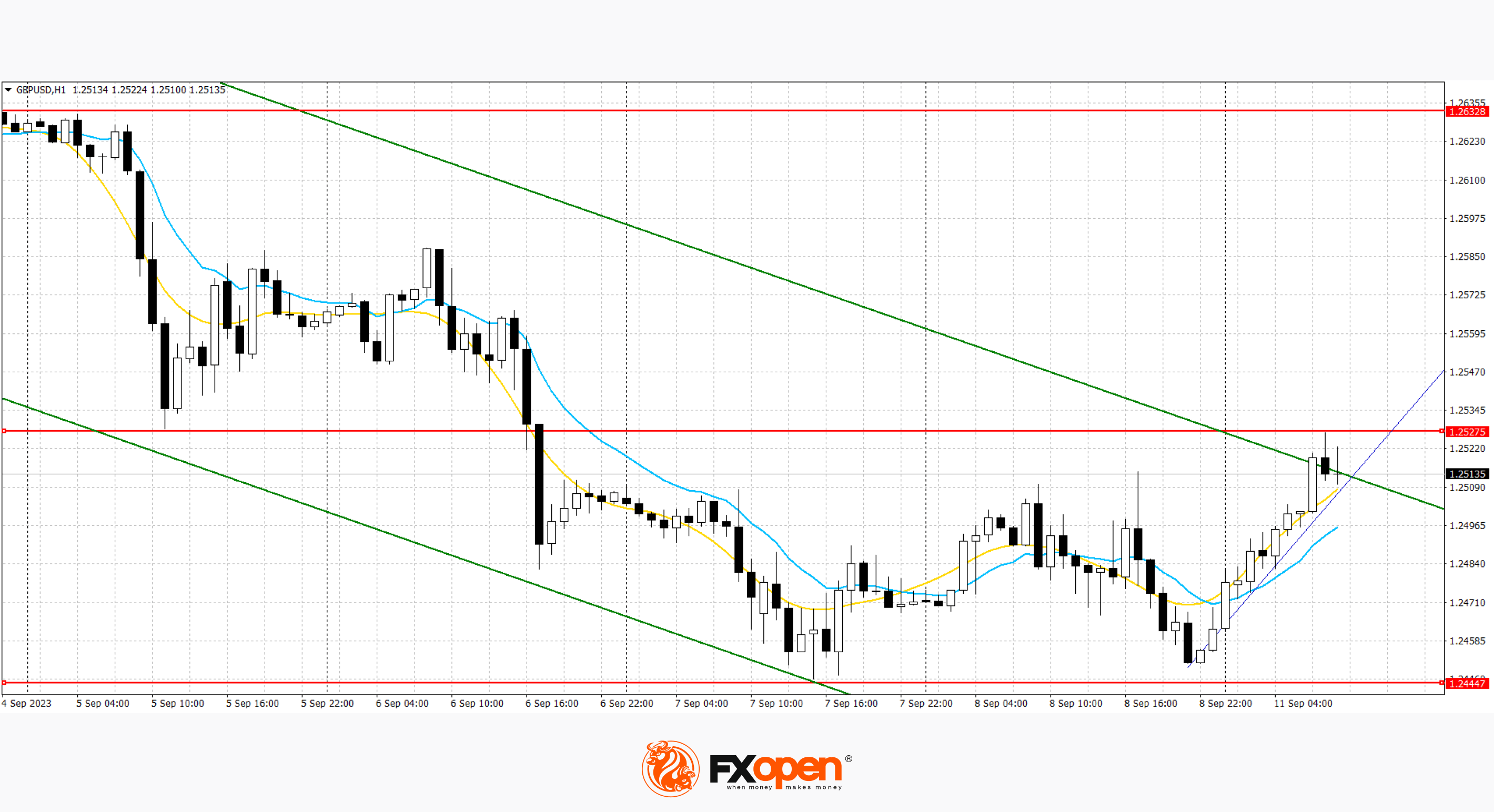

Sterling held near a three-month low against the US dollar on Friday after a survey showed hiring activity slowed last month, raising the prospect of the Bank of England hitting the pause button on its efforts to rein in inflation. Employers worried about the economic outlook cut hiring through staffing agencies last month at the fastest pace in more than three years, an industry survey showed. Investors were also reassured by a Bank of England survey on Thursday showing businesses were targeting the lowest price rises since February 2022, giving some confidence to policymakers that inflation will soon return to target. Traders are betting on a 25% chance the central bank will keep rates steady later this month. The nearest resistance can be seen at 1.2546; a breakout to the upside could trigger a rise to 1.2588. On the downside, immediate support is seen at 1.2455; a break below could take the pair towards 1.2426.

The previous downward channel remains. Now, the price is near the upper limit and in case of a breakdown, it may continue to rise.

USD/JPY

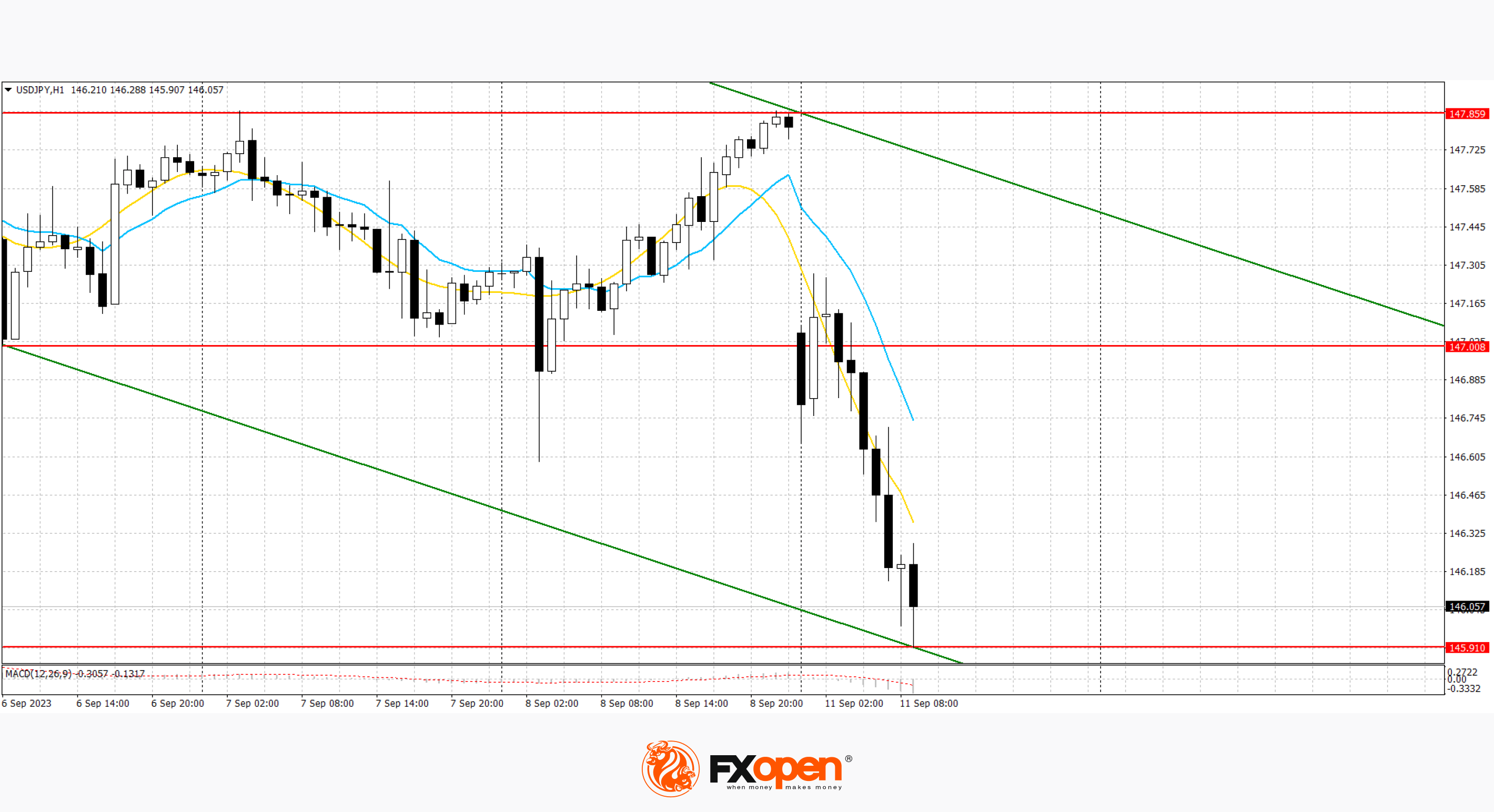

On Friday, the US dollar strengthened against the Japanese yen. Strong US economic data last week had some investors worried that even if the Federal Reserve left rates unchanged this month, they could remain high for longer than expected. Investors are awaiting US consumer price index data for August, due on Wednesday, especially as oil prices rise. The dollar index's weekly winning streak was its longest since 2014, boosted by recent data showing the US economy remains resilient. Strong resistance can be seen at 147.96; a break higher could trigger a rise towards 148.36. On the upside, immediate support is seen at 147.08; a break below could take the pair towards 146.47.

Based on the lows of two days, a new downward channel has formed. Now, the price is near the lower border of the channel and may continue to decline.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.