FXOpen

The position of the American currency came under pressure after the publication of the August report on the state of the US budget, which dropped from a surplus of 89.0 billion to a deficit of -171.0 billion, while experts expected -78.6 billion. In turn, the index of business activity in the manufacturing sector from S&P Global in the United States may decrease from 49.8 points to 49.5 points, and the indicator in the services sector - from 50.1 points to 49.9 points.

EUR/USD

The EUR/USD pair is showing a moderate decline, correcting after last week's growth. On Tuesday, investors will focus on October statistics on business activity in the manufacturing and services sectors of the US and the eurozone from S&P Global. Forecasts suggest a moderate rise in the eurozone manufacturing sector from 43.4 points to 43.7 points, while the service sector index could remain at 48.7 points. In Germany, the index in the manufacturing sector is expected to increase from 39.6 points to 40.0 points, and the index in the services sector to decrease from 50.3 points to 50.0 points.

On Thursday, the ECB's decision on the interest rate will be published, and the regulator will also hold a press conference. Analysts do not expect new steps from the central bank aimed at tightening monetary policy, but at the same time they are counting on hawkish comments from its representatives, since inflation in the region remains significantly above the ECB’s target levels.

The immediate resistance can be seen at 1.0590, a breakout to the upside could trigger a rise towards 1.0601. On the downside, immediate support is seen at 1.0525, a break below could take the pair towards 1.0442. The previous ascending channel remains. Now, the price is in the middle of the channel and may continue to rise.

GBP/USD

The GBP/USD pair is developing mixed trading, consolidating near the 1.2150 mark. On Friday, the pound showed uncertain growth, despite the publication of disappointing macroeconomic statistics in the UK. Retail sales volumes in September decreased by 0.9% after an increase of 0.4% in the previous month with a forecast of -0.1%, and in annual terms, the figure decreased by 1.0% after -1.3% a month earlier while analysts expected zero dynamics. Sales excluding fuel amounted to -1.0% month-on-month and 1.2% year-on-year, which also turned out to be significantly worse than expected at -0.4% and 0.0%, respectively.

Labour market statistics and the dynamics of business activity in the manufacturing and service sectors will be presented in the UK on Tuesday. The employment rate in August is projected to decline by 198.0k after -207.0k a month earlier, and the unemployment rate is expected to be 4.3%. At the same time, the number of applications for unemployment benefits in September may increase by 2.3K after an increase of 0.9K in the previous month.

The nearest resistance can be seen at 1.2218, a breakout to the upside could trigger a rise to 1.2261. In the fall, the nearest support is visible at 1.2099 (23.6% Fib), a break below could take the pair to 1.2051.

The downward channel is maintained. Now, the price is approaching the upper limit, from where it can continue to decline.

USD/JPY

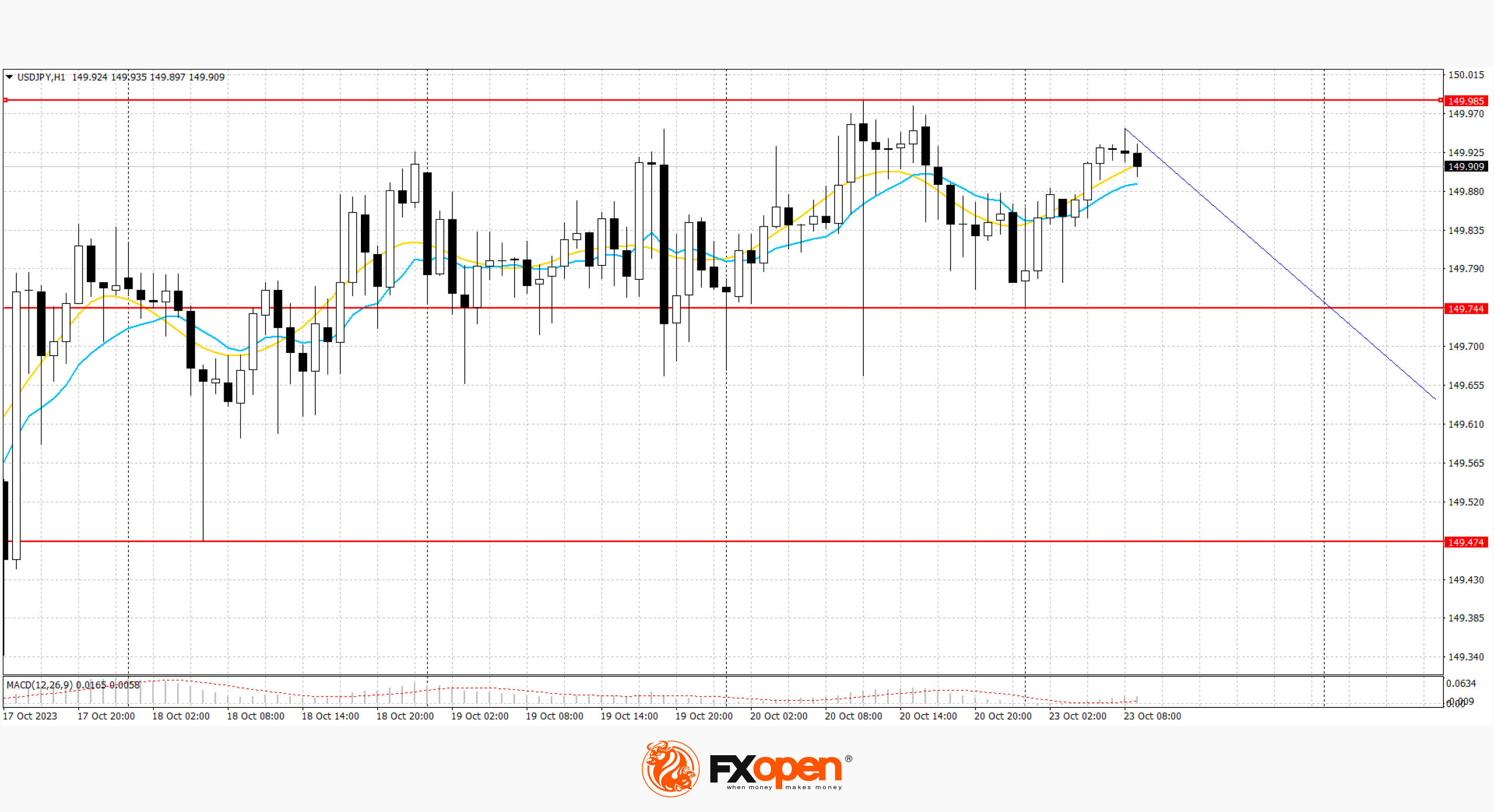

The USD/JPY pair is developing flat trading dynamics, staying close to the psychological resistance level of 150.00. Despite the strengthening of the American currency across almost the entire market spectrum, the pair cannot yet overcome this mark. Strong resistance can be seen at 149.91, a break higher could trigger a rise towards 150.13. On the downside, immediate support is seen at 149.24. A break below could take the pair towards 148.90.

Investors fear that if the yen weakens further, the Bank of Japan may intervene in the situation, as happened last year. So far, the Japanese regulator prefers to take a wait-and-see approach, and the inflation dynamics in the country do not signal in favour of a full tightening of monetary policy. Statistics showed a decline in the national consumer price index in September from 3.2% to 3.0%. The indicator adjusted from 4.3% to 4.2%, and inflation excluding prices for fresh food — from 3.1% to 2.8%.

Tomorrow in Japan, statistics on business activity from Jibun Bank in the manufacturing sector will be published. Forecasts suggest a slight increase in the index in October from 48.5 points to 48.9 points. Bank of Japan Governor Kazuo Ueda called on the nation's lending institutions to tighten controls on possible risks, citing the banking crisis that rocked the US financial system earlier this year as well as uncertainty in the nation's economy amid unprecedented inflation. Such rhetoric could serve as a signal of a likely interest rate increase as early as next year. The official spoke shortly after the regulator presented a report indicating that Japan's financial system remains resilient, but tightening monetary policy from global central banks will continue to put pressure on it.

Over the past week, a trading range has formed with boundaries at the levels of 149.47 and 149.98. Now, the price is at the top of the range, from where a decline is possible.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.