FXOpen

Today, markets are analysing US statistics published late last week. Thus, the indicator of personal consumption expenditures in September adjusted from 3.8% to 3.7% in annual terms and from 0.1% to 0.3% in monthly terms. The general indicator of personal expenses rose from 0.4% to 0.7%, while income slowed down slightly from 0.4% to 0.3%. The consumer confidence index from the University of Michigan showed a moderate increase in October from 63.0 points to 63.8 points, which turned out to be better than analysts' neutral forecasts.

The US Federal Reserve will meet on Wednesday, followed by the publication of the October labour market report on Friday. Experts do not expect an increase in interest rates, but will pay attention to the tone of officials’ statements: the dollar has recently received support even from forecasts of possible growth, so the bulls would not want to face the dovish rhetoric of the head of the regulator, Jerome Powell.

Analysts expect that the number of new jobs created outside the agricultural sector will decrease from 336.0k to 172.0k, unemployment will remain at 3.8%, and the average hourly wage will adjust from 0.2% to 0.3%.

EUR/USD

According to the EUR/USD technical analysis, the euro fell against the dollar on Friday after the European Central Bank confirmed interest rates would remain at current levels for an extended period. The ECB left rates unchanged as expected on Thursday and said talk of a rate cut in the market was premature. Money markets are pricing in almost zero chance of additional hikes by year-end and interest rate cuts starting next June. The ECB confirmed on Thursday that it will continue to reinvest funds from the Pandemic Emergency Purchase Program (PEPP) until the end of 2024. However, President Lagarde said the council had not yet discussed the issue.

Today, the EUR/USD pair is showing flat dynamics, holding near the 1.0560 mark. Activity in the market remains quite low, as traders are in no hurry to open new positions in anticipation of the emergence of new drivers of price movements. In the eurozone, October inflation statistics in Germany will be published today: forecasts suggest a slowdown in the consumer price index from 4.5% to 4.0%. The indicator for the eurozone as a whole will be presented tomorrow: experts expect a decrease from 4.3% to 3.4%. Also on Tuesday, investors will evaluate the dynamics of the eurozone's gross domestic product (GDP) for the third quarter: a slowdown in annual terms is predicted from 0.5% to 0.2% and a decrease of 0.1% in the quarter.

The immediate resistance can be seen at 1.0570, a breakout to the upside could trigger a rise towards 1.0606. On the downside, immediate support is seen at 1.0512, a break below could take the pair towards 1.0500.

At the lows of the week, a new downward channel has formed. Now, the price is in the middle of the channel and may continue to decline.

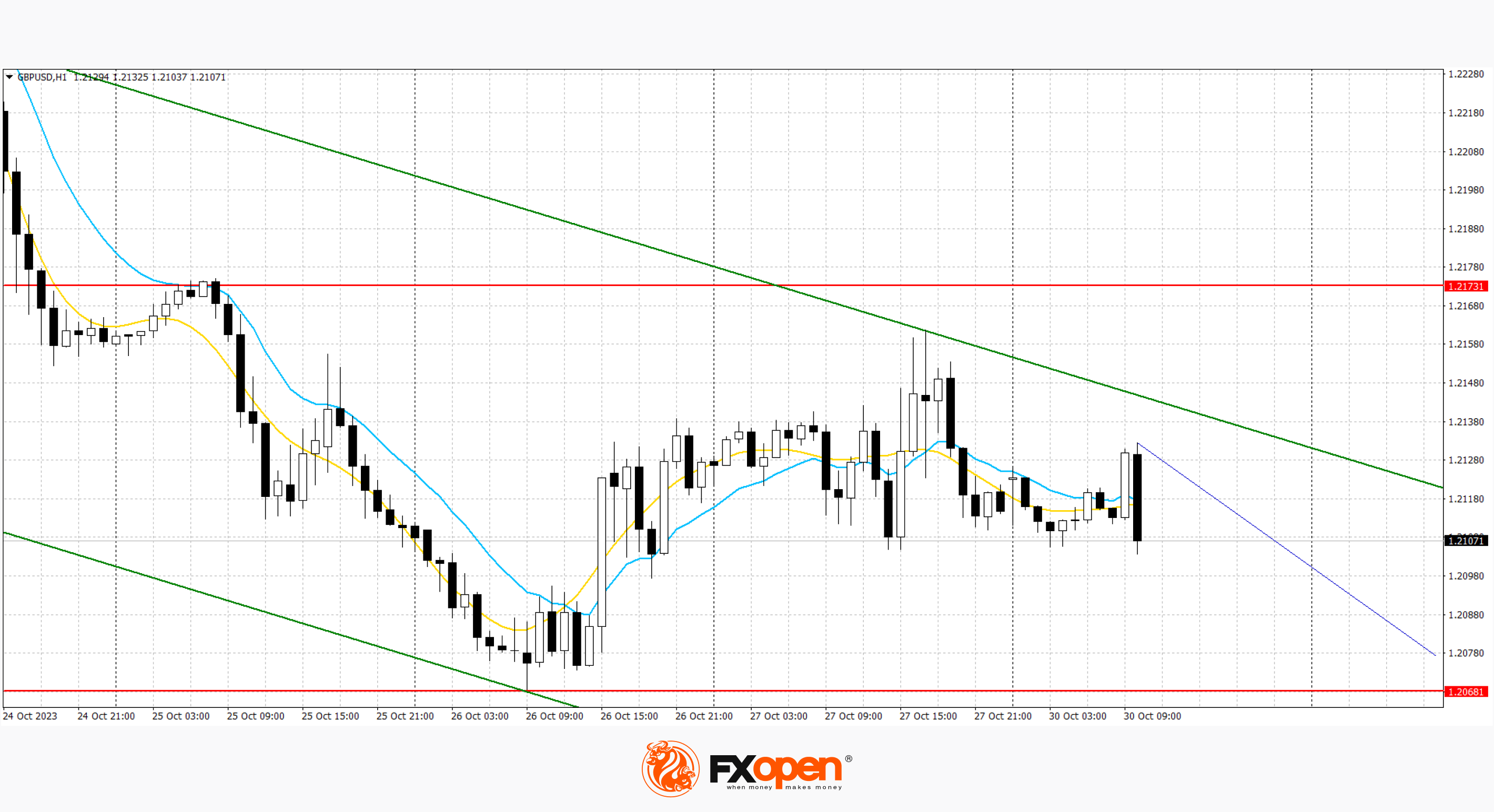

GBP/USD

On the GBP/USD H1 chart, the pair is trading virtually unchanged, consolidating near the 1.2120 mark. In the UK today, data will be presented on the dynamics of consumer lending in September. Forecasts suggest a slowdown from £1.644 billion to £1.300 billion. The number of approved mortgage applications in September may adjust from 45,354k to 45,000k, and the net volume of consumer lending may remain at around 2.9 billion pounds. Also, on Thursday, November 2, the Bank of England will meet on interest rates.

The nearest resistance can be seen at 1.2157, a break upward could trigger a rise to 1.2191. In the fall, the nearest support is seen at 1.2085, a break below could take the pair to 1.2037. At the lows of the week, a new downward channel has formed. Now, the price is in the middle of the channel and may continue to decline.

USD/JPY

On the USD/JPY H1 chart, the dollar fell on Friday as the yen strengthened ahead of the Bank of Japan's policy meeting on Tuesday. The USD/JPY pair is showing multidirectional dynamics, holding near the level of 149.50. The American currency is again trying to recover to the psychological level of 150.00 after the dollar showed the development of a corrective decline at the end of last week. Activity in the market remains quite low, which is associated with expectations of the results of the meetings of the Bank of Japan and the US Federal Reserve.

The Tokyo metropolitan area's October inflation data was released on Friday, with the figure rising from 2.8% to 3.3% year-on-year and the core reading from 2.5% to 2.7%, casting doubt on the Bank's view Japan said consumer price growth could slow in coming months as energy cost pressures ease. Thus, the statistics could act as a catalyst for abandoning the current ultra-loose monetary policy at tomorrow’s meeting, and also lead to an increase in the interest rate from -0.10%, where it has been held since 2016. Tomorrow investors will also focus on the unemployment rate, retail sales and industrial production. Forecasts suggest that the unemployment rate in September could correct from 2.7% to 2.6%, industrial production could add 2.5% after -0.7% in the previous month, and retail sales could slow down from 7.0%. up to 5.9%.

Strong resistance can be seen at 150.55, a break higher could trigger a rise towards 150.72. On the downside, immediate support is seen at 149.30. A break below could take the pair towards 149.28. At the highs of the week, a new ascending channel has formed. Now, the price is near the lower border of the channel, from where it may continue to grow.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.