FXOpen

Good data on core durable goods orders in the US for August and a general decrease in risk appetite in the market are helping to strengthen the US dollar. The American currency set new highs in such pairs as EUR/USD, GBP/USD, and USD/CHF. Commodity currencies, along with precious metals, continue to decline.

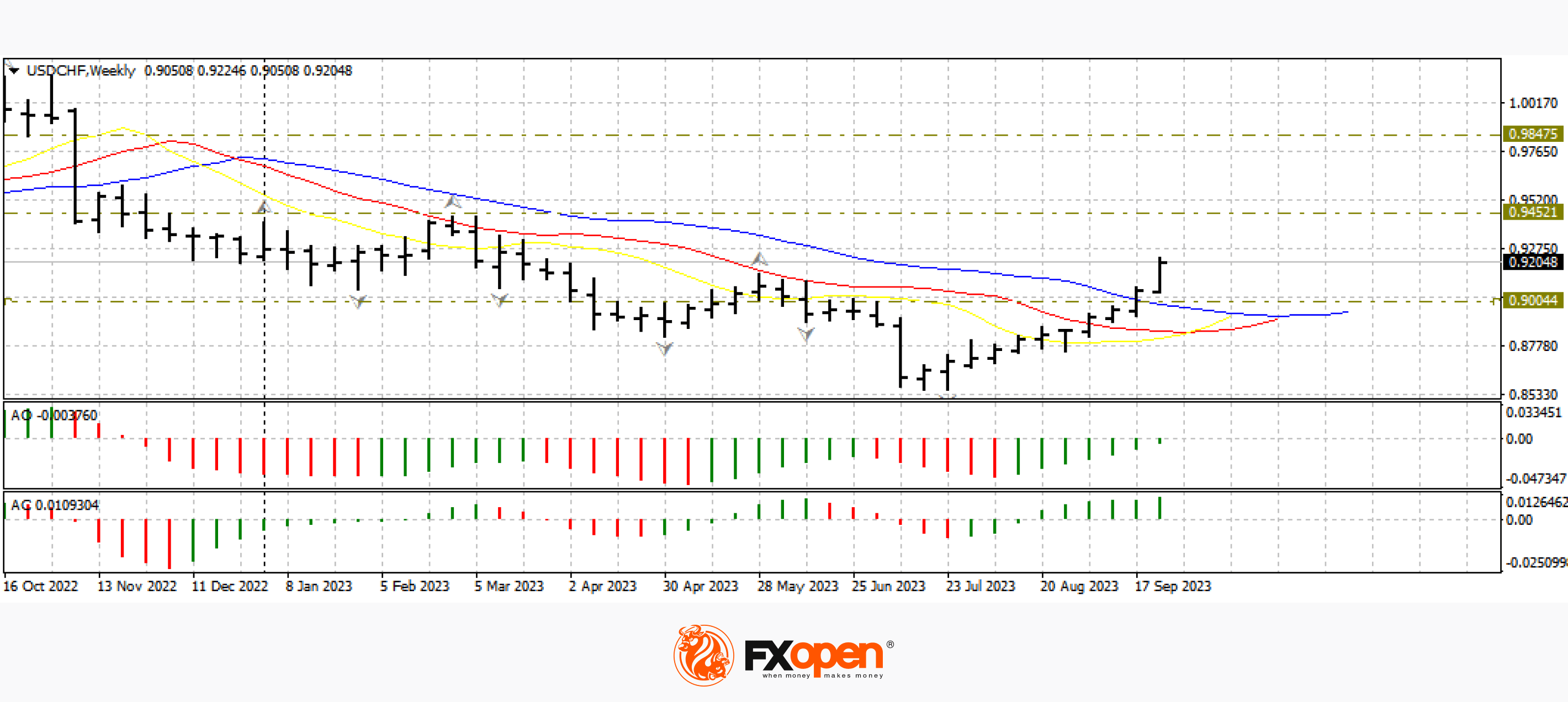

USD/CHF

The latest meeting of the Swiss National Bank (SNB) disappointed buyers of the Swiss franc. Contrary to analysts' forecasts, officials refused to raise the rate by 0.25%. The change in the vector of the SNB monetary policy contributed to a sharp strengthening of USD/CHF. In just a few days, the price rose by 300 points and strengthened above the alligator lines on the weekly timeframe. If the current situation does not change and the US dollar continues to strengthen, the pair may continue to rise towards the nearest important resistance range of 0.9400-0.9450. We can consider a cancellation of the upward scenario only after the pair moves below the psychological level of 0.9000.

Today's news on US GDP for the Q2 will be important for the pair's pricing. The publication of the indicator is scheduled for 15:30 GMT+3. Also, at the same time, weekly data on the number of applications for unemployment benefits in the United States will be released.

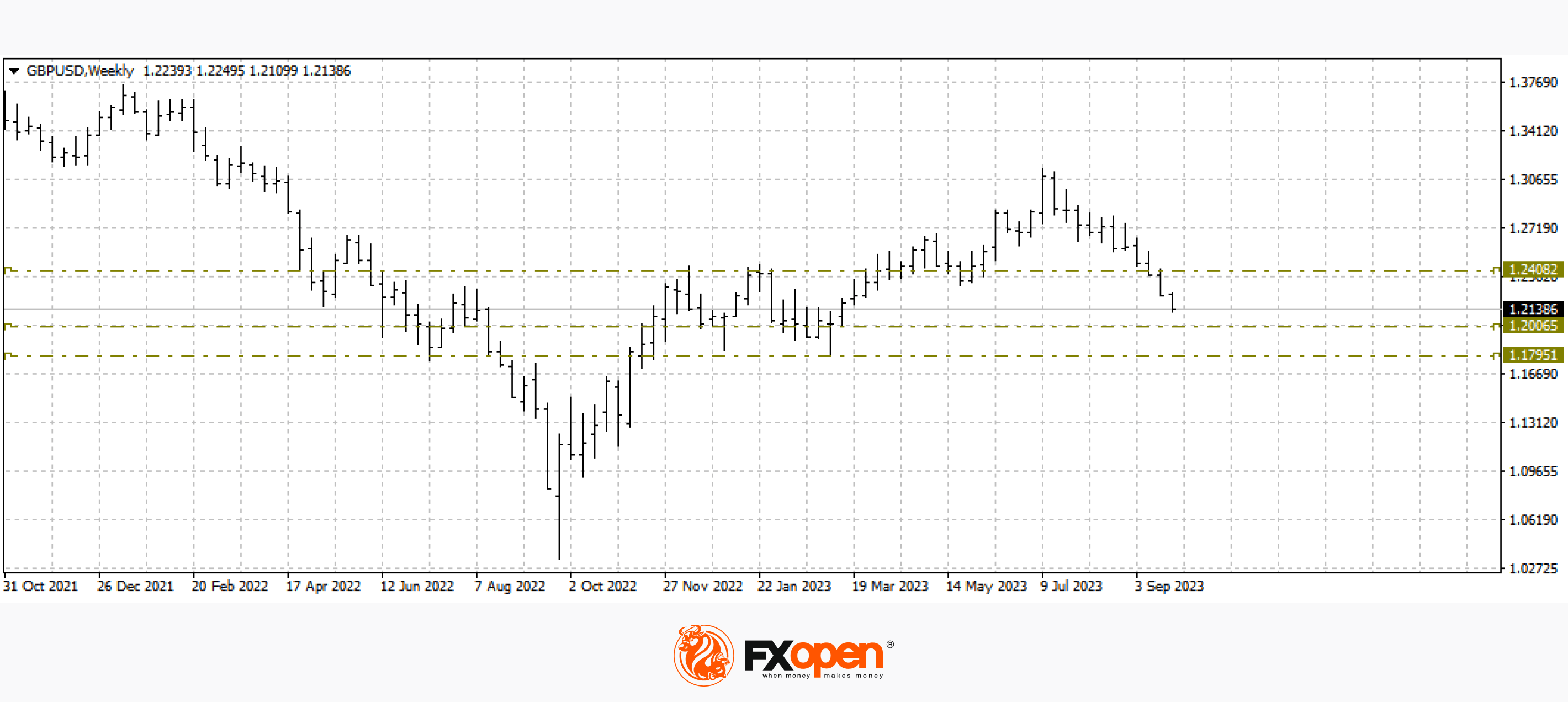

GBP/USD

The pound/dollar currency pair fell to important support at 1.2100 yesterday. The British currency continues its intense downward trend; the nearest support for the price is located at 1.2000-1.1800.

Tomorrow, the pair faces an important fundamental day. At 9:00 GMT+3, the UK GDP figure for the Q2 will be published. The Bank of England's consumer lending volume for August will be released a little later.

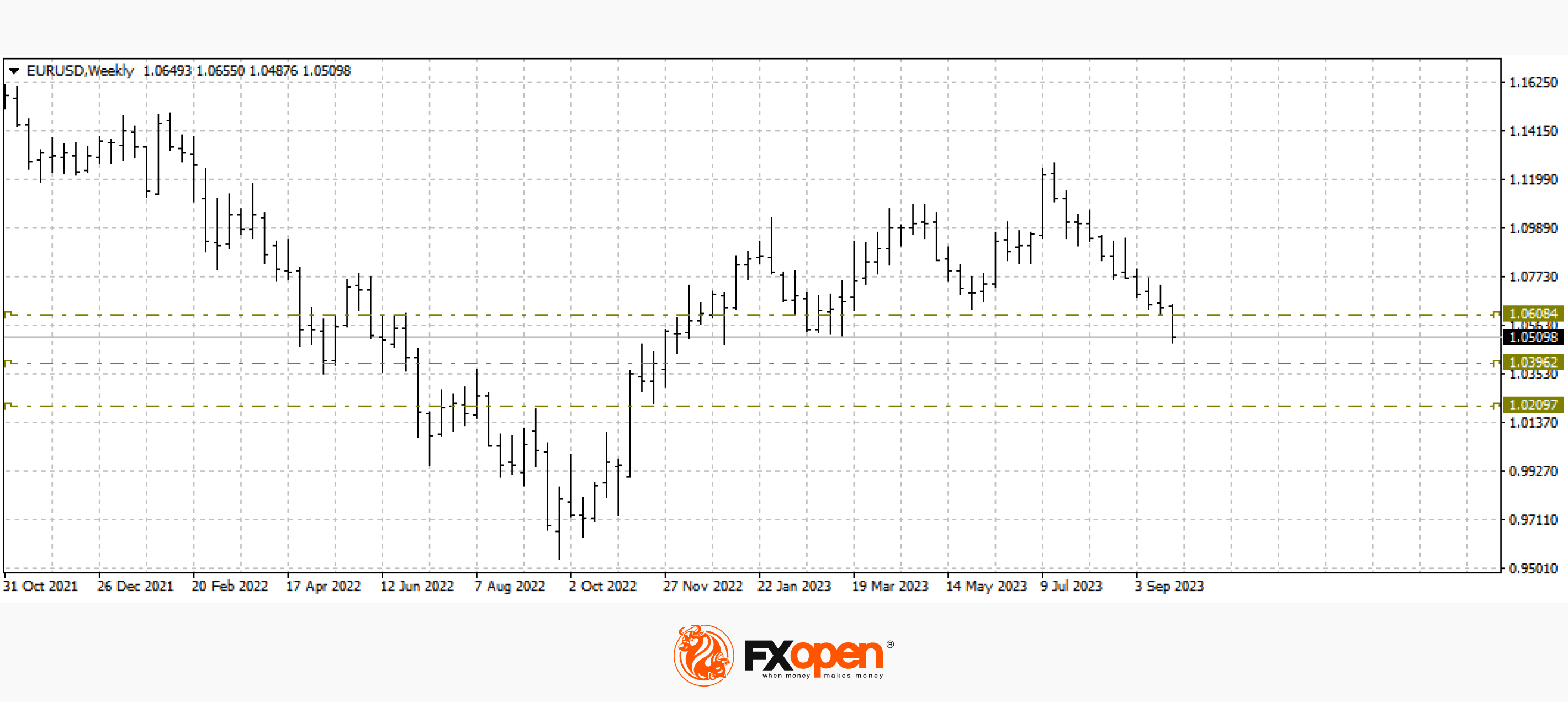

EUR/USD

The single European currency updated its current annual minimum yesterday. The price dropped to 1.0485 and, at the end of the day, returned above 1.0500. A lot of important events are expected today from both the Eurozone and the US. The price reaction to incoming news may provide more clues to the future direction of EUR/USD. At 10:00 GMT+3, Andrea Enria, Chairman of the Supervisory Board of the European Central Bank, will speak. At 15:00 GMT+3, the consumer price index (CPI) in Germany for September will be published. And finally, at 23:00 GMT+3, Fed Chairman Jerome Powell will speak.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.