FXOpen

EUR/USD

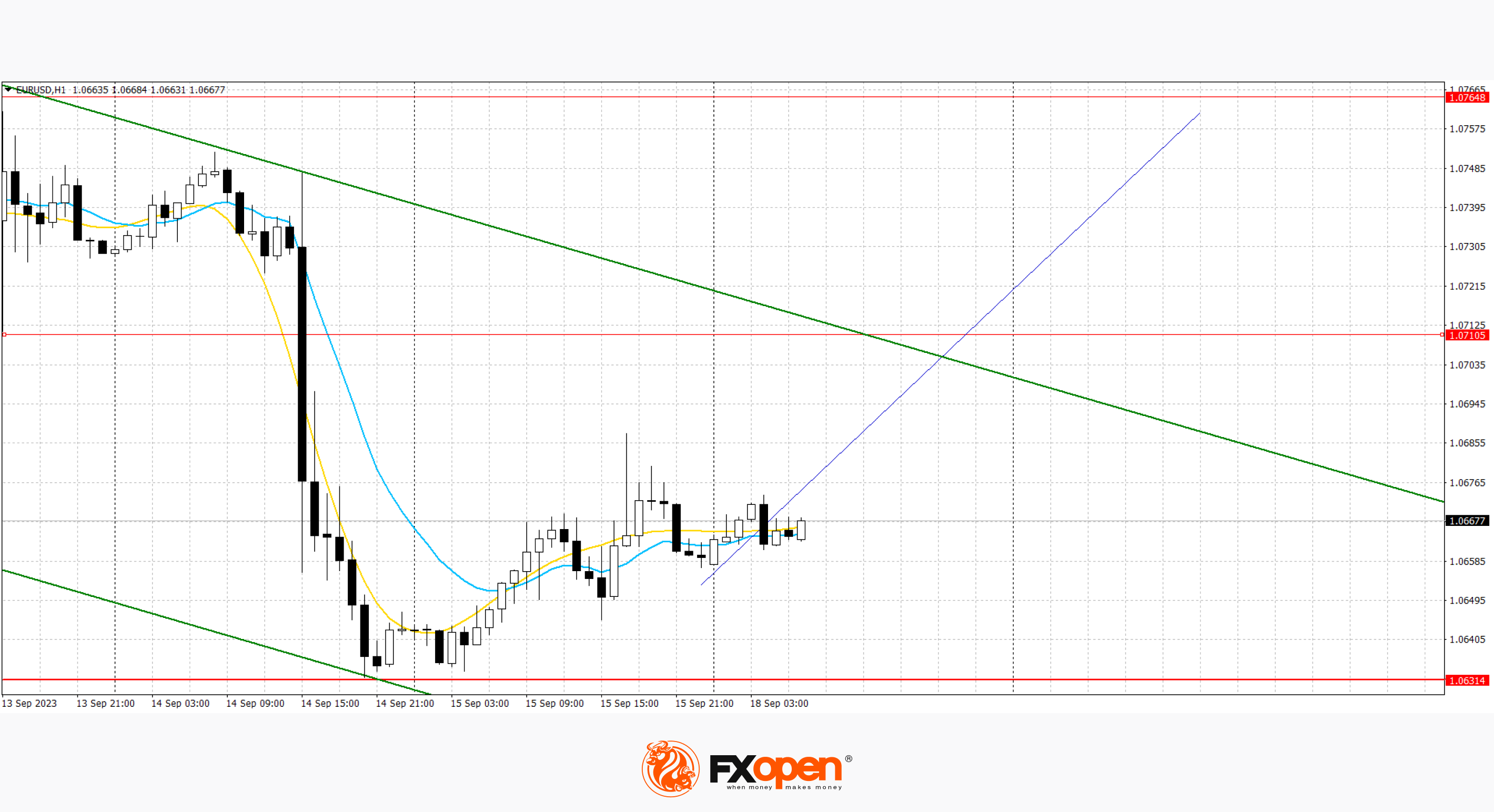

The euro rose against the US dollar on Friday, boosted by hopes that the ECB is ending its cycle of rate hikes and data suggesting China's faltering economy may be regaining some momentum. The ECB raised its key interest rate to a record 4% on Thursday and warned it would remain at that level until inflation above target is resolved. Data on Friday showed Chinese retail sales and industrial production figures for August beat economists' expectations, even as the housing market slump deepened. The euro rose 0.2% to $1.0675, off a low of $1.0632, its weakest since March 20. Immediate resistance can be seen at $1.0710, a break higher could trigger a rise towards $1.0760. On the upside, immediate support is seen at 1.0637, a break below could take the pair towards 1.0592.

Based on last week's lows, a new downward channel has formed. Now, the price is in the middle of the channel and may continue to rise.

GBP/USD

The pound rose against the US dollar on Friday as the dollar fell and traders awaited the Bank of England's interest rate decision. Sterling has been one of the best-performing currencies this year, rising 2.8% against the US dollar since early January. But it has fallen since mid-July as the UK labour market weakened and the dollar recovered amid a relatively strong US economy. The Bank of England will set interest rates this week (September 21, 14:00 GMT+3), and prices in derivatives markets show traders believe it is highly likely policymakers will raise borrowing costs by 25 basis points to 5.5%. Sterling rose 0.18% against the US dollar to $1.2444. The immediate resistance can be seen at 1.2454, a breakout to the upside could trigger a rise towards 1.2488. On the downside, immediate support can be seen at 1.2375, a break below could take the pair towards 1.2334.

The previous downward channel remains. Now, the price has moved away from the lower boundary and may continue to rise.

USD/JPY

The US dollar strengthened and hit a 10-month high against the Japanese yen on Friday as investors' attention turned to the US monetary policy meeting. Economic indicators bolstered expectations that the Fed will leave its key interest rate unchanged and raised hopes that the central bank's tightening cycle may have run its course. Financial markets have pegged the Fed at 97% likely to keep its rate target at 5.00%-5.25% and at 68.5% likely to do the same at the end of its November report. The dollar was last up 0.25% at 147.84 yen after hitting a 10-month high of 147.96. Strong resistance can be seen at 147.96. A break upward could trigger a rise to 148.43. On the downside, immediate support is seen at 147.00, a break below could take the pair towards 146.40.

The previous ascending channel remains. Now, the price is in the middle of the channel and may continue to move towards the lower border.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.