FXOpen

Yesterday, one could observe a continuation of the upward momentum in the dollar. Good data on the number of open vacancies in the US labour market from JOLTS allowed the USD/JPY pair to update its annual maximum at 150.00. The USD/CAD currency pair has strengthened above 1.3700, and the AUD/USD pair is approaching last year’s extremes at 0.6200-0.6100.

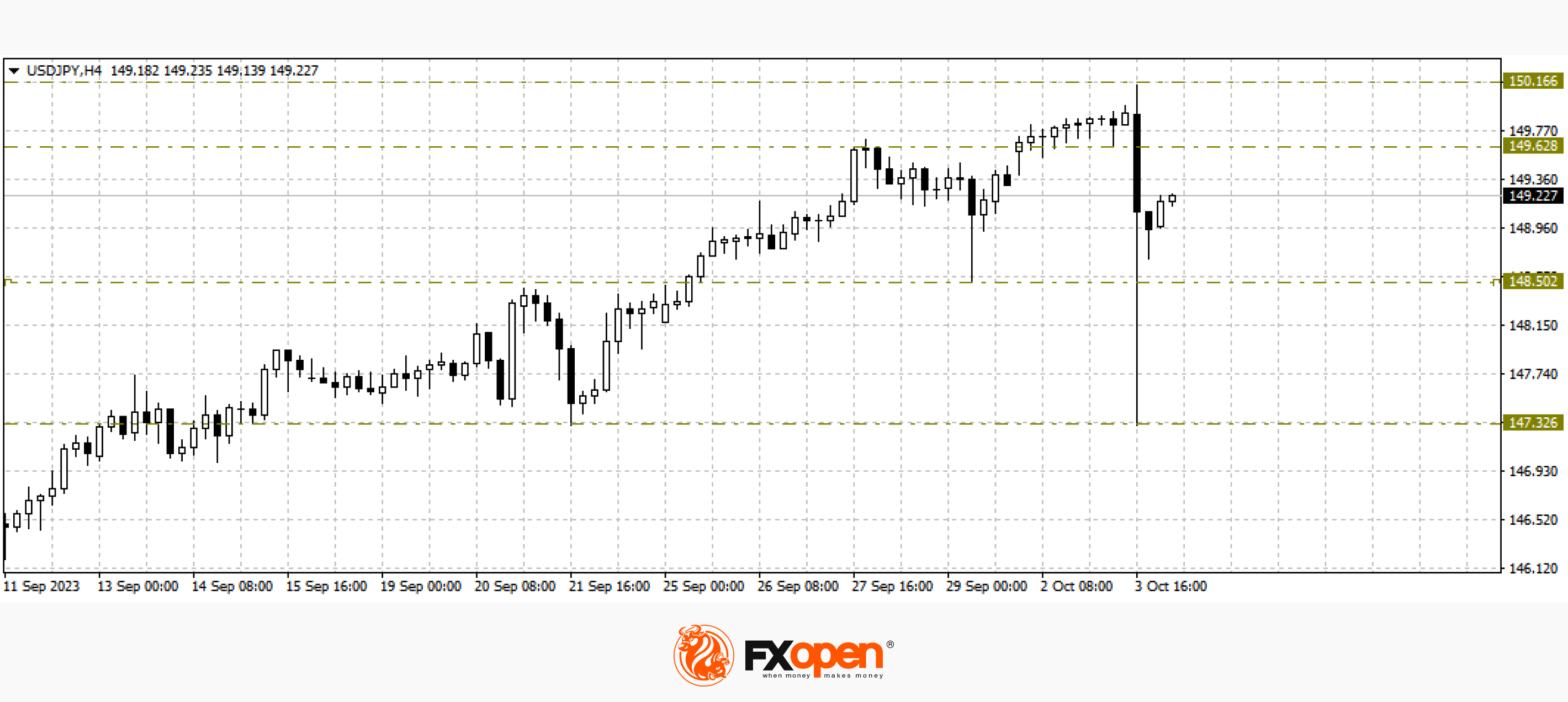

USD/JPY

The American currency continues to hold its leading position in the first five-day trading period of October. But, since many pairs have reached important levels, corrective pullbacks from the main movements can be expected in the near future. Thus, the USD/JPY pair fell sharply yesterday after testing the psychological level of 150.00 and lost more than 250 points in just an hour. US dollar buyers very quickly returned the price above 149.00, but apparently, the range of 150.20-150.00 could become a serious obstacle to further growth of USD/JPY. A corrective downward pullback for the pair may be limited by recent extremes at 147.30-148.50.

Today at 15:15 GMT+3, we are waiting for preliminary data on employment in the US for September from ADR. A little later, the business activity index (PMI) in the US services sector for the same period will be released.

AUD/USD

The RBA's decision to leave the AUD rate at the same level, predicted by analysts, contributed to a sharp collapse and the pair's departure below 0.6300. At the end of the day, Aussie buyers attempted to return the price above 0.6300, but so far, as we see, they have been unsuccessful. If the current situation does not change and AUD/USD remains under pressure, the price may fall to the 2022 lows at 0.6170. We can consider cancelling the downward scenario only after a confident consolidation above 0.6500-0.6550.

Tomorrow, early in the morning, we are waiting for data on imports and exports in Australia for August.

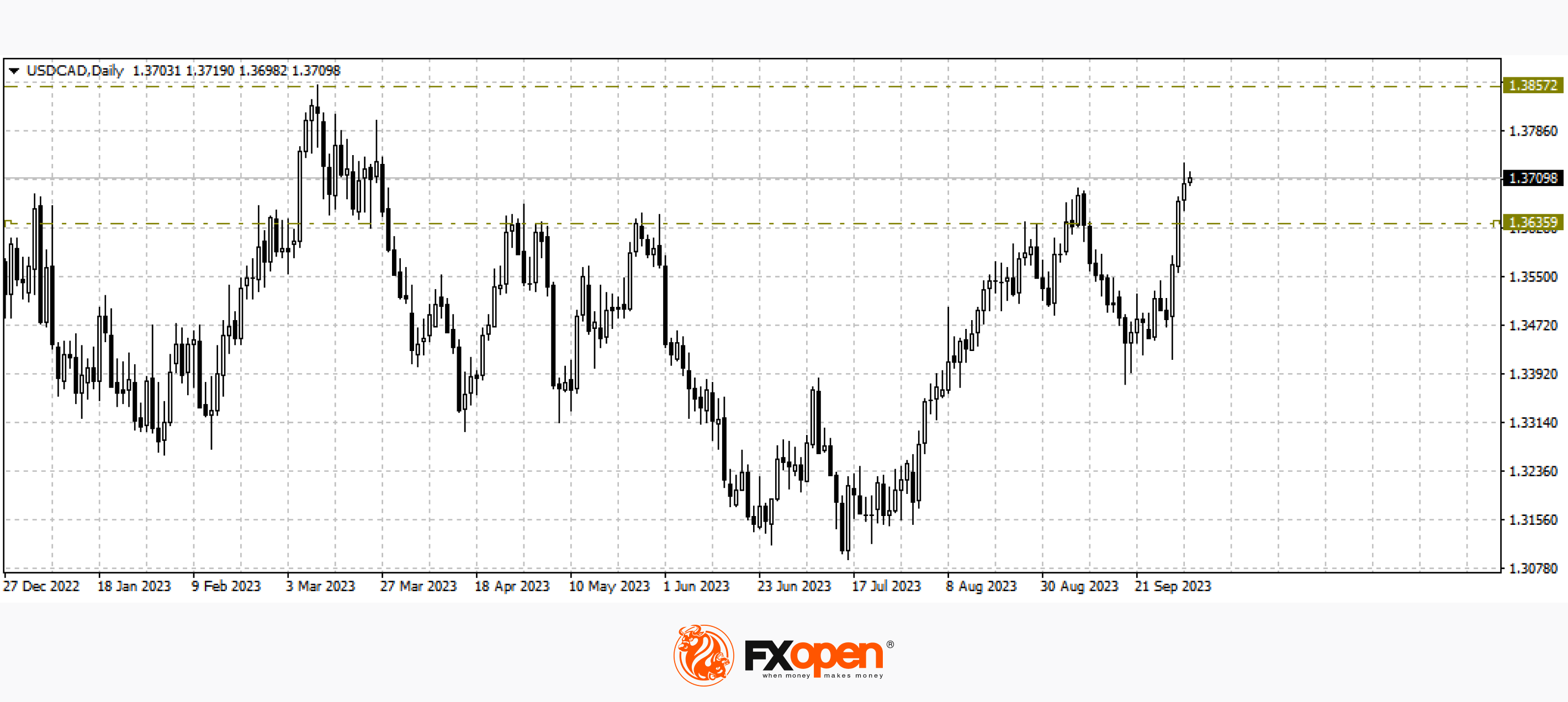

USD/CAD

High oil prices restrained the collapse of the Canadian dollar, but nevertheless, buyers of the pair managed to move it above 1.3700 before updating the annual maximum at 1.3860 by only 150 points.

In addition to data from the United States, today at 14:00 GMT+3, it is worth paying attention to the publication of the index of leading economic indicators in Canada for September. Also, at 17:30 GMT+3, weekly figures on crude oil inventories in the United States will be published.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.