FXOpen

The American currency, despite a rather multidirectional fundamental data, resumes growth at the end of February. In the main currency pairs, one can observe both rebounds from key levels and continuation of the main trends. Thus, the USD/CAD pair managed to strengthen above 1.3500, the GBP/USD pair lost about 100 pp after rebounding from 1.2700, and EUR/USD buyers failed to strengthen above 1.0900.

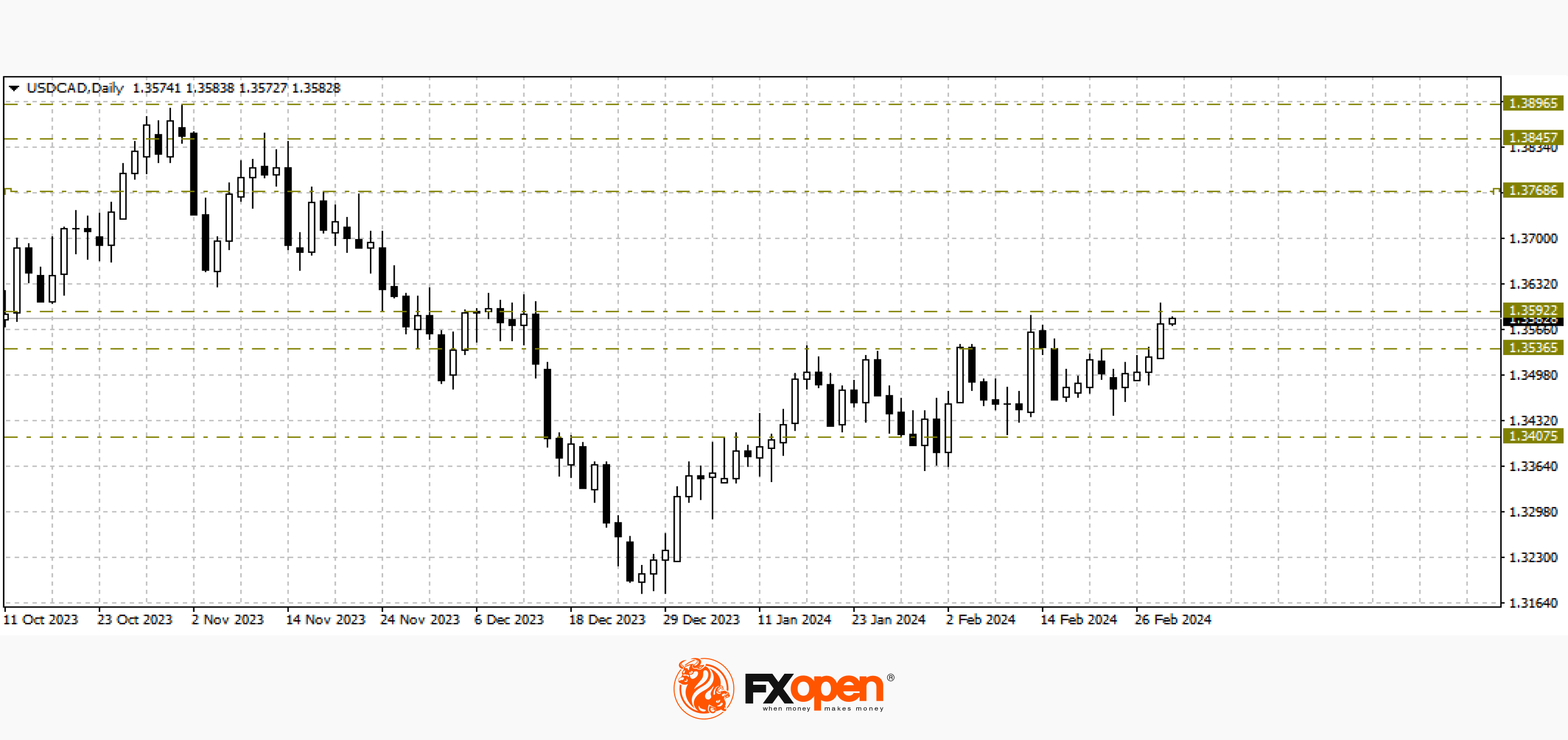

USD/CAD

Fluctuations in the oil market contributed to the strengthening of the USD/CAD pair. At the beginning of the week, sellers of the pair tried to break the support at 1.3400, but, as we see, were unsuccessful. Yesterday, the price on the USD/CAD chart not only strengthened above 1.3500, but also updated the current year’s maximum at 1.3580. If the pair's buyers do not lose their upward momentum, the price may strengthen to 1.3770-1.3700. The upward scenario may be cancelled by consolidation below the level of 1.3400.

Today, we can expect increased volatility in the pair. At 16:30 GMT+3, we are waiting for data on Canadian GDP for the fourth quarter of last year. At the same time, the basic price index of personal consumption expenditures in the US for January and indicators on applications for unemployment benefits for the current week will be published.

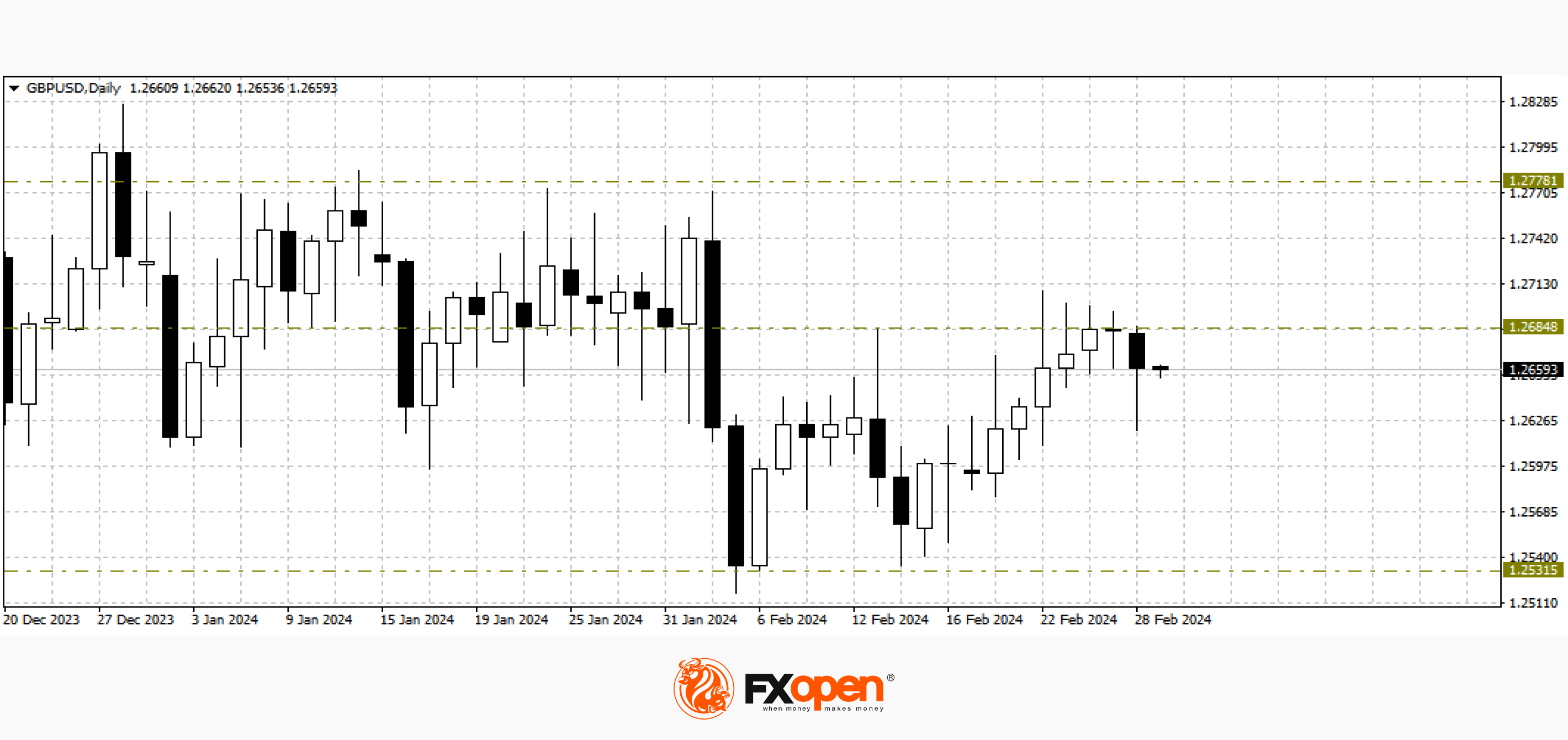

GBP/USD

At the end of last week, buyers of the British currency tried to break through the important resistance level at 1.2700. For about four trading sessions, the price on the GBP/USD chart was trading near this level, and yesterday it fell to 1.2620. If sellers of the pair manage to develop a downward movement, the pair may test the January lows of this year at 1.2530-1.2510.

Today at 12:30 GMT+3, we are waiting for the publication of data on mortgage lending in the UK for January. Also at the same time, data on the volume of consumer lending from the Bank of England for the same period will be released.

EUR/USD

On the EUR/USD chart, the pair continues to trade in a rather narrow range of 1.0900-1.0800. In the coming trading sessions, we expect the release of important fundamental data that may contribute to exiting the flat corridor.

Bundesbank President Joachim Nagel is scheduled to speak at 12:00 GMT+3. At 16:00 GMT+3, the consumer price index (CPI) in Germany for February will be published.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.