FXOpen

European currencies continued their rally this week, setting fresh yearly highs: the euro and the Swiss franc consolidated at new levels, supported by a weaker US dollar and expectations of a Federal Reserve rate cut. The key question remains whether this rise will develop into a new bullish impulse or give way to a correction.

Today, the Federal Reserve is set to deliver its crucial interest rate decision. The market is almost certain of a 25-basis-point cut, driven by signs of a cooling labour market. The decision comes against a backdrop of unprecedented political pressure and ongoing legal proceedings, raising concerns about the Fed’s independence and the composition of its board.

Investors will focus closely on Jerome Powell’s comments and the updated macroeconomic projections, which are expected to provide guidance for the remaining meetings this year. The central intrigue is the size of the rate reduction the Fed will signal. A dovish Fed stance could support further gains for the euro and the franc against the dollar, while a cautious tone would heighten the risk of a pullback. However, the further trajectory of EUR/USD and USD/CHF will depend not only on Powell’s rhetoric but also on incoming data from the US, the eurozone, and Switzerland.

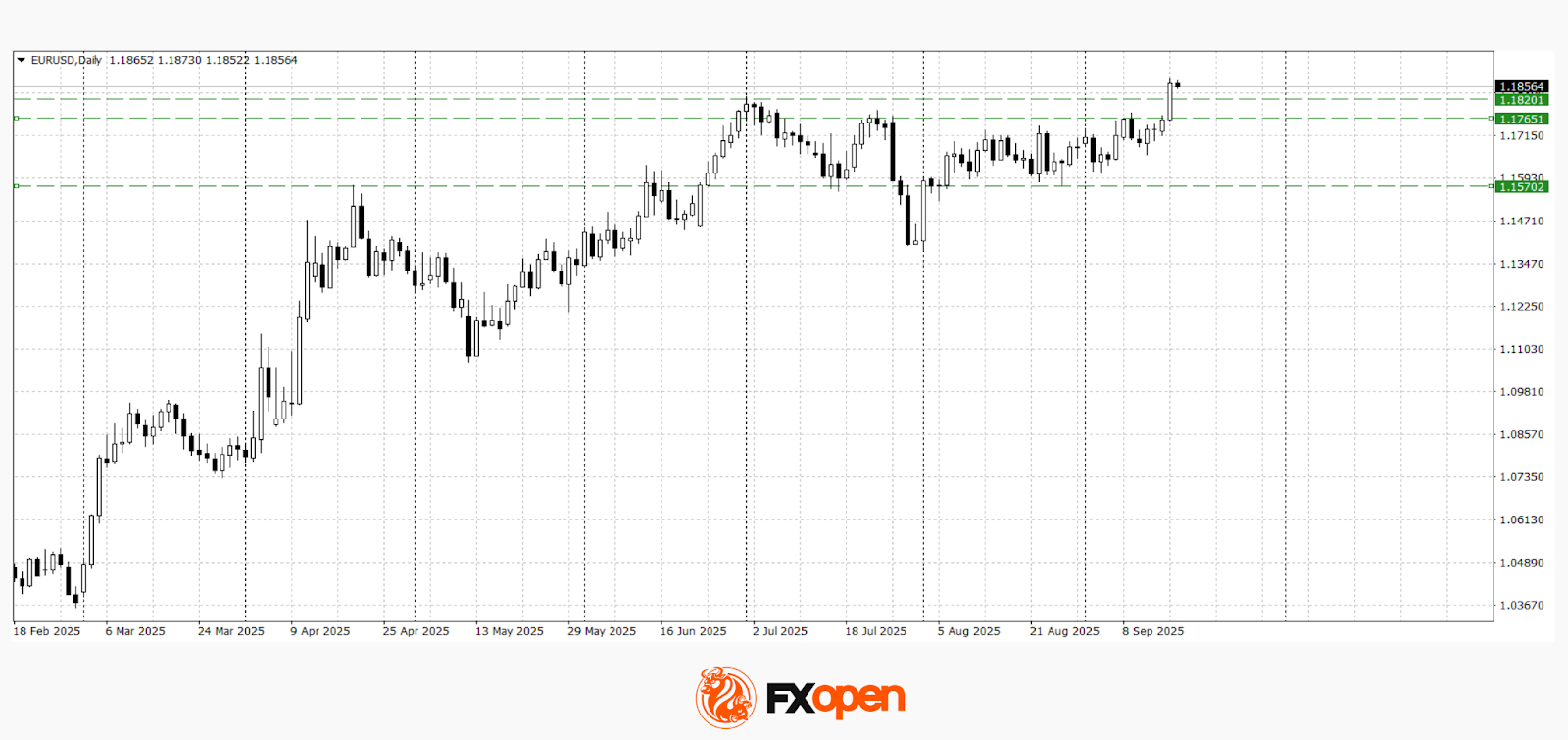

EUR/USD

The EUR/USD pair yesterday broke out of the 1.1570–1.1760 range, where it had been trading for several weeks. A new yearly high was recorded at 1.1830. Technical analysis suggests the potential for further upside towards 1.1900–1.2000, provided that 1.1830 holds as a support level. However, if the daily candle closes below 1.1830 in the coming days, a downward correction may follow.

In addition to the Fed meeting, the following events may influence EUR/USD price dynamics:

- 10:30 (GMT+3): ECB President Lagarde’s speech

- 12:00 (GMT+3): Eurozone Consumer Price Index (CPI)

- 13:00 (GMT+3): Bundesbank monthly report

USD/CHF

The USD/CHF pair has updated its July low at 0.7870. Should the Fed meeting outcome disappoint dollar bulls, the decline could extend towards the 0.7600–0.7700 area. Conversely, positive news from the US may push the pair back to 0.7900–0.7920.

Key factors that may affect USD/CHF movements include:

- 10:00 (GMT+3): Swiss economic growth forecasts from SECO

- 21:00 (GMT+3): Federal Reserve interest rate decision

- 21:30 (GMT+3): FOMC press conference

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.