FXOpen

A rather weak US employment report published last week contributed to the US dollar's decline in almost all areas. Thus, the USD/JPY pair lost more than 150 pp in just a couple of hours, the pound/US dollar pair tested important resistance at 1.2900, and euro/US dollar buyers managed to strengthen above 1.0900.

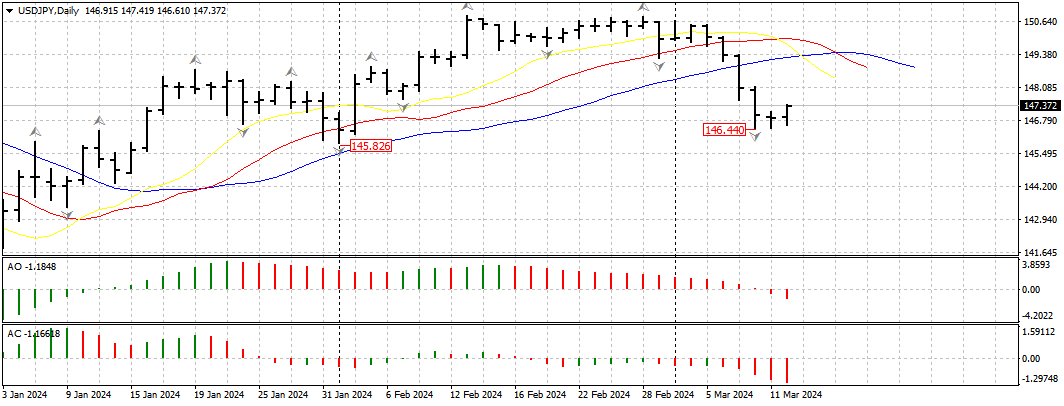

USD/JPY

The weak fundamentals from the US are bolstering investor confidence that the Fed will begin cutting interest rates later this year. And although recent statements by the head of the American regulator, Jerome Powell, can hardly be called dovish, market participants prefer short-term sales of greenbacks.

The USD/JPY currency pair fell to 146.50 at the end of last week. Yesterday, buyers of the pair managed to return the price above 147.00, but the full development of an upward correction has not yet been observed. If the pair manages to consolidate above 148.00, the price may test resistance at the alligator lines on the weekly timeframe near the range of 149.50-149.00. An update to the recent low on the USD/JPY chart could trigger a collapse to the extremes of the current year at 146.00-145.80.

Today's news on the basic US consumer price index for February will be important for the pair's pricing.

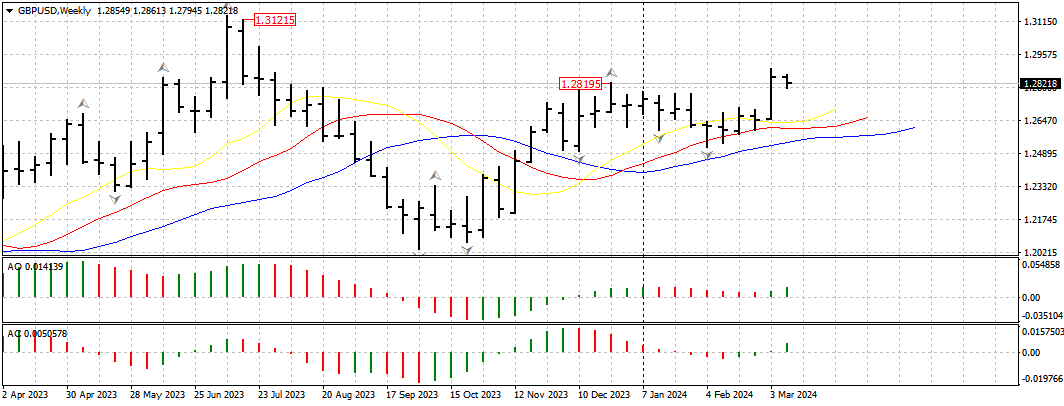

GBP/USD

The pound/US dollar currency pair, after strengthening to 1.2900, rolled back a little and is consolidating in a small 100-point corridor. If the pair’s buyers manage to resume the upward movement, the price may strengthen to last year’s extremes at 1.3140-1.3100. We can consider the cancellation of the upward scenario on the GBP/USD chart after a breakdown downward to 1.2600.

In the coming trading sessions, the pair will experience a strong fundamental impulse. So, today at 10:00 GMT+3, we are waiting for the publication of data on average wages and changes in the unemployment rate in the UK for January. Tomorrow at the same time the country's GDP indicator for the same period will be published.

EUR/USD

Last week, buyers of the single European currency managed to strengthen the EUR/USD pair by more than 150 points. Technical analysis of EUR/USD shows that on the daily and weekly timeframes the price is above the alligator lines; with the appropriate fundamental background, the pair can test the psychological resistance level at 1.1000.

Today at 10:00 GMT+3, we are waiting for data on the consumer price index in Germany for February. Tomorrow at 11:00 GMT+3, a meeting of the European Central Bank is scheduled on non-monetary policy issues.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.