FXOpen

The last January trading session of this year was marked by the announcement of the results of the two-day Fed meeting. As analysts expected, the regulator left rates at the same level in the range of 5.50-5.25%. Also, after the announcement of the results of the Fed meeting, a press conference was held by Jerome Powell, at which it was announced that the start of lowering interest rates is possible only after more evidence is received that “inflation is steadily moving towards 2%.” Naturally, such a hawkish tone of the American regulator’s statement could not but support the American currency. The dollar has strengthened in almost all directions; at the moment we are seeing a pullback from yesterday’s growth.

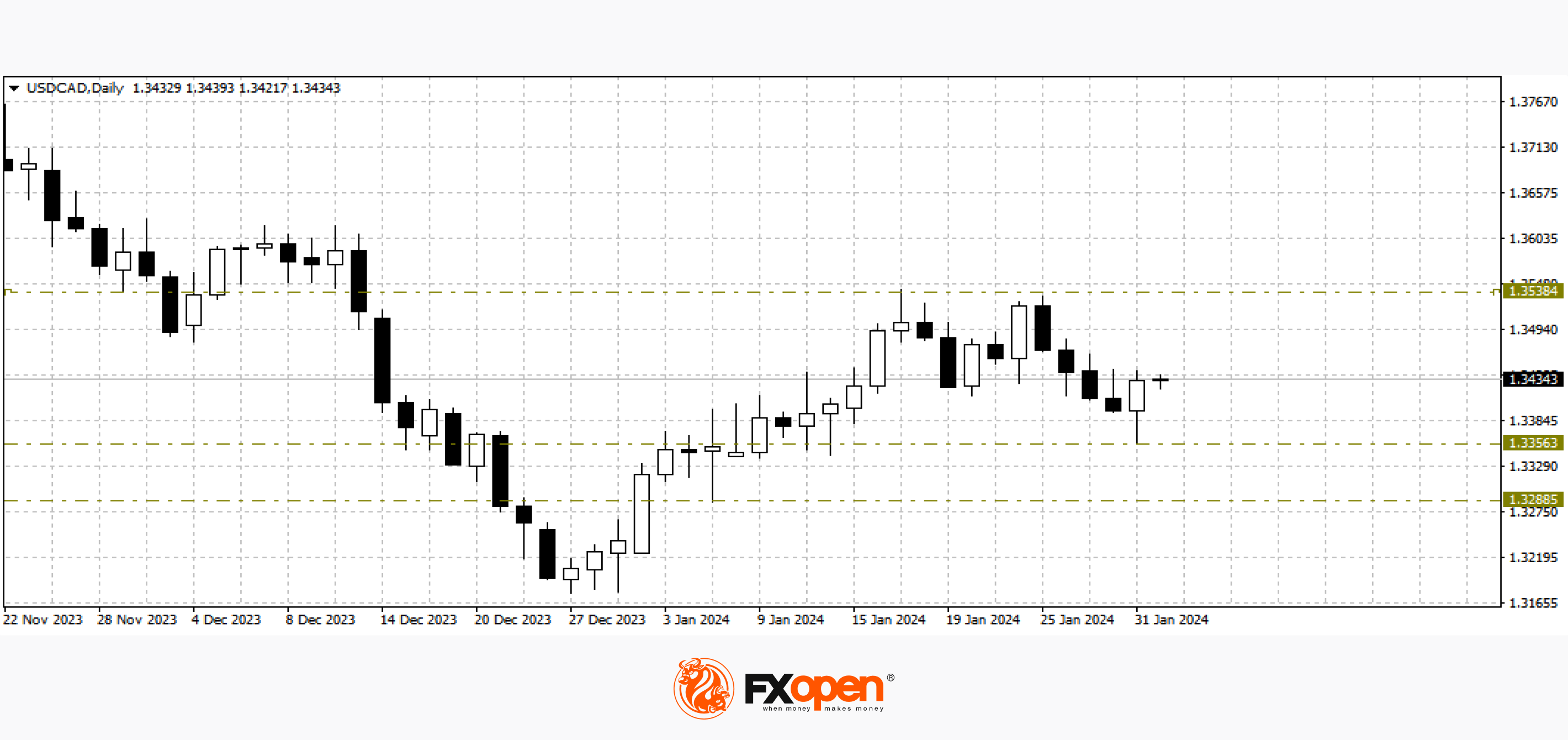

USD/CAD

Thanks to yesterday's events, the US dollar/Canadian currency pair found support at 1.3360. On the daily USD/CAD chart, the pair closed the day by forming a bullish engulfing combination. If this formation is confirmed, the price may continue to rise in the direction of 1.3540-1.3500. If yesterday's low is renewed, the downward movement to 1.3300-1.3280 may resume.

Today at 16:30 GMT+3, we are waiting for weekly data on the number of applications for unemployment benefits in the United States. Also important for the pair’s pricing will be the publication of the US manufacturing business activity index (PMI) for January, which is scheduled for 17:45 GMT+3.

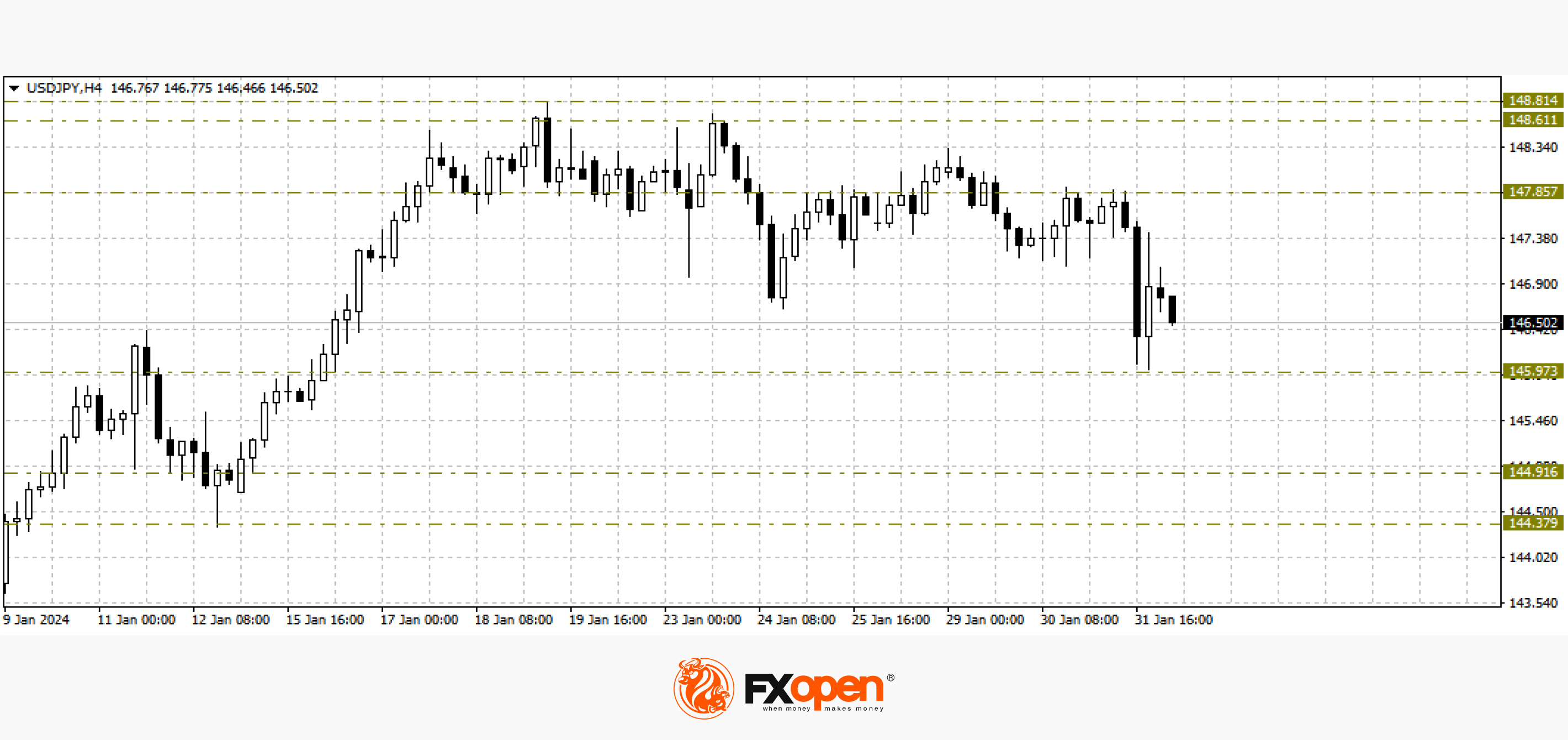

USD/JPY

Dollar sellers in the USD/JPY pair yesterday broke through support at 147.00 and almost tested the important level of 146.00. After Jerome Powell’s press conference, the price on the USD/JPY chart sharply rebounded upward, but has not yet been able to consolidate above 147.40-147.00. If yesterday's low is updated, the pair may decline to 145.00-144.40.

From the fundamental analysis point of view, tomorrow we are waiting for the publication of the employment report in the United States. The number of new jobs, the unemployment rate and the average wage will be published.

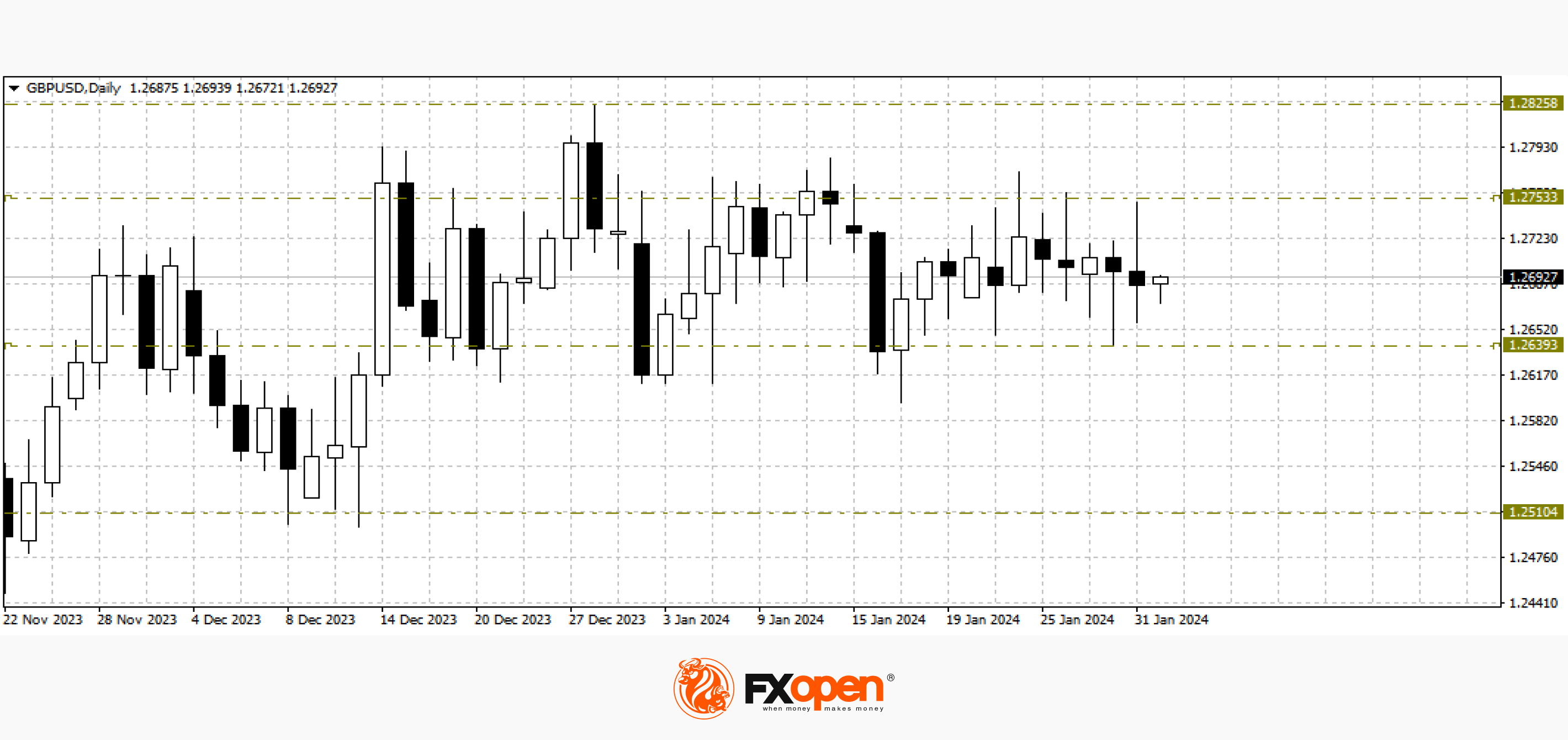

GBP/USD

Despite the rich fundamental background of the current five-day period, the GBP/USD chart shows that the currency pair continues to trade in a narrow range between 1.2750 and 1.2650. Perhaps today's news will help change the volatility of the pair. At 15:00 GMT+3, a meeting of the Bank of England will take place, at which a decision on the base interest rate will be announced. Bank of England Governor Andrew Bailey is scheduled to speak a little later.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.