FXOpen

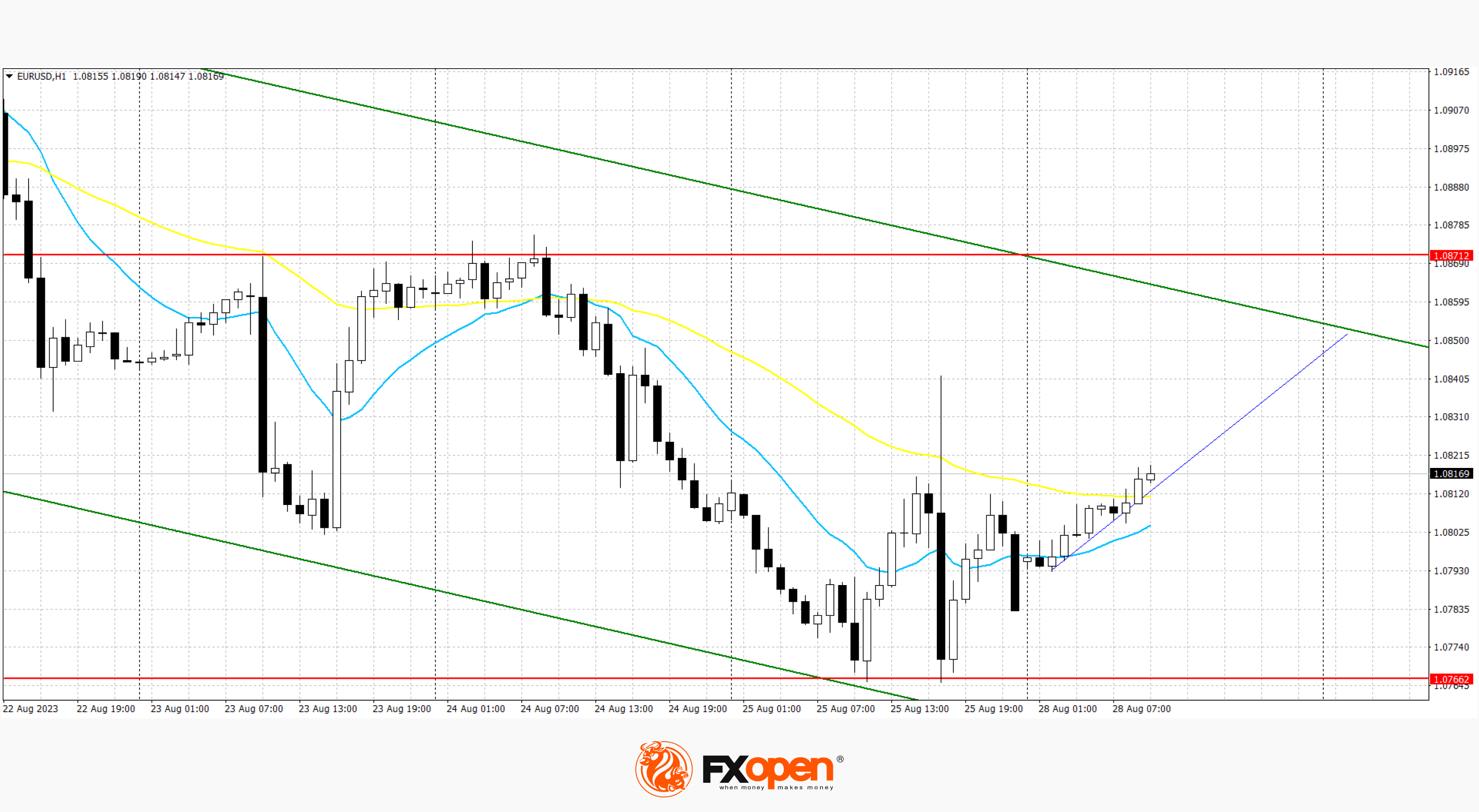

EUR/USD

The EUR/USD pair shows a slight growth, recovering from a moderate decline last week. It's testing the level of 1.0800 for a breakout, waiting for new growth drivers to appear. At the same time, noteworthy macroeconomic publications are not planned today, and only in the middle of the week will investors evaluate inflation statistics in Germany and the eurozone. Forecasts suggest a slowdown in the annual consumer price index in Germany in August from 6.2% to 6.0%, and on a monthly basis, the figure may add 0.3%. In general, analysts expect inflationary pressure to decrease from 5.3% to 5.1% in the eurozone. Compared to the previous month, inflation may demonstrate zero dynamics or a slight decrease by 0.1%. Due to the sharp slowdown in the eurozone economy and the overall decline in business activity, there is a risk that the ECB will delay further tightening of monetary policy, while inflation in the region remains well above the target levels.

Data on business sentiment in Germany from the Institute for Economic Research (IFO), published on Friday, turned out to be worse than expected: the index of business optimism in August corrected from 87.4 points to 85.7 points, while the market was counting on 86.7 points, and the indicator of assessment of the current situation declined from 91.4 points to 89.0 points with expectations of 90.0 points.

The previous downward channel is in place. Now the price is in the middle of it and may continue to rise.

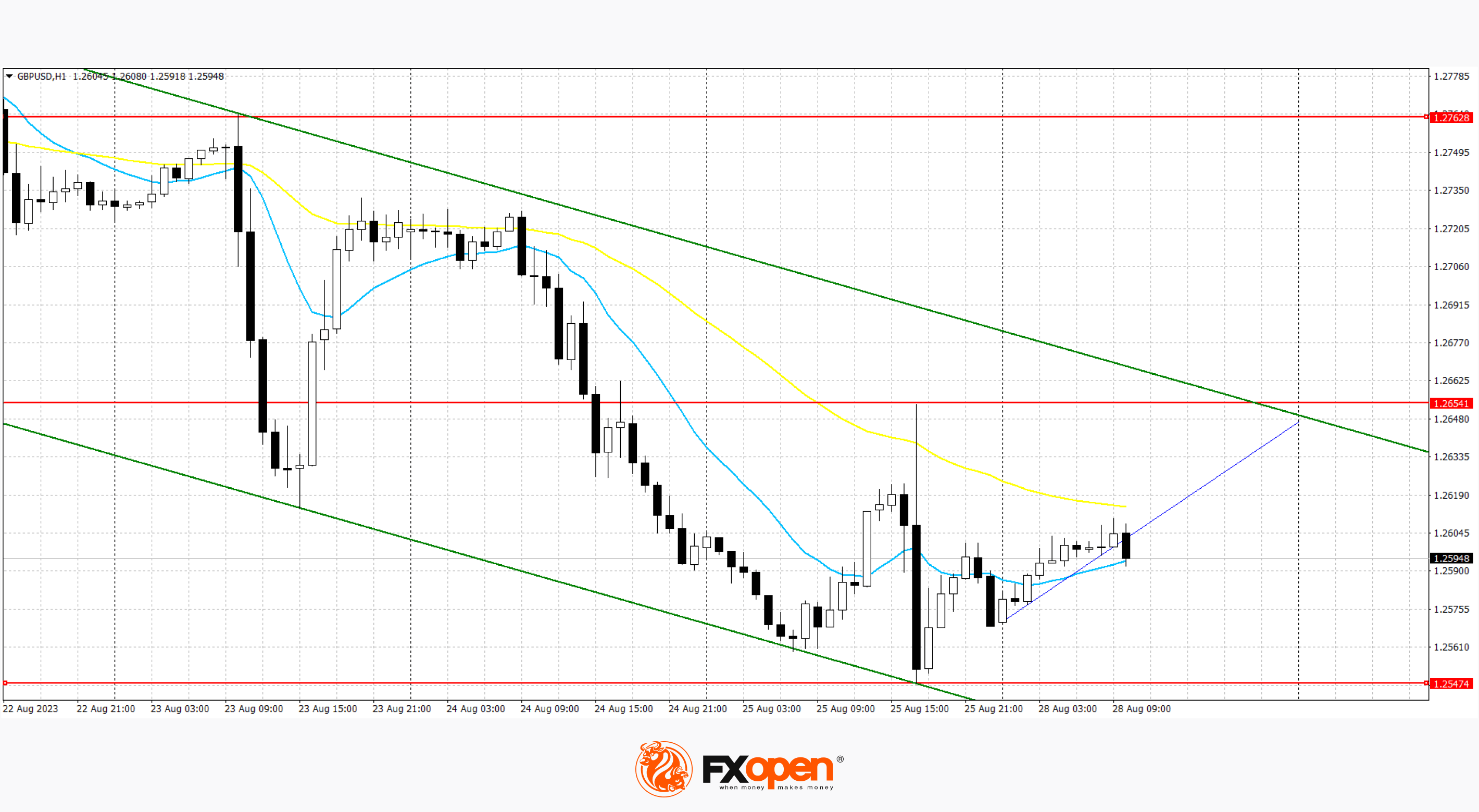

GBP/USD

The GBP/USD pair is slightly rising, getting ready to test the 1.2600 mark for an upside breakout. Positive dynamics are facilitated by technical factors, as investors cover part of short positions, fixing profits. Markets are still analysing the results of the US Federal Reserve Chairman Jerome Powell's speech at the annual economic symposium in Jackson Hole. As expected, the official pointed to the readiness of the regulator to continue raising the interest rate, as well as to keep it at high levels for a long time, which led to a slight increase (from 38.0% to 42.0%) in expectations for the adjustment of the cost of borrowings in November, however, in general, the situation on the market has changed insignificantly. The probability of a renewed decline in the second half of 2024 also slightly increased from 71.0% to 78.0%.

Some support for the pound at the end of last week was provided by macroeconomic publications from the UK. The consumer confidence index from the analytical portal Gfk Group in August rose from -30.0 points to -25.0 points, while analysts expected growth only to -29.0 points. During the week, investors will evaluate the July data on consumer lending in the UK, as well as the speech of Huw Pill, a representative of the Bank of England.

The downward channel is preserved. Now the price has moved away from the lower border of the channel and may continue to grow.

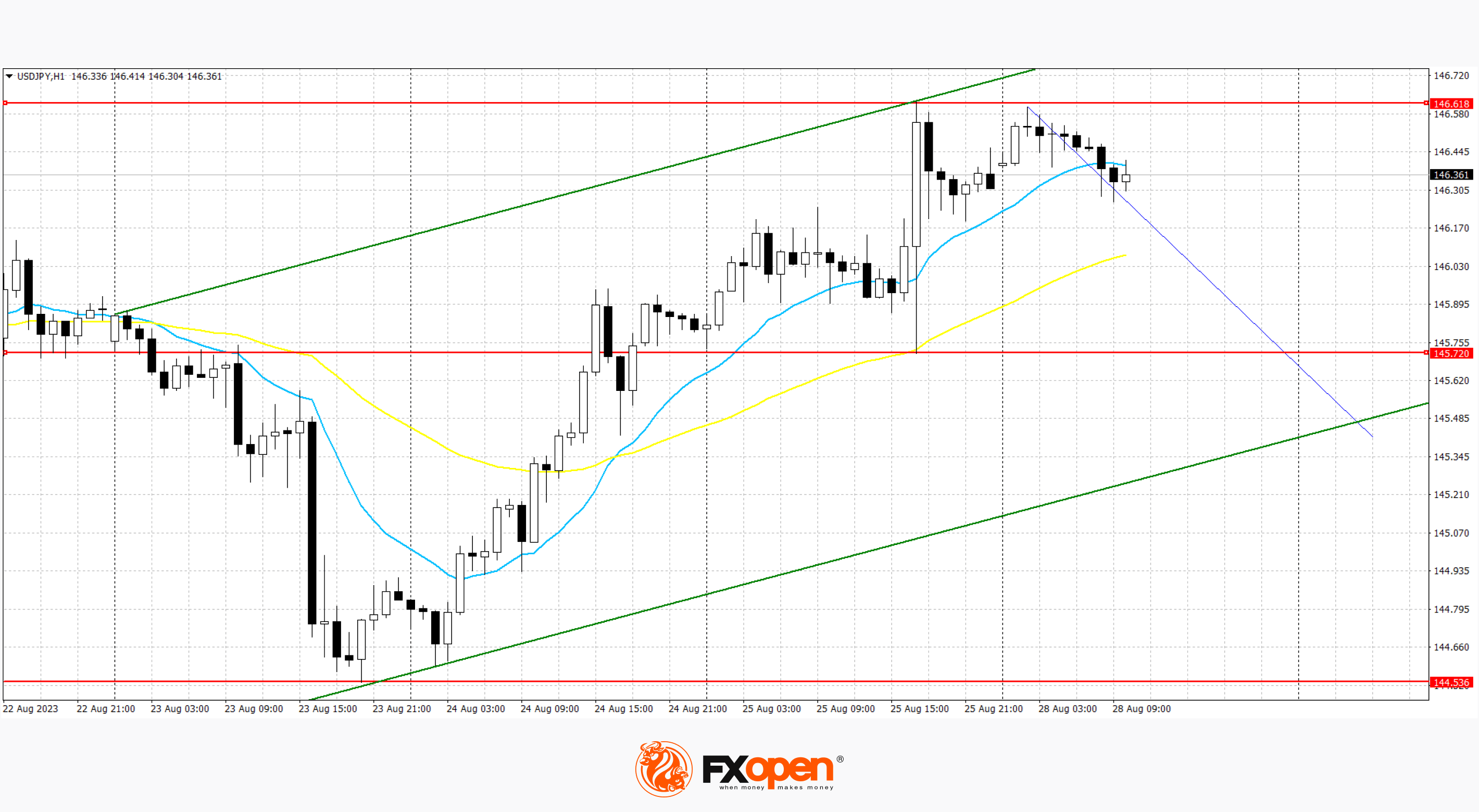

USD/JPY

The USD/JPY pair is showing flat dynamics, consolidating near the 146.40 mark and renewing the record highs of November 2022. At the end of last week, the pair showed fairly active growth, which was the market's reaction to the speech of US Federal Reserve Chairman Jerome Powell at the annual economic symposium in Jackson Hole.

Some pressure on the positions of the yen on Friday was exerted by macroeconomic statistics from Japan. The consumer price index in the Tokyo region in August fell from 3.2% to 2.9%, which was below analysts' forecasts of 3.0%, and the figure excluding fresh food prices fell from 3.0% to 2.8%, while analysts expected 2.9%. Low inflation in the country is one of the reasons for the neutral position of the Bank of Japan. At the moment, only a weak exchange rate of the national currency, which acts as a catalyst for foreign exchange interventions of the department, can affect the monetary policy of the regulator.

At the highs of two days, a new ascending channel has formed. Now the price has moved away from the upper limit and may continue to decline.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.