FXOpen

The dollar strengthened across the board following the publication of the minutes from the latest Federal Reserve meeting. The document confirmed the regulator’s readiness to cut rates further, but without clear timing and with an emphasis on future decisions depending on incoming data. For some market participants, this sounded less “dovish” than expected, prompting increased demand for the dollar, while Treasury yields held near local highs.

Another source of uncertainty remains the impact of the prolonged US government shutdown. Due to the suspension of statistical agencies, some key releases on employment and inflation were not published on schedule, meaning that the upcoming batch of labour-market data may bring surprises. Today, investors are focused on private-sector employment reports, jobless-claims data, and related indicators, which will help shape expectations ahead of the Fed’s next decisions.

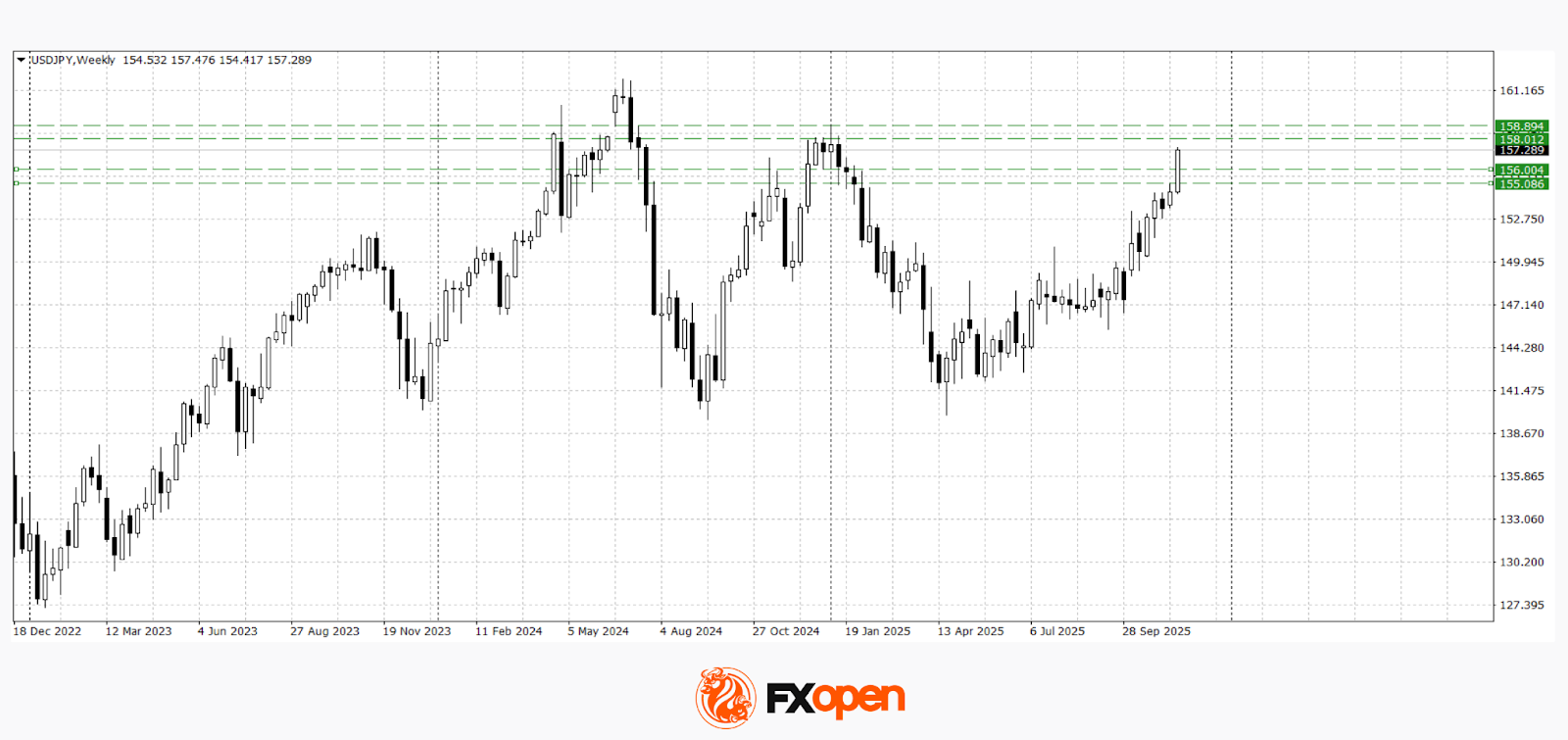

USD/JPY

The USD/JPY pair has reached this year’s extremes, reacting to the monetary-policy differential. The pair is trading above 157.00, reflecting a combination of a more resilient dollar and the Bank of Japan’s persistently dovish stance. The market still does not see the Japanese regulator preparing for tightening, whereas the Fed, despite being in a rate-cutting cycle, maintains a cautious tone and highlights inflation risks.

Technical analysis of USD/JPY suggests a possible test of the key 158.00–158.90 range if the 157.00 level confirms itself as support. Should a downward pullback develop, the pair may decline towards 155.20–156.00.

Events that may influence USD/JPY pricing in the coming trading sessions include:

- today at 16:30 (GMT+3): US average hourly earnings

- today at 16:30 (GMT+3): US non-farm employment change

- today at 16:30 (GMT+3): Philadelphia Fed manufacturing index

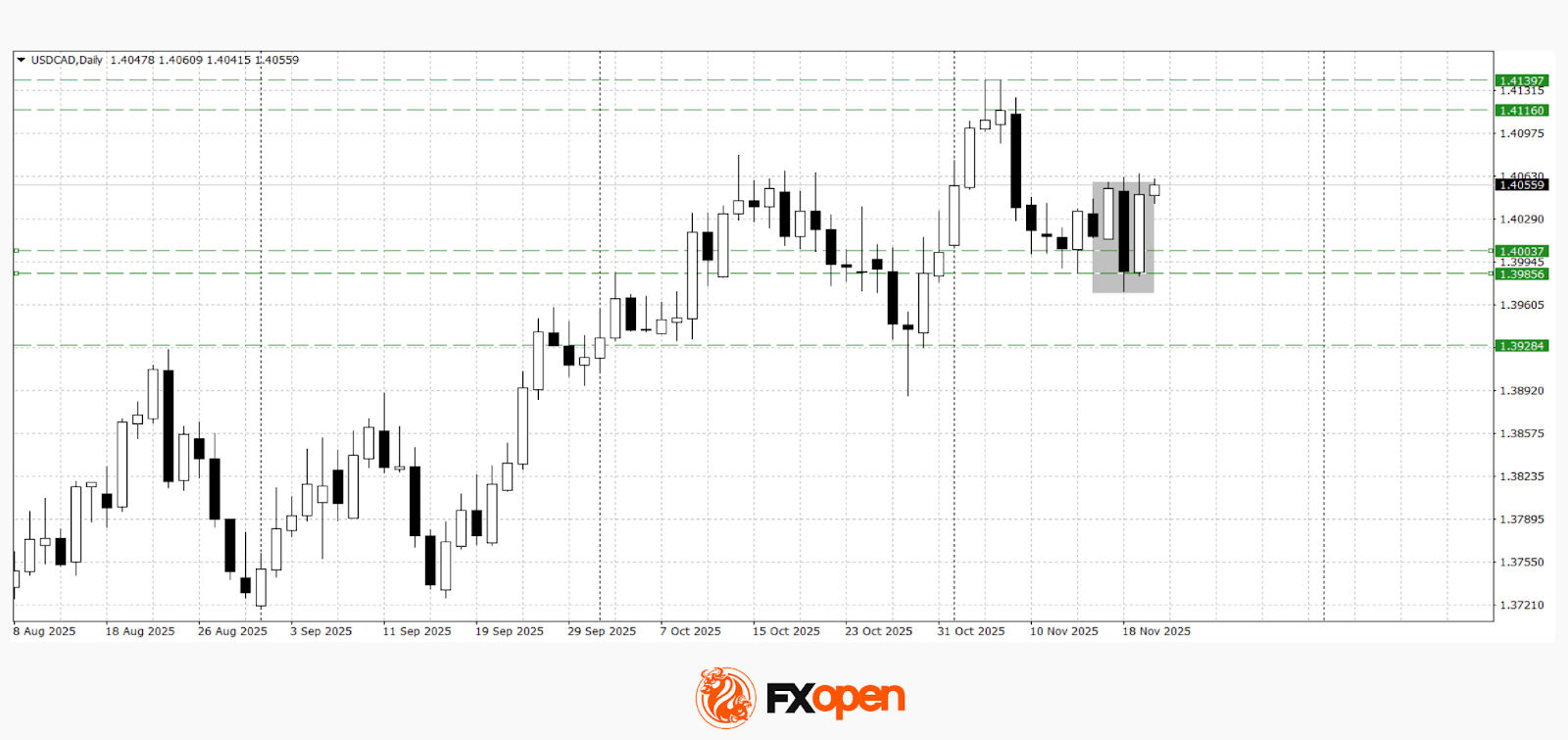

USD/CAD

Sellers of USD/CAD made another attempt yesterday to break support at 1.3980, but were unsuccessful. The price rebounded sharply from this level and held above 1.4000. If the upward momentum continues, the pair may revisit recent highs near 1.4140. A firm move back below 1.4000 could trigger another approach towards 1.3930.

Events that may influence USD/CAD pricing in the coming trading sessions include:

- today at 15:30 (GMT+3): Canada Raw Materials Price Index (RMPI)

- today at 18:00 (GMT+3): US existing home sales

- tomorrow at 16:30 (GMT+3): Canada core retail sales index

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.