FXOpen

Yesterday was a dark day for Europe and the world. Russia invaded its neighbor, Ukraine, starting a war that diplomats had been trying to avoid by all means in the past months.

Diplomacy failed, and arms are going off all over Ukraine. The attack is a full-scale invasion, with all parts of the country under military pressure.

So big was the shock that financial markets reacted immediately. The tensions had been building up in the past weeks, but there was hope that reason would prevail.

However, during the early hours of February 24, Russia attacked. Investors panic-bought safe-haven currencies, such as the Japanese yen and the Swiss franc, as well as the US dollar, the world’s reserve currency.

Moreover, the common currency, the euro, was sold across the board. After all, this is a conflict in the Eastern Europe that will permanently change the geopolitical relations on the continent.

Furthermore, the contagion quickly spread to US futures. The S&P 500 index, for instance, opened more than 2% into negative territory, albeit it recovered all the losses by the end of the trading day, and then some more.

What was the reason for the sharp recovery in risk assets? The answer comes from the sanctions imposed on Russia both by Europe and the States.

Western Allies Sanctions Exclude Energy Products

The US President Joe Biden addressed the nation and made it clear that the US would not intervene in the conflict. Nor would NATO.

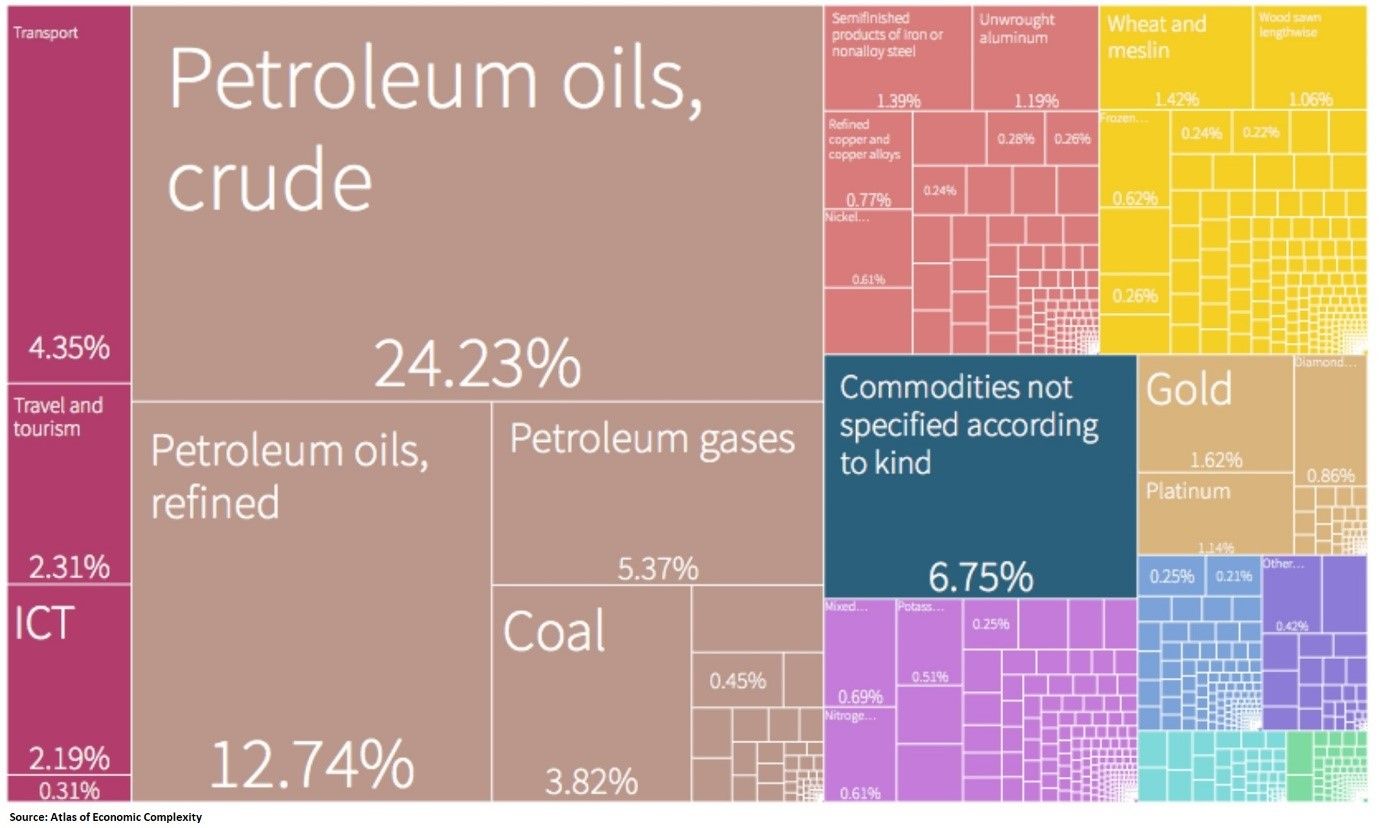

As such, the only way to deal with Russia is through sanctions. But the revealed sanctions exclude the most important part of Russian exports: the energy sector.

More than 40% of Russian exports are petroleum oils, crude or refined, gas, and coal. Speaking of oil, the WTI crude oil price traded above $100 for the first time in 8 years, putting further pressure on central banks to raise rates to fight inflation.

However, raising rates in this environment might affect economic growth. As such, central banks appear to be trapped at the moment.

Gold bounced too against the backdrop of war reports before giving up the gains as the US stock market rebounded. But if the West can only deliver swift sanctions, further escalation in the conflict may spur another attempt at the 2020 highs.

All in all, the war in Ukraine is a game-changer for geopolitics on the old continent, as well as for the fundamental picture. Expect increased volatility in the days and weeks ahead.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.