FXOpen

The 2020s is an exciting time to be trading the global markets.

In the previous decade, the electronic markets went through a revolutionary period. We witnessed the invention and uprising of cryptocurrencies, the 'influencer' generation beginning to move into the financial markets with memes and internet-based trends, and we saw the entire existing framework change in dramatic restructures in the trading methods of financial products traded on the electronic markets in the wake of the 2008/2009 financial crises.

European and American authorities began to make major changes which have fomented the sustainability of the electronic derivatives trading markets where traditional asset classes such as Forex, commodities and equities are concerned, and a whole host of decentralized asset classes have joined them along the way.

As the last exciting decade of revolutionary technological and regulatory development came to an end, the 2020s became a period of limitless innovation, in which FinTech, cryptocurrency and multi-asset trading has been embraced.

Along with the community-driven cryptocurrency revolution and its entry into the mainstream, came various geopolitical milestones that are unprecedented.

Lockdowns, inflation and a volatile commodities market, as well as a myriad of new traders who had switched their ambitions from working for a company prior to the lockdowns to seeking their own financial independence from the convenience of their own laptop or smartphone by trading the markets. We have entered the age of the analytical, pragmatic and goal-orientated trader.

Despite the cryptocurrency revolution and the massive number of people getting involved in investing in Bitcoin, Ethereum and all manner of new native tokens that are now hot property, the commodities market is the hot topic of the decade, and to be more specific: Oil.

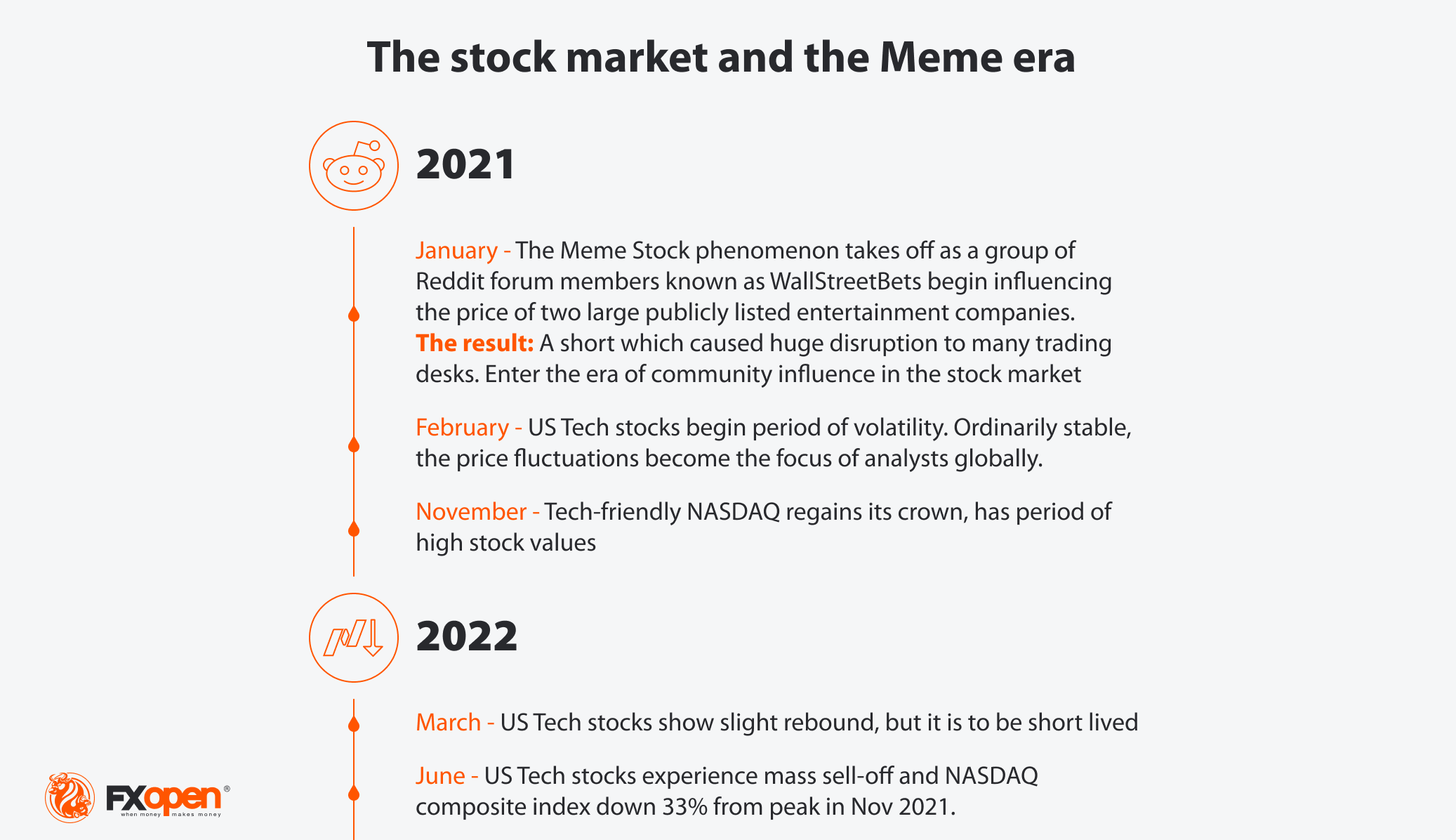

Just as the oil market is as traditional as the actual fossil fuel itself, the modern stock market is the absolute opposite! A new era has come about, born out of the minds of mavericks and entrepreneurs seeking to build a community-driven marketplace where influencers are beginning to become market makers in their own right.

The ever-changing and ever increasingly innovative markets are at your fingertips. These are the times when your financial destiny is in your hands. Open an account with FXOpen today.

Cryptocurrency CFDs are not available to Retail clients in the UK.

Buy and sell stocks of the world's biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

Start trading commodity CFDs with tight spreads. Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.