FXOpen

The FX market came to a halt in the last couple of trading days. Traders and investors await one of the most important Fed decisions in recent history, scheduled later today in the North American session.

Inflation is running out of control in the United States. It reached a four-decade high recently, and it is way above the Federal Reserve’s target.

Therefore, the Fed must (and will) act. It had done so already.

Prior to the previous decision six weeks ago, the central bank ended the quantitative easing program before lifting the federal funds rate by 25 basis points. But when inflation runs at much higher levels, a mere 25 basis points hike is not enough.

A central bank’s task is to anchor inflation expectations. Because the inflation rate is much higher than the federal funds rate, households and businesses keep expecting higher inflation in the future. As such, the Fed must act to anchor these expectations.

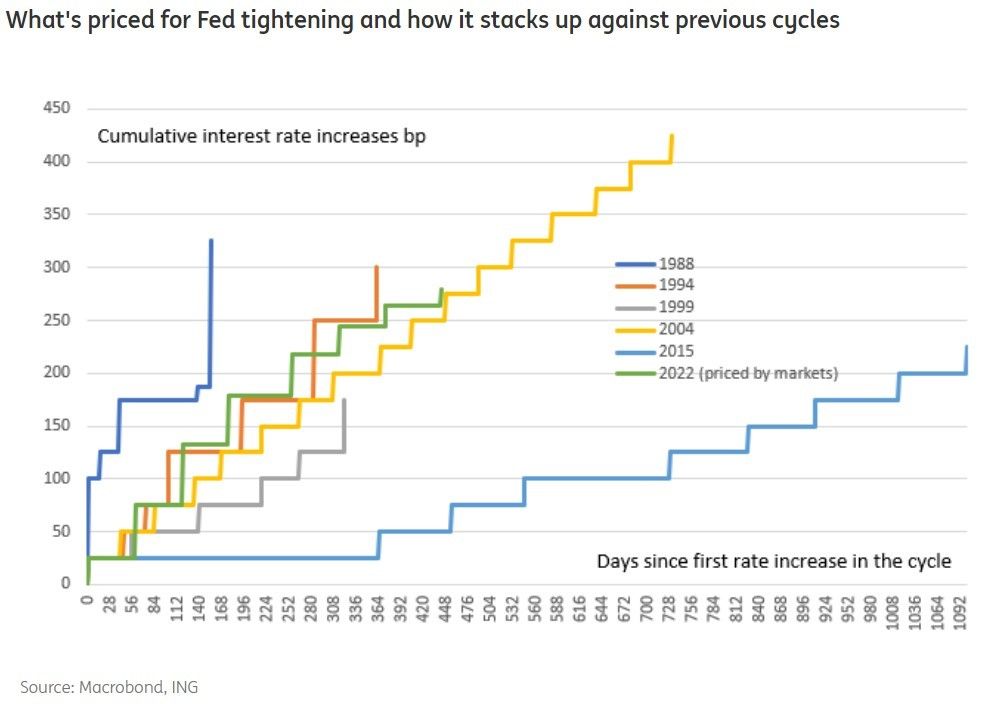

To be sure there is no room for misunderstanding, the Fed members used a hawkish tone in the weeks that passed since the previous meeting. As such, the market has now priced in several rate hikes.

Fed to Announce Quantitative Tightening

One good question ahead of the Fed’s decision scheduled for later today refers to the US dollar’s strength. Why is the dollar still strong if the market has already priced in so many rate hikes?

It holds close to its 2022 highs, with no significant pullbacks.

The explanation comes from quantitative tightening. Like all other major central banks, the Fed embarked on quantitative easing during the last couple of recessions. It bought bonds and the balance sheet reached trillions and trillions of dollars.

But now, the Fed plans to reverse that. To do so, it will sell bonds to the market, and so, instead of quantitative easing, the Fed will do quantitative tightening.

The problem with quantitative tightening is that no one knows what follows next. The last time when the Fed tried to shrink the balance sheet was during Janet Yellen’s mandate.

Unfortunately, the Fed was forced to reverse its decision as a new crisis unfolded. As such, the market does not know the effect of quantitative tightening, so the US dollar remains strong even though so many hikes are already priced in.

All in all, expect wild price action surrounding the Fed’s decision and press conference. If that is one event to monitor this week, it is today’s Fed presser.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.