FXOpen

Tesla (TSLA) is one of the most closely watched growth stocks in the market. Analysts predict the stock could trade between $330 and $600 by the end of 2026, driven by its electric vehicle leadership and AI ambitions. Investors looking for a Tesla stock forecast for 2026–2030 are trying to assess whether the company’s AI ambitions and EV leadership can sustain long-term share price growth. While Tesla’s share price has experienced significant volatility, the company’s investments in artificial intelligence, autonomous driving, and energy storage continue to shape its long-term growth narrative.

In this article, we break down analysts’ Tesla price forecasts for 2026 to 2030, discuss key factors that are expected to influence the TSLA stock price direction, and go through the stock price history.

Forecast Summary

2026

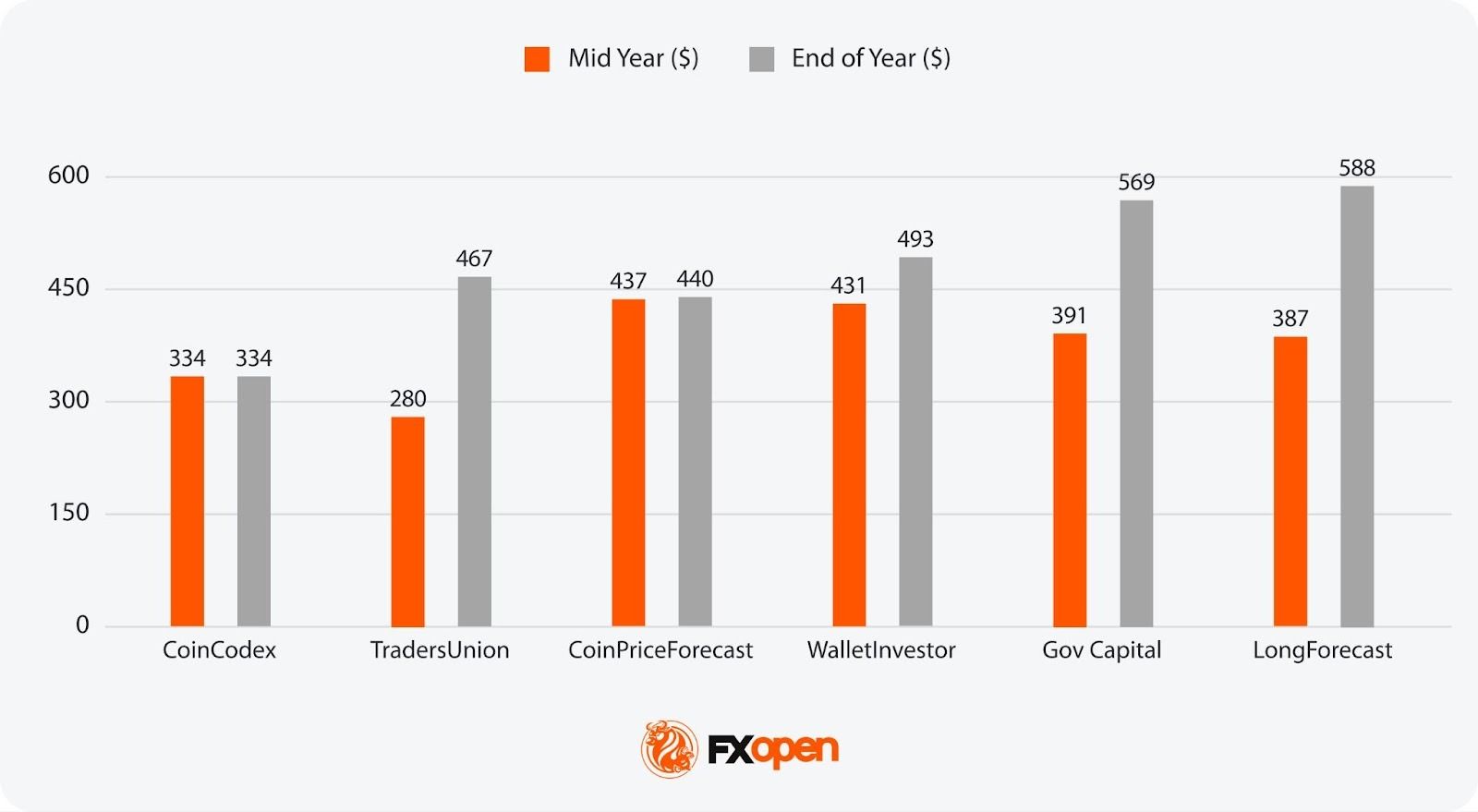

Algorithmic forecasting sources project TSLA between $334 and $588 by year-end, a wide range reflecting deep disagreement over Tesla's near-term trajectory. Wall Street analyst targets cluster between $400 and $600, with the Robotaxi rollout timeline, Cybercab production ramp, and FSD monetisation expected to be the dominant price drivers.

2027

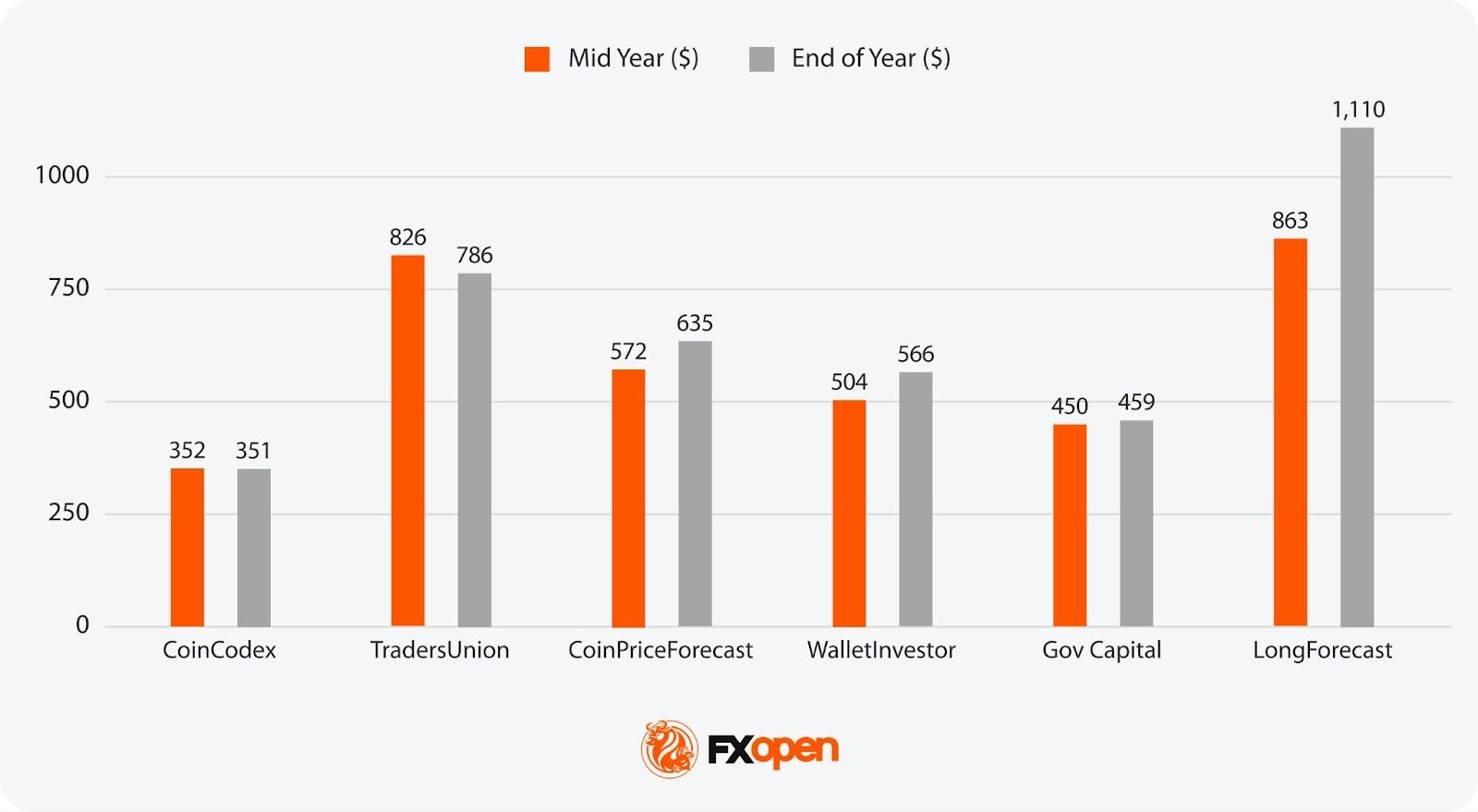

Predictions range from $351 to $1,110. Sources at the bullish end assume Tesla successfully scales autonomous ride-hailing across multiple US cities, while bearish models reflect concerns over EV margin compression and intensifying competition from BYD and other Chinese manufacturers.

2028

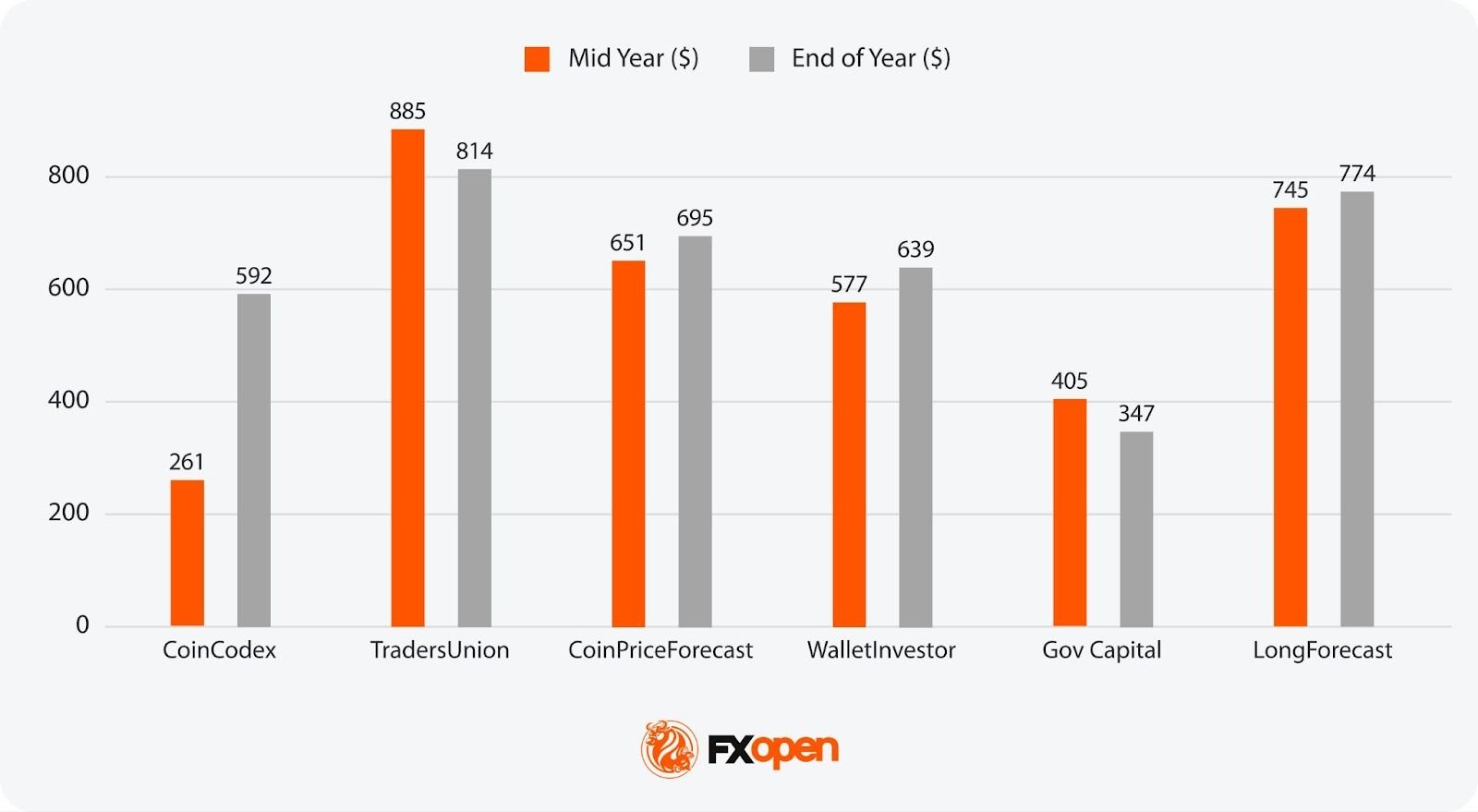

Estimates span $347 to $814. The spread reflects uncertainty over whether Robotaxi and Optimus revenue can meaningfully offset a maturing core EV business, and whether Tesla can maintain pricing power as the global EV market becomes increasingly commoditised.

2029

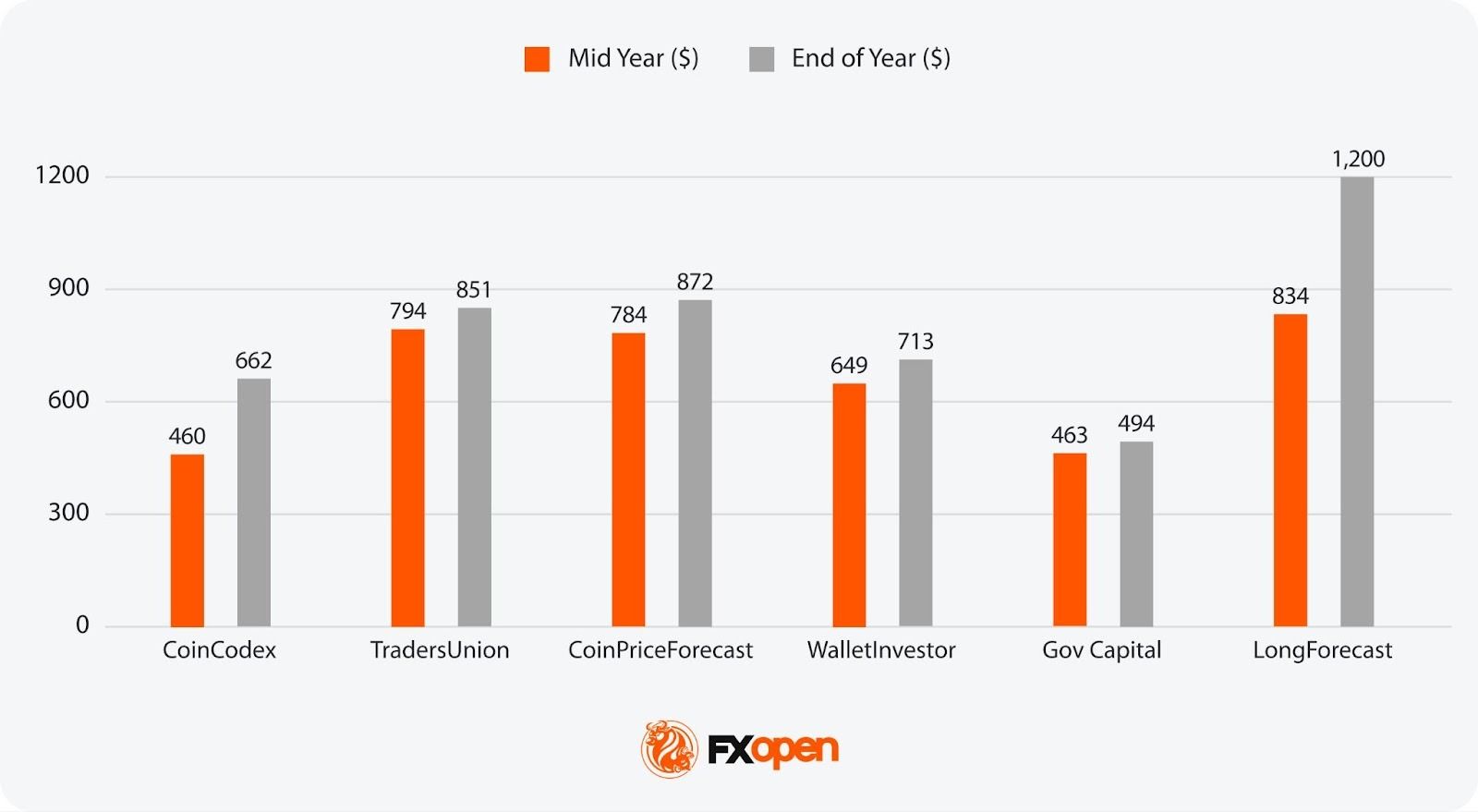

Most projections fall between $494 and $1,200. Sources note that execution on Optimus commercialisation and international Robotaxi expansion could drive significant re-rating, while regulatory setbacks or autonomous safety incidents remain key downside risks.

2030

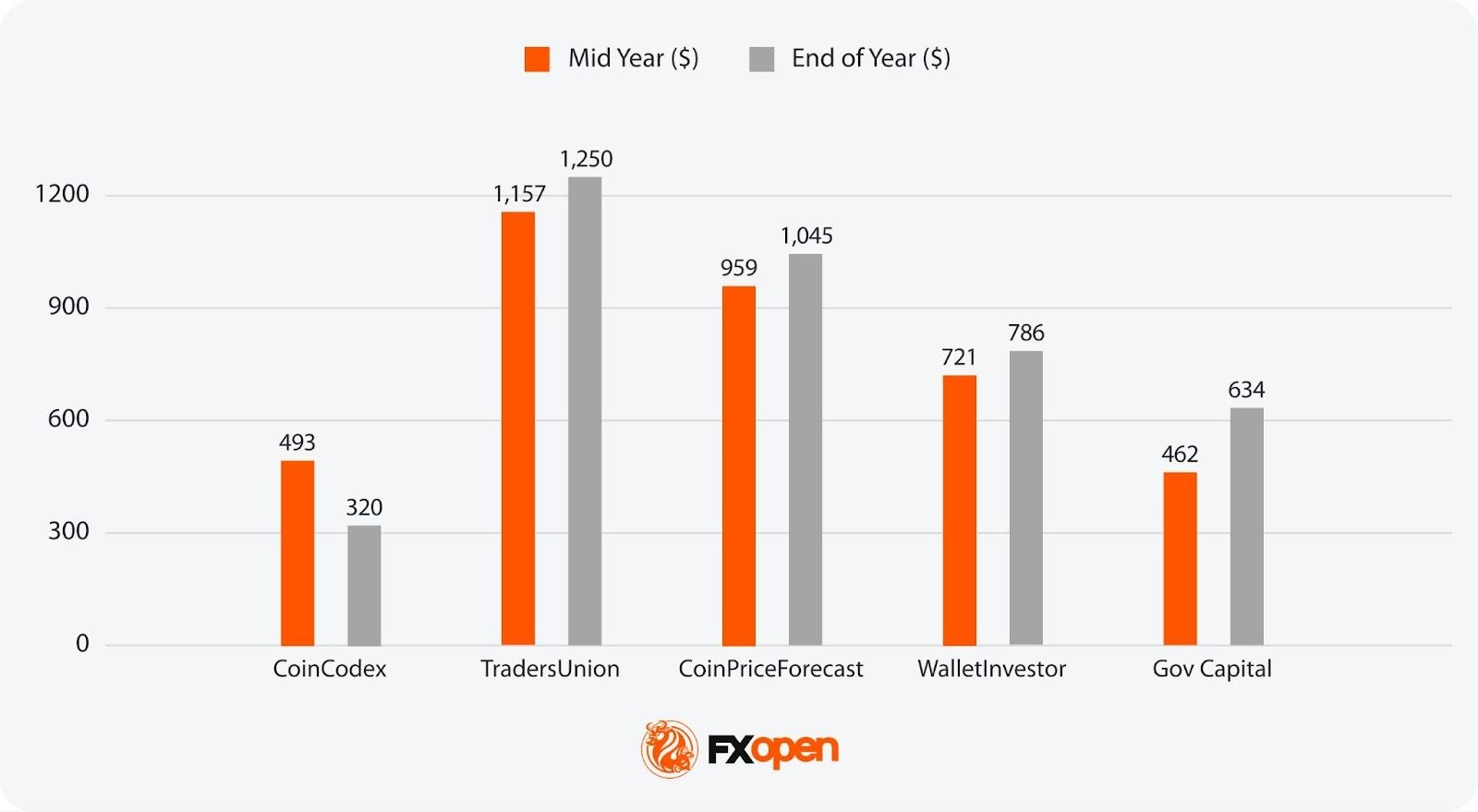

Long-range forecasts suggest $320 to $1,250, with the spread underscoring how speculative five-year projections for Tesla remain. Outcomes hinge largely on whether autonomy and robotics deliver the transformative revenue streams that currently underpin much of the stock's premium valuation.

What Factors Could Impact Tesla’s Stock Price in 2026-2030 and Beyond?

Looking ahead to 2026 and beyond, Tesla's future stock price is expected to be shaped by significant technological advancements, market expansions, and strategic initiatives. Analysts present a diverse range of forecasts, reflecting both optimistic and cautious perspectives on Tesla's future.

Technological Advancements

Tesla's ongoing development of Full Self-Driving (FSD) technology is a critical factor in its long-term outlook. By 2026, Tesla aims to fully integrate autonomous driving capabilities, potentially revolutionising the transportation industry. The success of FSD could open new revenue streams through autonomous ride-hailing services, with ARK Invest projecting a substantial market for these services.

Production and Market Expansion

Tesla plans to ramp up production capabilities significantly, aiming to produce millions of vehicles annually by the end of the decade. The company is expected to leverage its Gigafactories in Berlin, Shanghai, and Texas to meet global demand. Expansion into new markets, particularly in Asia and Europe, will be crucial for sustaining growth. Analysts believe Tesla's ability to efficiently scale production while maintaining quality will be a major determinant of its success.

Energy Solutions

Beyond automotive, Tesla's energy division, including solar and energy storage products, is poised for substantial growth. The demand for renewable energy solutions is expected to surge, and Tesla's innovations in battery technology and energy storage systems could capture a significant share of this market.

Financial Performance

Analysts predict a wide range of outcomes for Tesla's financial performance. Revenue growth is expected to be driven by increased vehicle deliveries, higher adoption of FSD, and expanding energy solutions.

Challenges and Risks

Tesla faces several potential challenges, including increased competition from other electric vehicle manufacturers and traditional automakers entering the EV market. Regulatory changes, supply chain constraints, and economic fluctuations could also impact Tesla's growth trajectory. Despite these risks, many analysts remain optimistic about Tesla's ability to navigate these challenges and continue its upward momentum.

Analytical Tesla Stock Price Forecasts for 2026 to 2030 and Beyond

Check the long-term analytical price projections for the TSLA stock price.

Wedbush Securities analyst Dan Ives maintains a Street-high $600 price target with an Outperform rating, projecting Tesla could reach a $2 trillion market cap in 2026 and up to $3 trillion in a bull case. Ives expects an accelerated Robotaxi rollout across more than 30 US cities this year. "We are raising our price target on Tesla to $600, reflecting our view that an accelerated AI autonomous path is now on the horizon in 2026 and investors are underestimating the major transformation underway," Ives wrote. "We believe this will be the biggest growth chapter in Tesla's history."

Morgan Stanley expects Tesla to deploy around 1,000 Robotaxis by end-2026, with a path toward one million by 2035. Analyst Adam Jonas declared in October 2025 that "autonomous cars are solved," comparing the moment to the invention of the steam engine and noting that Tesla's camera-only system would "seriously challenge the conventional thinking of many in the robotaxi community." The firm places Tesla's broader product suite, including Tesla's Full Self-Driving (FSD), charging, and licensing, at almost $160 per share. As of the TSLA stock price, Morgan Stanley believes that it may reach $415.

Goldman Sachs analyst Mark Delaney lowered its target to $405 from $420 following Q4 2025 earnings, maintaining a Neutral rating. Delaney flagged Tesla's plan to increase capital expenditure to over $20 billion in 2026, partly to fund AI training infrastructure, writing: "We now expect negative overall free cash flow this year for Tesla."

Stifel reiterated its Buy rating on Tesla with a $508 price target following Q4 2025 results, noting that revenue, gross profit, and operating income all exceeded estimations. The firm highlighted Tesla's progress expanding its Robotaxi service in Austin and the Bay Area and plans to cover seven additional metro areas in H1 2026, alongside ongoing improvements in AI capabilities supporting FSD. Stifel also flagged Tesla's shift to a monthly FSD subscription model and expects Optimus 3 supply chain development with production beginning by the end of 2026.

TD Cowen lifted their target to $519 from $509 after Q4 2025 results, retaining a Buy rating. The firm pointed to better-than-expected margins and encouraging Robotaxi developments, estimating that Tesla's Cybercab could achieve operating costs of around $0.30 per mile - low enough to unlock growth in rideshare markets where penetration remains limited. The company flagged several near-term catalysts, including the start of Cybercab production, Robotaxi geographic expansion, continued FSD improvements, and progress on Optimus V3.

Tesla Stock Price Predictions for 2026

Mid-Year 2026:

- Most Bullish Projection: $437 (CoinPriceForecast)

- Most Bearish Projection: $280 (TradersUnion)

End-of-Year 2026:

- Most Bullish Projection: $588 (LongForecast)

- Most Bearish Projection: $334 (CoinCodex)

Tesla Stock Price Predictions for 2027

Mid-Year 2027:

- Most Bullish Projection: $863 (LongForecast)

- Most Bearish Projection: $352 (CoinCodex)

End-of-Year 2027:

- Most Bullish Projection: $1,110 (LongForecast)

- Most Bearish Projection: $351 (CoinCodex)

Tesla Stock Price Predictions for 2028

Mid-Year 2028:

- Most Bullish Projection: $885 (TradersUnion)

- Most Bearish Projection: $261 (CoinCodex)

End-of-Year 2028:

- Most Bullish Projection: $814 (TradersUnion)

- Most Bearish Projection: $347 (Gov Capital)

Tesla Stock Price Predictions for 2029

Mid-Year 2029:

- Most Bullish Projection: $834 (LongForecast)

- Most Bearish Projection: $460 (CoinCodex)

End-of-Year 2029:

- Most Bullish Projection: $1,200 (LongForecast)

- Most Bearish Projection: $494 (Gov Capital)

Tesla Stock Price Predictions for 2030

Mid-Year 2030:

- Most Bullish Projection: $1,157 (TradersUnion)

- Most Bearish Projection: $462 (Gov Capital)

End-of-Year 2030:

- Most Bullish Projection: $1,250 (TradersUnion)

- Most Bearish Projection: $320 (CoinCodex)

Tesla Stock Price Prediction Beyond 2030

While long-term forecasts for Tesla’s stock beyond 2030 are uncommon, several sources provide projections. By 2035, CoinPriceForecast estimates Tesla's share price could reach $1,354, while TradersUnion projects $1,131. Looking further ahead to 2040, TradersUnion projects $3,935.

Tesla: How It Started

Tesla was established in 2003 by engineers Martin Eberhard and Marc Tarpenning, driven by a vision to develop electric vehicles that could compete with conventional internal combustion cars in both performance and design. Shortly thereafter, Elon Musk joined the company, assuming the role of CEO and spearheading critical investment rounds that played a pivotal role in defining Tesla’s long-term strategic direction.

Tesla’s first car, the Roadster, launched in 2008 and set the stage for what the brand would become—an innovator in high-performance electric vehicles. The Roadster could travel over 200 miles on a single charge, shattering public scepticism about EV capabilities and proving that electric cars could be fast, efficient, and practical.

This early success positioned Tesla as a serious player in the automotive industry. As the company continued to innovate, Tesla’s mission evolved: to accelerate the world’s transition to sustainable energy, a goal that would define its trajectory in the years to come.

Tesla’s Recent Price History

Tesla's journey in the stock market has been marked by significant milestones and periods of volatility. Since its initial public offering (IPO) in June 2010, when it debuted at $17 per share, Tesla has seen dramatic price changes driven by key events and developments.

If you want to follow TSLA CFD price movements, consider heading over to the TickTrader trading platform.

2010-2012

Tesla's early years as a public company were challenging. After its IPO, the stock price fluctuated but remained relatively low. A pivotal moment came in 2012 with the launch of the Model S, Tesla's first mass-market electric vehicle (EV), which boosted investor confidence and put TSLA at a high of $2.66 in March 2012.

2013

This year marked a turning point as Tesla reported its first profitable quarter. The stock price soared from $2.33 at the start of 2013 to over $10 by the end of the year, reflecting increased market confidence and investor enthusiasm.

2014-2016

Tesla continued to innovate and expand. The announcement of the Gigafactory in Nevada in February 2014 aimed to scale up battery production, boosting TSLA’s price further. It closed 2014 at $14.83. In 2016, the introduction of the Model 3 and the acquisition of SolarCity were significant milestones. However, the stock faced volatility due to high capital expenditures and production challenges, reaching a low of $9.40 in February 2016 before closing the year at $14.25.

2017-2019

The release of the Model 3 in 2017 was a turning point, making EVs vastly more accessible to the general public. Despite production bottlenecks, the stock price reached new heights, peaking at $25.97 in mid-2017. The unveiling of the Cybertruck in 2019 and the ramp-up of production in the Shanghai Gigafactory kickstarted significant bullish momentum, with TSLA ending 2019 at $27.89.

2020-2024

Tesla's stock experienced explosive growth in 2020. While the onset of the COVID-19 pandemic prompted a brief downturn, Tesla quickly became one of 2020/2021’s biggest success stories. It closed 2020 and 2021 at $232.22 and $352.26, respectively. This surge was fueled by four consecutive profitable quarters (the middle of 2020), the S&P 500 index inclusion (December 2020), and increasing global demand for EVs.

However, a generally restrictive economic environment led Tesla to experience its most notable slump to date. As US interest rates began to rise in March 2022, sales of EVs began to decline while competition in the market increased—particularly in China, one of its key markets. Elon Musk’s acquisition of Twitter also raised concerns about potential distractions and conflicts of interest. TSLA opened 2022 at $382.58 and closed the year at $123.18.

Stocks began to rebound in 2023, and Tesla was a prime beneficiary. After cutting prices, increasing production, and working to improve profitability, sentiment around TSLA began to rise again, with the stock rising to a high of $299.29 in July 2023.

Since then, TSLA has seen volatility. After beginning 2024 at $250.08 and trending downward for the first half of the year—factors including a slowing adoption rate of EVs, declining Tesla sales, competition from Chinese rivals like BYD, and general economic uncertainty—TSLA has since recovered to break its 2023 high.

Confidence has bounced back, with developments in full self-driving (FSD) capabilities and the unveiling of FSD-enabled Robotaxis in October 2024 helping drive the stock higher. Following the US presidential election, Tesla surged amid speculation that Elon Musk’s strong relationship with Donald Trump could benefit the company. As a result, by the end of the year, on 17th December 2024, Tesla reached its all-time high of $479.86.

2025-2026

After an all-time high the price needed to correct, and despite the S&P 500 index continuing to rise, TSLA moved down. By March 2025, the price had dropped below $250, and it wasn't just the price correction that sent the stock down. One of the main reasons was weak global sales. Another major factor that initially drove TSLA’s price higher but then had a negative impact on it was concerns about Elon Musk’s close ties to Donald Trump. A leading position in the US Department of Government Efficiency (DOGE) raised doubts about whether this could shift Musk’s focus from Tesla. Another potential reason for TSLA stock depreciation was Musk’s controversial political activities, which could significantly reduce the number of Tesla customers.

Between late April and early September 2025, Tesla’s stock demonstrated notable resilience and volatility. Following a dip in April as global EV sales slowed and Chinese demand softened, TSLA rebounded in May amid optimism over its upcoming robotaxi initiative.

A significant factor driving the turbulence was the public feud between Elon Musk and President Donald Trump. Their conflict ignited following Musk’s criticism of Trump’s “Big Beautiful Bill,” which proposed eliminating EV tax credits, triggering a sharp ~14% one‑day drop in TSLA shares in early June—the stock losing over $150 billion in market capitalisation in mere hours.

In July, market sentiment remained fragile as Musk’s announcement of the “America Party” raised concerns about distraction from Tesla’s core business.

Tesla’s Q2 2025 earnings report on 23 July showed weaker margins and slowing profit growth, leading to another sell-off despite positive news about the first builds of a lower-cost vehicle. In early August, the board’s approval of a $29 billion stock-based compensation package for Musk added volatility, as investors debated dilution risks and governance issues.

Between September and mid-October 2025, Tesla’s stock rose sharply as investor sentiment turned positive. Elon Musk’s $1 billion share purchase in mid-September acted as a strong confidence signal, boosting demand for TSLA. The company also reported better-than-expected Q3 deliveries, though analysts warned that some sales were pulled forward ahead of expiring US tax credits.

Optimism increased further after Tesla gained new approvals to expand autonomous-vehicle testing in Arizona and Nevada, reinforcing its position in the “physical AI” space. But the third-quarter earnings report exposed weaknesses in the company, which, as it evolves into a hybrid automaker and artificial intelligence company, faces the growing pains of trying to juggle both.

TSLA surged to an all-time high of $498.83 on 22 December 2025, fuelled by Robotaxi testing milestones in Austin, including the first rides without a safety driver, and Elon Musk's $1 billion personal share purchase in September. However, the stock has since pulled back, trading around $417 in mid-February 2026 amid weaker Q4 2025 deliveries (down ~16% year-on-year), escalating US-EU trade tensions, and growing investor scrutiny over whether Tesla's ambitious AI and autonomy spending can deliver near-term returns.

The Bottom Line

Tesla’s long-term trajectory to 2030 will largely depend on its ability to sustain technological leadership, scale production efficiently, and navigate evolving macroeconomic conditions. While short-term volatility remains inherent in high-growth equities, Tesla’s strategic position in electric vehicles, AI-driven automation, and energy storage provides a solid foundation for continued development. Maintaining an objective outlook and regularly reassessing valuation metrics against operational performance is important in evaluating Tesla’s progress throughout its next growth cycle.

If you are interested in trading Tesla stock and other financial assets via CFDs, you may consider opening an FXOpen account and gain access to tight spreads and low commissions (additional fees may apply).

FAQ

Will Tesla Stock Go Up in 2026?

Analytical Tesla stock forecasts in 2026 are divided. Most Wall Street analysts hold targets above the current price of ~$417, with a consensus around $400–$500. However, declining deliveries, negative free cash flow from heavy AI spending, and rising EV competition mean gains are far from guaranteed.

What Is the 12-Month Forecast for Tesla Stock?

Forecasts for TSLA over the next 12 months range from around $334 to $588. This wide spread reflects deep disagreement over whether Tesla's Robotaxi and FSD initiatives can offset slowing growth in its core automotive business.

How Much Will Tesla Stock Be in 5 Years?

Analytical Tesla price targets in 5 years range from $320 to $1,250 by 2030. The outcome depends heavily on whether Tesla can commercialise its autonomy and robotics programmes at scale, and maintain market share against intensifying global EV competition.

How Much Will Tesla Stock Be Worth in 10 Years?

CoinPriceForecast projects Tesla could exceed $1,350 by 2035, while TradersUnion predicts around $1,100 over the same period. These long-range outlooks factor in Robotaxi scaling, Optimus production, and energy division growth, though predictions this far out are inherently speculative.

Can Tesla Stock Reach $1,000?

Several algorithmic sources project TSLA crossing $1,000 between 2027 and 2030. However, reaching this level requires successful execution on autonomy, robotics, and sustained investor confidence in Tesla's premium valuation.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.