FXOpen

In the world of technical analysis, candlestick patterns play a vital role in helping traders decipher market trends and potential reversals. Among the many setups, the hanging man holds particular significance. This distinctive formation captures traders' attention as it often serves as a warning sign of a possible trend reversal. This article will go through the technical analysis of hanging man and explain how traders can trade with it.

What Is a Hanging Man Pattern?

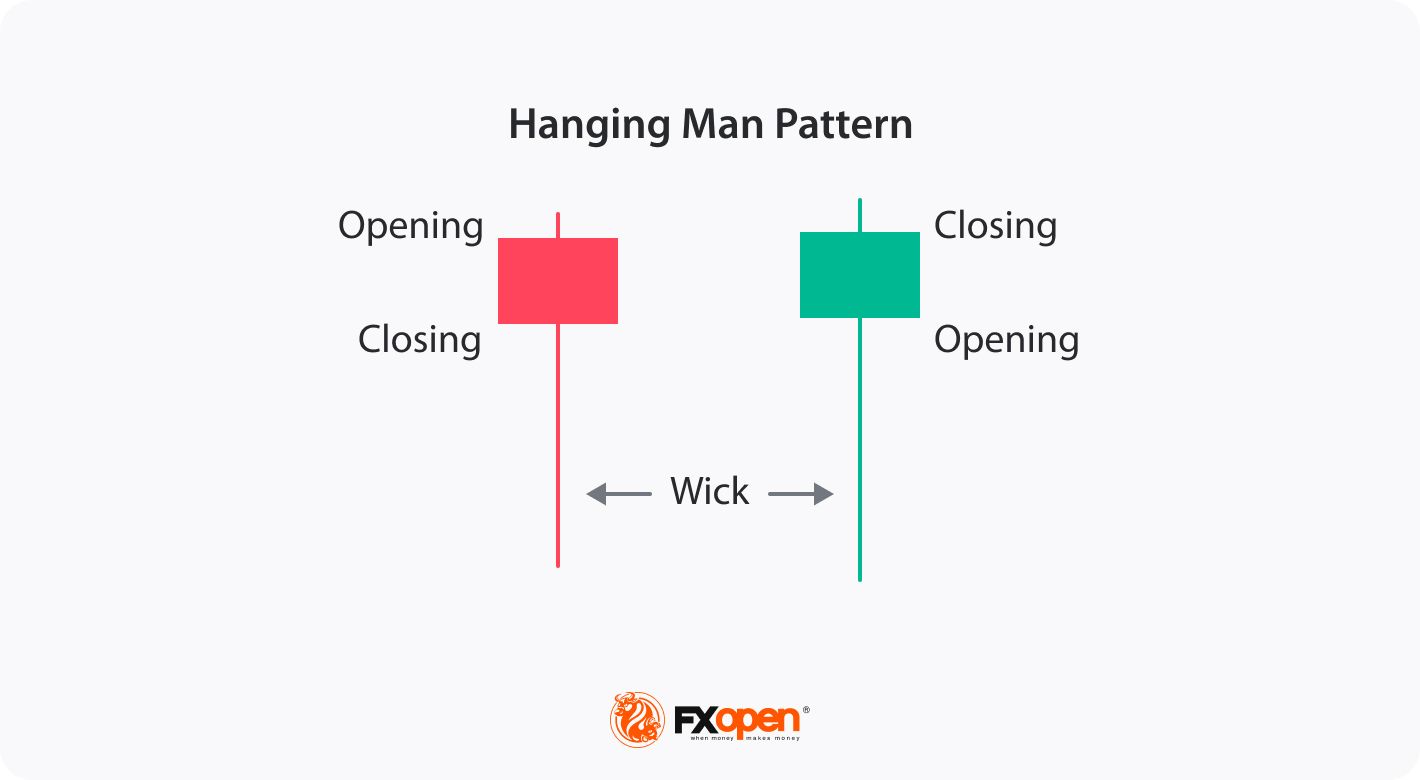

The hanging man candlestick chart pattern is characterised by a small body near the top of the candlestick, a long lower shadow, and little to no upper shadow. This pattern resembles a figure hanging from its head, hence the name "Hanging Man." The formation suggests that buyers, who have been in control during the uptrend, are losing their strength and that selling pressure is increasing. It indicates a potential shift from bullish to bearish sentiment.

The hanging man is a versatile formation that can be applied across a wide range of financial instruments, including stocks, cryptocurrencies*, ETFs, indices, and forex, on different timeframes. If you're looking to use this pattern, FXOpen provides ideal opportunities, offering the advantages of margin trading and low spreads.

Identifying a Hanging Man on Trading Charts

To spot a hanging man pattern in stock or other financial instruments, you may follow these key steps:

- Look for an existing uptrend: Start by identifying a prevailing upward price movement on the chart.

- Locate a candlestick with specific characteristics: Search for a candlestick with a small body near the top of the candle, a long lower shadow, and little to no upper shadow. This formation resembles a figure hanging from its head. The colour of the candle doesn’t matter, but if it’s bullish, the signal is stronger.

- Consider supporting indicators: Utilise other technical indicators or oscillators to further validate the potential reversal. These can include trendlines, moving averages, or momentum indicators that align with the bearish interpretation.

Note that there is no such thing as an inverted hanging man candlestick, or a reverse hanging man setup.

Traders can use the free TickTrader platform to get acquainted with the hanging man pattern rules.

Trading the Hanging Man Candlestick Pattern

Those trading the hanging man reversal pattern need to apply a systematic approach in order to increase the likelihood of successful trades. Here are a few steps traders usually follow to trade this pattern:

- Identification: Identify the setup by using the steps mentioned above.

- Look for confirmation signals: The setup alone is not sufficient for making trading decisions. Seek additional confirmation through subsequent candlestick patterns or technical indicators. This can include bearish candlestick patterns (e.g. bearish engulfing or shooting star), a breach of support levels, or the convergence of other indicators signalling a potential reversal.

- Define your entry and exit points: An entry point can be either when the next candlestick confirms the bearish sentiment or when the price breaches a significant support level. You may use the next support level to take profit.

- Consider risk management: Assess the risk-reward ratio of the trade and ensure it aligns with your risk tolerance. For efficient risk management, you may adjust your position size accordingly. Risk management tools like position sizing, setting stop-loss orders, and diversification can help protect your capital. You may set a stop-loss order above the hanging man pattern to limit potential losses if the trade goes against you.

- Monitor the trade: Keep a close eye on your position as it progresses. Pay attention to any changes in market conditions or additional signals that may invalidate the trade.

- Learn from outcomes: Regardless of the outcome of the trade, analyse it afterwards to identify areas for improvement. Assess whether the setup provided accurate signals and identify any factors that may have affected its success. This analysis will help refine your trading strategy over time.

Live Market Example

Consider the example of a hanging man on the forex USDJPY pair. An entry is placed on the next bearish candlestick with a stop loss just above the hanging man. The take profit is the next level of support marked by the blue line.

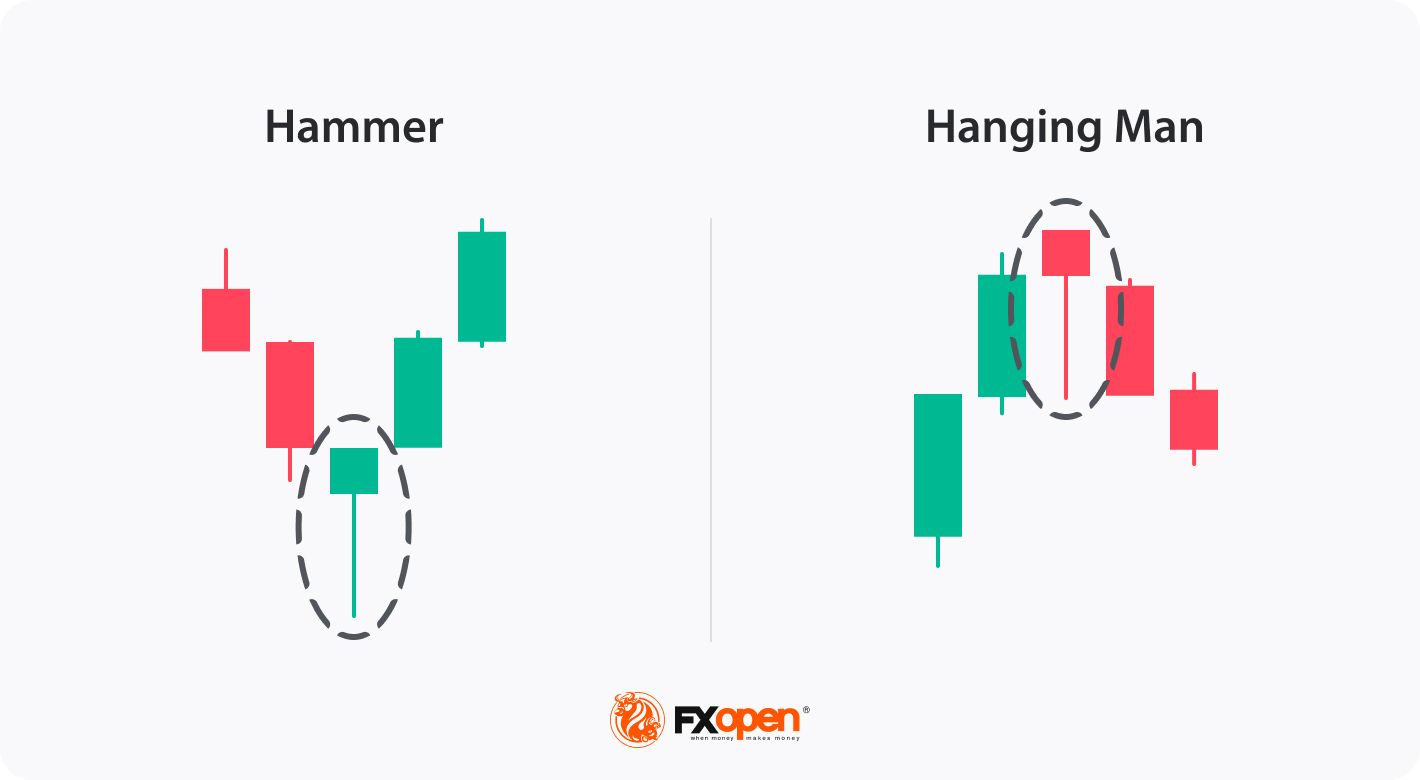

Hanging Man vs Hammer

The hanging man candlestick in an uptrend signals a potential bearish reversal, while the hammer occurs in a downtrend indicating a potential bullish reversal. Both have the same candle structure and require confirmation from subsequent price movements. They should be analysed within the context of the overall market trend and other technical indicators.

Final Thoughts

While the hanging man alone is insufficient for making trading decisions, it serves as a warning signal that buyers may be losing control and that selling pressure could increase. Traders seek additional confirmation through subsequent candlestick patterns, support and resistance levels, and other technical indicators to validate the potential reversal.

By understanding the implications of the setup within the broader market context and employing proper risk management strategies, traders can enhance their decision-making processes and improve their chances of identifying attractive trading opportunities. Once they feel comfortable with their strategy, traders may open an FXOpen account to trade the live markets.

FAQ

What does the hanging man pattern indicate?

The hanging man trading pattern in technical analysis typically indicates a potential trend reversal in an uptrend. It suggests that the buyers, who have been driving the market higher, are losing control, and the selling pressure may increase.

The hanging man is represented by a small body near the top of the candlestick, a long lower shadow, and little to no upper shadow. It resembles a figure hanging by the neck. This visual representation conveys the potential bearish sentiment.

Can a hanging man candle be bullish?

No, there is no such thing as a bullish hanging man candlestick pattern. The bearish hanging man pattern indicates a potential trend reversal from an uptrend to a downtrend.

Is the hanging man pattern reliable?

The reliability of the formation, like any candlestick pattern, can vary depending on several factors. While the setup is widely recognised and considered a potential bearish reversal signal, it should not be relied upon as the sole basis for trading decisions. It is crucial to consider other factors and confirmation signals to increase its reliability.

How does the hanging man differ from a hammer?

The hanging man signals a potential bearish reversal in an uptrend, while the hammer suggests a potential bullish reversal in a downtrend. The hanging man resembles a figure hanging by the neck, while the hammer resembles a hammer. Traders typically look for confirmation signals and consider the market context to validate these patterns.

Is the hanging man pattern bearish?

Yes, it is generally considered a bearish pattern in technical analysis. It is formed when the price’s open or close is near or at its high, there is a significant decline during the trading session, and it closes not far from the opening price. The pattern resembles a hanging man with his legs dangling.

* At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.