FXOpen

Summer trading is already here as June started last week. As a result, the price action is usually lull during the summer months, with little or no movement.

However, this year might differ. One reason to support more volatility in the FX markets, and not only is the quantitative tightening or QT program that began June 1stin the United States.

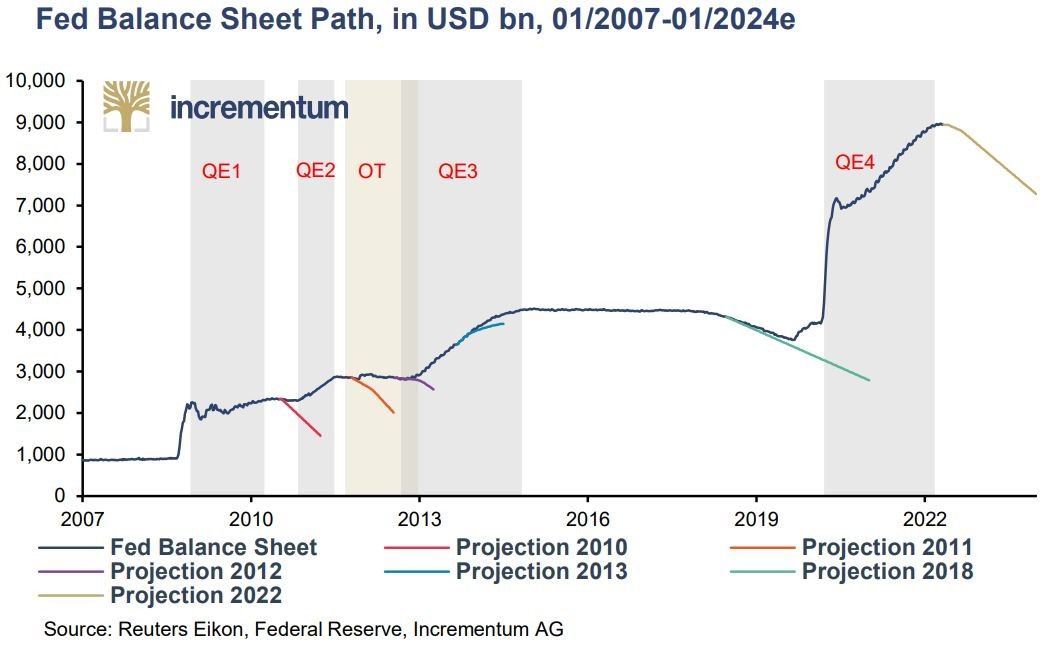

To understand QT, one needs to start with the QE or quantitative easing. This is a program first introduced by the Federal Reserve of the United States under the leadership of Ben Bernanke.

The Fed’s Chair during the 2008-2009 Great Financial Crisis and in the years that followed was the first one to introduce QE as part of the so-called “unconventional” monetary policy. It means that the Fed already lowered the funds rate to zero, but it needed to do more.

Buying government bonds was the solution dubbed quantitative easing. It worked, even though Bernanke himself admitted that he had doubts – in theory, it should not have worked.

But because it did, other central banks followed suit. The result of the QE in the United States was a rising stock market and record low volatility, among others.

Should we expect the opposite now that the Fed started the opposite of the QE – quantitative tightening?

Will the Fed Stick to the Plan?

Inflation is much higher in the United States than the Fed’s target. As such, the Fed raised the funds rates in 2022 and plans to raise them even more.

Just like turning to QE to ease financial conditions further in times of economic recessions, the Fed turns to QT to tighten financial conditions beyond hiking the funds rate. As such, by selling the bonds it holds, the Fed drains liquidity from the markets.

Higher stocks led to a lower dollar in the years of QE. Will we see a stronger US dollar now that QT has begun?

It depends.

Because the US dollar is the world’s reserve currency, it did not act like an emerging economy’s currency. In other words, while inflation reached a four-decade high in the United States, the US dollar gained against its rivals.

So QT might tighten financial conditions further, but the US dollar has already strengthened a lot against its peers. Think of the euro – the EUR/USD exchange rate dropped from 1.23 to 1.04 while the Fed was doing QE.

To sum up, the Fed shrinking its balance sheet is something that never happened before on this scale. In other words, no one knows what will happen next.

Therefore, to say that the QT is a hawkish development for the US dollar is a bit too much at this point. Only time will tell.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.