FXOpen

Yesterday, a dramatic start to the year 2023 began, as the British Pound and Euro sank rapidly against the US Dollar.

Indeed, the British Pound dropped significantly on the first trading day of the year, plunging to its lowest point in over 2 months in the first two hours of the London session yesterday.

Today, things have begun to suddenly reverse, as the US Dollar's rally has subsided.

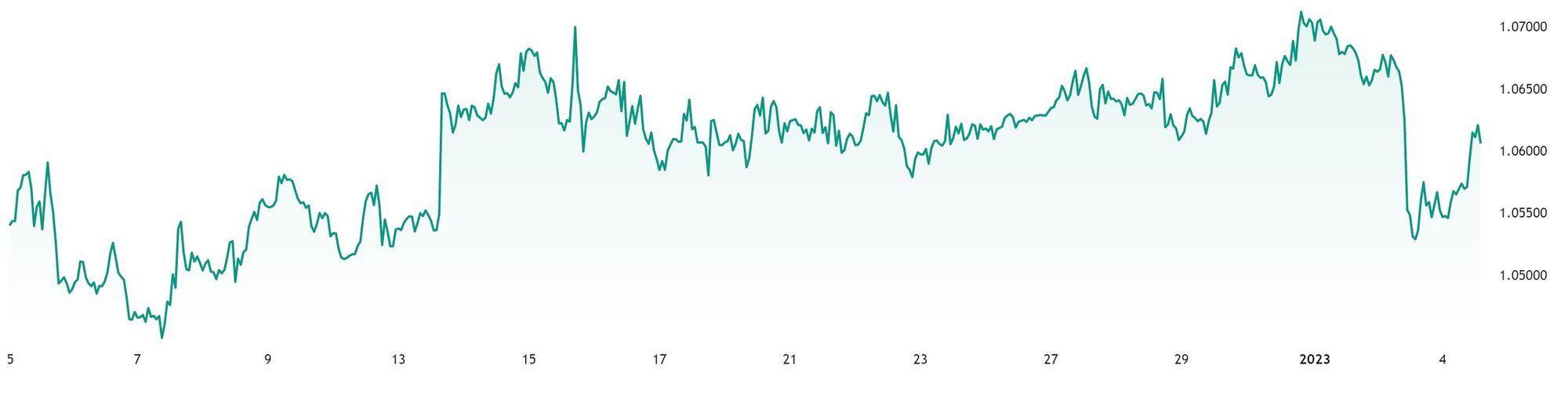

The US Dollar was in high demand yesterday and as a result the EUR/USD pair was being heavily sold off below 1.0600, correcting sharply from two-week highs above 1.0700.

Many analysts had drawn the conclusion that investors had sought security in the US Dollar ahead of important economic events which are scehduled to take plac this week, including today's S&P Global Manufacturing PMI.

Today, however, this sudden and very pronounced collapse in value by the Euro and British Pound against the US Dollar has been short-lived.

The Pound is back up to 1.21 against the US Dollar from a lowly 1.19 yesterday, a depth that it plumbed at 9.30am on January 3, after opening just two hours earlier at 1.21, which is the value at which it is trading today.

Such sudden volatility among major currencies is rare, and it could be considered that it is a welcome return to interesting changes in value between commonly traded currency pairs after very long periods of stagnation.

Interestingly, the EUR/USD pair has also garnered more interest after dropping to near 1.0650 in the Asian session yesterday morning, that being the first trading session of the year. The major currency pair has recovered as the rebound move in the US Dollar Index (DXY) has faded. The Euro is currently looking steady, however, as investors are awaiting the release of the Eurozone Harmonized Index of Consumer Prices (HICP) data for fresh impetus.

In general, reports on price indexes, and overall consumer issues are not such big influencers in the value of certain currencies, but over the last two days, volatility has been rife between the US Dollar and its contemporaries on the other side of the Atlantic.

If volatility is the lifeblood of trading, the currency markets are well and truly alive again.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.