FXOpen

The main event of the Easter week was the European Central Bank (ECB) meeting that ended last Thursday. The central bank left the monetary policy unchanged and even though it sounded more hawkish than expected, the euro lost ground against the US dollar.

The ECB announced that it would end its asset purchases in the third quarter of this year but acknowledged that the ECB and the Fed are on different paths in their policy normalization plans.

While the ECB may deliver one or two rate hikes this year, the Fed already hiked once. Moreover, many voices inside the FOMC Committee favor a 50bp rate hike in May, thus widening the gap between the interest rates on the two sides of the Atlantic.

Since COVID-19 started two years ago, many have been shocked by the Fed’s and other central banks’ responses to the pandemic. Monetary and fiscal policies expansion have led to excessive inflation, hurting savings and driving investors into inflation-protecting assets.

Some bought cryptocurrencies such as Bitcoin and Ethereum in the hope that they will keep their value intact. Some other ones bought gold, the traditional hedge against inflation.

But the one currency that did appreciate was the US dollar. With all the doom and gloom over the years, the US dollar remains the de-facto world’s reserve currency.

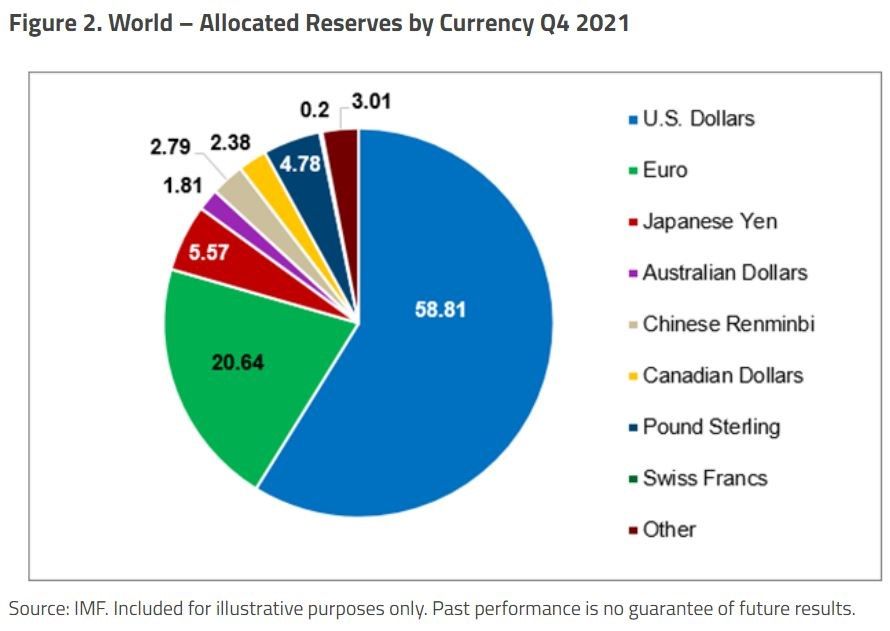

The greenback has no rival, as almost 60% of the world’s reserves are in dollars. The euro comes in a distant second place, while the Japanese yen is in third place.

This is an important statistic ahead of the Fed’s May meeting. The three central banks (the Fed, the ECB, and the Bank of Japan) have different and divergent monetary policies.

As mentioned earlier, the Fed started to tighten the monetary policy. Excessive inflation will push the Fed to hike at every meeting in 2022 and, most likely, more than 25bp.

Moreover, the Fed has begun the process of shrinking its balance sheet. Quantitative tightening is the opposite of quantitative easing, thus contributing to even tighter financial conditions.

The ECB, as argued above, is nowhere near the Fed in terms of policy normalization. While inflation in Europe is above the ECB’s target, the war in Ukraine prevents the central bank from raising rates too fast.

As for the Bank of Japan is involved in a yield curve control process that led to one of the fastest depreciation on record for the Japanese yen.

Therefore, the central banks of the three top currencies in which reserves are kept have divergent policies. They all favor a stronger dollar ahead of the Fed’s May meeting and beyond.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.