FXOpen

Divergence is one of the simplest signals even traders with little experience can spot on a chart. The only challenge is distinguishing between regular and hidden patterns. In this FXOpen guide, we will highlight the fundamental differences between the two and explain how to read their signals.

What Is Divergence?

In technical analysis, the term divergence has two meanings. You may have heard of the MACD indicator. It’s an abbreviation for Moving Average Convergence Divergence. In this case, divergence stands for the movement of two lines relative to each other – they move away from each other. Convergence occurs when the lines move closer together.

The second meaning relates to the topic we will discuss in this article – how the price and the indicator relate to each other. Traders look for divergence between the price and an oscillator, like the relative strength index, stochastic, awesome oscillator, or MACD. It occurs when the market forms an extreme high or low, but the indicator doesn’t follow.

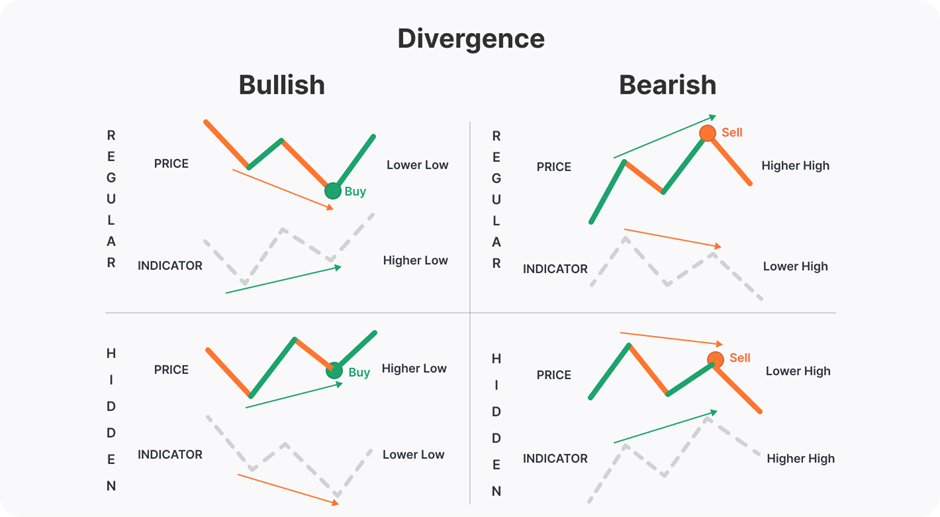

There are two types of divergence – regular or classic and hidden. Both are divided into bearish and bullish categories. Let’s consider the differences between regular and hidden divergence.

What Is Regular Divergence?

Regular divergence reflects waning trend strength and market momentum. Therefore, it is considered a strong signal of a market reversal. It can be bullish and bearish, meaning it predicts a downtrend and uptrend reversal, respectively.

The rules are simple:

- Bullish. When the price forms lower lows, but the indicator sets higher lows, the market may turn up.

- Bearish. When the price places higher highs, but the indicator sets lower highs, the market should decline.

In the chart above, the price and the relative strength index formed a regular bearish divergence, and the market turned down. It’s essential to note that divergence doesn’t necessarily predict a trend reversal; it may be a short-term correction in a solid trend, especially on long-term timeframes.

What Is Hidden Divergence?

Hidden divergence provides weaker signals but is also used in trading. It’s called hidden because it’s less obvious than the regular type. Have a look at the rules:

- Bullish. When the price forms higher lows, but the indicator sets lower lows, the market may rise soon.

- Bearish. When the price sets lower highs, but the indicator places higher highs, the market may turn down soon.

According to the theory, hidden divergence usually predicts a trend continuation.

In the chart above, the price and the RSI formed a bullish divergence, and the market continued moving upwards.

Hidden Divergence vs Regular Divergence: Where to Look for It

The reliability of a divergence depends on a timeframe and the trend's strength. If it occurs in a solid trend on a medium- or long-term chart, it's more likely the trend will continue, even in the case of classic divergence. If the trend is weakening, it may reverse soon.

However, two common rules to distinguish between divergences are:

- Regular variation usually occurs before a market reversal. It doesn’t necessarily mean a change in the overall trend but can be used to trade against the current direction. Here, it’s necessary to implement additional indicators to identify exit points.

- Hidden variation usually appears in a solid trend and predicts a trend continuation.

You can open an FXOpen account to test both types in a live market.

Regular Divergence vs Hidden Divergence: How to Confirm Their Signals

None of the technical analysis tools work independently. As divergence signals are based on the strength of a trend, traders usually use indicators like moving averages. Let’s consider some live market examples.

Regular Divergence

In the chart above, the price formed a regular bearish divergence with the relative strength index. The RSI left an overbought area, which was an additional confirmation of an upcoming decline. However, as it's risky to rely on one indicator, a trader could consider a signal of the shooting star candlestick (1). Appearing at the peak of an uptrend, it predicts a market reversal. While a trader could have used it to go short, this wouldn't be enough to identify exit points.

The nearest support level (2) wasn't that obvious, so a trader could have added the EMA cross tool. Although the exponential moving average is a lagging indicator, it can provide precise exit points if used with short periods. In this case, there are 9- and 26-day MAs. The trader could have exited the market once the EMA cross occurred (3).

A stop-loss level could have been calculated following the risk-reward ratio rules or placed above the high of the shooting star candlestick.

Hidden Divergence

In the chart above, there is a hidden divergence between the price and the RSI indicator. As a hidden divergence usually occurs in a solid trend, a trader could use the EMA cross to confirm the trend direction. Although it’s a daily chart, we used exponential moving averages with periods of 9 and 26 as they are more sensitive to market fluctuations and have a smaller lag than longer-term MAs. To confirm a market rise, a trader could have checked the crossover. As the shorter-term MA (orange) was above the longer-term MA (green), it was a confirmation of a trend continuation (1), so a trader could have opened a long position.

However, this wouldn’t have determined the period of the rise. Therefore, a trader could have utilised the opposite cross of EMAs (2) or placed take-profit targets at the nearest resistance levels.

A stop-loss level could have been placed below the closest support levels (3).

Final Thoughts

Divergence signals are effective; however, traders never use them exclusively. Regular divergence can predict a short-term correction, and hidden is less reliable; therefore, it’s worth adding indicators and patterns that forecast future price direction. You can test various technical analysis tools on the TickTrader platform for free.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.